Nickel account: prices, cards and account opening, nickel | The account for all open to your tobacconist

1 account 1 card 1 rib

Contents

- 1 1 account 1 card 1 rib

- 1.1 Nickel account: prices, cards and account opening

- 1.2 �� Nickel card, nickel chrome and nickel metal: the offers of the bank for all

- 1.3 �� How to open a nickel account ?

- 1.4 �� Nickel account: Review of comparabanques

- 1.5 �� Nickel account customer service number: emergency, advice, information

- 1.6 ❓ Nickel counts: how it works ?

- 1.7 1 account + 1 card + 1 rib

- 1.8 online services but also a network of nickel points !

- 1.9 Discover Apple Pay: your iPhone also becomes your nickel card

- 1.10 88% satisfied customers *

- 1.11 Nickel review (2023): Is this without bank account made for you ?

- 1.12 Nickel account: that includes the offer, concretely ?

- 1.13 Nickel was from the start a guaranteed cardboard ��

- 1.14 Complete Nickel account test

- 1.15 How to supply the nickel account with money ?

- 1.16 Nickel payment cards in 2023

- 1.17 Our opinion on nickel: is the without bank account made for you ?

�� Withdrawal outside the euro zone: ✔️ at no cost and unlimited

Nickel account: prices, cards and account opening

The Nickel account is the first current account without bank in France. The opening of an online nickel account or via one of the 7,000 tobacconists present in the territory gives the right to a full offer of banking services: a current without deposit account + a RIB + a bank card. Focus on the nickel offer, accessible to all.

- Current account

- Minor account

- Common account

- Pro account

- Saving

- Real estate and personal credit loan

- Sotck exchange

- Nickel card: 20 €/year

- My Nickel card: € 22.50/year

- Chrome nickel card: € 50/year

- Nickel Metal card: € 100/year

Welcome offer: ❌

Google Play note: ⭐ 4.1/5

Apple Store note: ⭐ 3.9/5- Teens

- Network of tobacconists and nickel points

- Telephone line

- No categorization expenditure

- € 1 for paying PIN code by SMS code

- No overdraft authorization

- Regular apps of the app

Updated data in September 2023

�� Nickel card, nickel chrome and nickel metal: the offers of the bank for all

The individual can choose between 3 nickel bank card offers associated with separate services and advantages.

The nickel offer is clear and transparent for all individuals with 4 international nickel cards with immediate debit and systematic authorization, Opening entitled to a current account without an overdraft authorization:

- The classic nickel account

- Nickel account Chrome

- Nickel Metal account

- The young nickel account (contribution of € 20/year) For 12-18 year olds. A Nickel account for minors Ideal to empower adolescents and reassure parents via remote account control.

Nickel nickel

€ 1.65 per monthNickel Chrome

€ 4.20 per monthNickel Metal

€ 100 per yearWelcome offer: ❌

Welcome offer: ❌

Welcome offer: ❌

Mastercard bank card with systematic authorization

Mastercard bank card with systematic authorization

Mastercard Metal Bank card with systematic authorization

- Banking prohibited accepted

- No income condition

- Rib fr

- Banking prohibited accepted

- Travel insurance abroad

- No income condition

- Metal card without income conditions

- Withdrawals in France and on free trips abroad

- Travel insurance abroad

- No authorized overdraft

- Significant banking costs on current operation

- Traveling costs abroad on withdrawals and payments

- No authorized overdraft

- Significant banking costs on current operation

- Traveling costs abroad on withdrawals and payments

- No additional banking offers

- Reloading by paying and capped bank card

- No authorized overdraft

- High banking fees

Updated data in September 2023

Nickel account services: advantages and disadvantages

THE Nickel account offers offer a number of advantages and disadvantages that can be summed up in the following table:

- Offers accessible to all: 190 accepted passports

- Without income conditions or outstanding

- French RIB

- 3 bank card offers

- Simple and quick account opening

- Online subscription or a partner tobacconist

- Email and SMS alerts

- Contactless payment

- Modifiable payments/withdrawal ceilings

- Check and cash deposit

- Young offer from 12 years old

- Online customer service or by phone

- No premium insurance

- No savings products or credits

- Reloading by paying and capped bank card

- No checkbook or check

- No authorized overdraft

- High banking costs on withdrawals and cash deposit

Updated data September 2023

COURSE OF COURAGE OPERATIONS

L’Opening of a nickel account then the realization of common banking operations involve costs for the individual. The classic nickel offer and the young nickel offer are accessible via an annual subscription of 20 € , that the individual must pay each anniversary date of the contract. Regarding the Nickel Chrome offer, its annual subscription is to 50 € ; € 100 for the Nickel Metal offer. THE Nickel costs on current banking operations want to be transparent, without hidden fees.

Transfer time for nickel the deadlines for Nickel account transfer to another nickel account are instantaneous, for a transfer of a nickel account To another bank, count between 24 hours and 48 hours.

⚠️The there is no transfer on weekends, public holidays and Monday for some banks.The tariff conditions of the Nickel account are clearly announced by the banking provider, of which here are the main services in 2023:

Nickel nickel

€ 1.65 per month➡️ Current costs:

�� Account holding costs: 20 € per year

�� Inactive account holding costs: ✔️ None

➡️ Travel costs abroad:

�� Withdrawal in euro zone: ✔️ 3 Withdrawals per free month in nickel point then 0.5 € per withdrawal (

�� Withdrawal outside the euro zone: € 2 per withdrawal

✈️ Payments while traveling abroad: 1 €/payment

➡️ costs on payment incidents:

��️ Intervention committee: 8 €/operation – max 80 € per month

�� Authorized discovered: ❌ No overdraft authorization

�� Unauthorized discovered: ❌

➡️ Fresh on transfers:

�� Instant transfer: ✔️ Free between Nickel accounts

�� SEPA transfer: ✔️ Free

�� International transfer: Paying with partner Ria

Nickel Chrome

€ 4.20 per month➡️ Current costs:

�� Account holding costs: 20 € per year

�� Inactive account holding costs: ✔️ None

➡️ Travel costs abroad:

�� Withdrawal in euro zone: ✔️ 3 Withdrawals per free month in nickel point then 0.5 € per withdrawal (

�� Withdrawal outside the euro zone: € 1 per withdrawal

✈️ Payments while traveling abroad: ✔️ at no cost and unlimited

➡️ costs on payment incidents:

��️ Intervention committee: 8 €/operation – max 80 € per month

�� Authorized discovered: ❌ No overdraft authorization

�� Unauthorized discovered: ❌

➡️ Fresh on transfers:

�� Instant transfer: ✔️ Free between Nickel accounts

�� SEPA transfer: ✔️ Free

�� International transfer: Paying with partner Ria

Nickel Metal

€ 100 per year➡️ Current costs:

�� Account holding costs: 20 € per year

�� Inactive account holding costs: ✔️ None

➡️ Travel costs abroad:

�� Withdrawal in euro zone: ✔️ at no cost and unlimited

�� Withdrawal outside the euro zone: ✔️ at no cost and unlimited

✈️ Payments while traveling abroad: ✔️ at no cost and unlimited

➡️ costs on payment incidents:

��️ Intervention committee: 8 €/operation – max 80 € per month

�� Authorized discovered: ❌ No overdraft authorization

�� Unauthorized discovered: ❌

➡️ Fresh on transfers:

�� Instant transfer: ✔️ Free between Nickel accounts

�� SEPA transfer: ✔️ Free

�� International transfer: Paying with partner Ria

Updated data in September 2023

�� How to open a nickel account ?

Since its launch in France in 2014, the Nickel account has encountered a dazzling success with nearly 1.7 million customers ! Bank for all attracts more and more individuals by its practical side, with transparent pricing, an opening to everyone without income conditions, and without tedious approaches.

Opening conditions of a nickel account

The conditions of eligibility andNickel account opening are particularly attractive for many individuals:

- opening without income conditions;

- be a natural person;

- Residence in France: postal address and tax residence;

- Nickel account opening From 12 years old (young nickel offer);

- Eligibility of the Nickel account to people in banking prohibitions (fell by the Banque de France), to foreign students (+190 passports accepted !) and people hosted;

- No obligation to have a first bank account in a traditional bank or online bank;

- Opening of the online nickel account only accessible for adults. THE Nickel account for minor must be done with a tobacconist or nickel point ;

- individuals must simply present an identity document as proof.

Open a nickel account with a tobacconist

The main asset of the nickel offer is to be able to open your current account without going through a traditional bank or online bank. Opening your nickel account can be done directly at the tobacconist or point nickel closest to his home, and comes down in a few steps:

- Locate the nearest nickel point via the interactive card of the Nickel site, or go to a partner tobacconist;

- Buy a nickel box at 20 € containing the Mastercard bank card;

- Register on the nickel terminal present in the tobacco office or the nickel point: fill out the membership form, scan your identity document;

- Activate the Nickel account With the help of the tobacconist, who immediately gives a RIB (with the Nickel account number) to the individual;

- Receive by SMS, the PIN code of its nickel card;

- Immediately use your bank card and make a first payment on your current account up to € 250 for free.

Open an online nickel account

To save time, the individual can also make his Online nickel account opening via the subscription form available on the Nickel website. Again, the steps are minimal and fast:

- Go to the Nickel site and click on “Account opening”;

- Fill out the membership form by indicating your phone number, and scan the proof of identity;

- SMS receive The secret code (5 digits) activation for its nickel account ;

- Go to your nearest tobacconist or nickel point;

- Buy your Nickel box, indicate the validation code to the tobacconist and receive your RIB;

- Receive by SMS the PIN code from your nickel card;

- L’opening of the nickel account is active, The individual can make their first deposit on the current account (free up to € 250).

Nickel opening online or at the tobacconist: validate the postal address ! It is essential to Validate your postal address to confirm the opening of your Nickel account. Under 2-4 days after the opening of the online account or at the tobacconist, an authentication code is sent to his home. Two means are available for Validate your Nickel account : by sms at 38063 (or on 06 33 13 48 64 for the DOM), or on its customer area.

�� Nickel account: Review of comparabanques

The Nickel account has benefited from a success story since its launch in 2014 with nearly 3.2 million customers. Its offer of banking services is particularly appreciated by its customers for its practicality, its simplicity of handling and the transparency of the prices practiced.

In addition, thenickel offer is triple accessible ::

- The opening of a nickel account is open to everyone, people with a minimum of resources as well as banking prohibitions;

- The Nickel network consists of just over 5,700 tobacconists and nickel points, which One of the most important banking networks in France. A real asset compared to online banking players such as N26 or Revolut, neobancs without the presence of physical offices;

- User reviews: The Nickel application is noted 2.9/5 on the Apple Store and 3.6/5 on Google Store.

�� Nickel account customer service number: emergency, advice, information

The individual can Contact Nickel Customer Service via different means of contact available to it:

- By phone at ☎️ 01 76 49 00 Monday to Friday from 8:30 a.m. to 7 p.m. and Saturday from 9 a.m. to 6 p.m.;

- Via the contact form available on the Nickel website;

- Via Twitter and Facebook profiles, sending a private message to nickel advisers;

- via the nickel aid center, a FAQ that lists a wealth of information on the nickel account.

��️ Open an online account

❓ Nickel counts: how it works ?

The offer of “Bank for all” allows individuals to access a reduced banking service, but nevertheless effective in terms of services and current operations.

How to recharge my nickel account ?

The individual can make cash payments and deposits to supply his nickel account by 3 different means:

- by bank transfer via the RIB of the current account;

- by Liquid money deposit on his nickel account (commission of 2% of the amount deposited). It is enough for the individual to go to one of the 5,700 tobacconists or nickel point in France.

- by bank card via the Nickel customer area (commission of 2% of the amount deposited). Please note, transfers by foreign bank cards from the following countries are not authorized: Australia, Brazil, Canada, United States, Norway, Mexico, Sweden.

- THE Check deposit on the Nickel account is now possible.

Note that the Payment ceiling on the Nickel account is € 950/month by bank card or in cash in a tobacconist.

When the money is available after a payment ? THE Recharge of the nickel account is instantaneous after a species deposit and a bank card payment. On the other hand, it is necessary to count between 24 and 48 hours for a bank transfer. This period is similar in all conventional banks and online or neobank banks.

How to close my Nickel account

In case of dissatisfaction, it is quite possible to Request the closing of the Nickel account. The steps to terminate your bank account are simple and quick, since it is enough for the Nickel account holder to connect to its customer area.

There Nickel account termination request is carried out via the section ” Modify my profile “>” Access the account closing form »> Indicate the reason for its termination via a choice list.

In case of’existence of a balance on the nickel account, It is possible to obtain the funds available via a bank transfer, a withdrawal from a DAB, or via nickel customer service by sending the RIB of the new bank account.

Who is nickel, the bank for all ?

Nickel is a brand of the Financial payments (FPE) Launched in 2014 in France. The objective of the Nickel account is to offer a banking service with the essentials: 1 current account + 1 bank card + 1 rib. All for 20 €/year (classic offer) !

The nickel offer, accessible without income conditions, is aimed at all individuals, and more particularly to people excluded from the traditional banking network (banking and minors)).

In 2017, Nickel was bought by the BNP Paribas banking group and continues its growth in France with the aim of developing its network of tobacconists and increasing its customers with 4 million customers in 2024.

1 account + 1 card + 1 rib

online services but also a network of nickel points !

Remove around the world

From millions of distributors with your MasterCard card or remove directly from one of the 7,000 tobacconists or nickel points everywhere in France.

You want to deposit species ?

It’s possible ! Go to our tobacconists and nickel points in France and overseas.

3 MILLION Customers

+ 7,000 Nickel points

Made in FRANCE

TRANSACTIONS 100% Securized

A simple offer

An account for allHow to open your account ?

- 1 Open your account online or on a terminal with a tobacconist or a partner nickel point

- 2 No need to wait !

In 5 minutes you leave with your Active Mastercard card and your French RIB

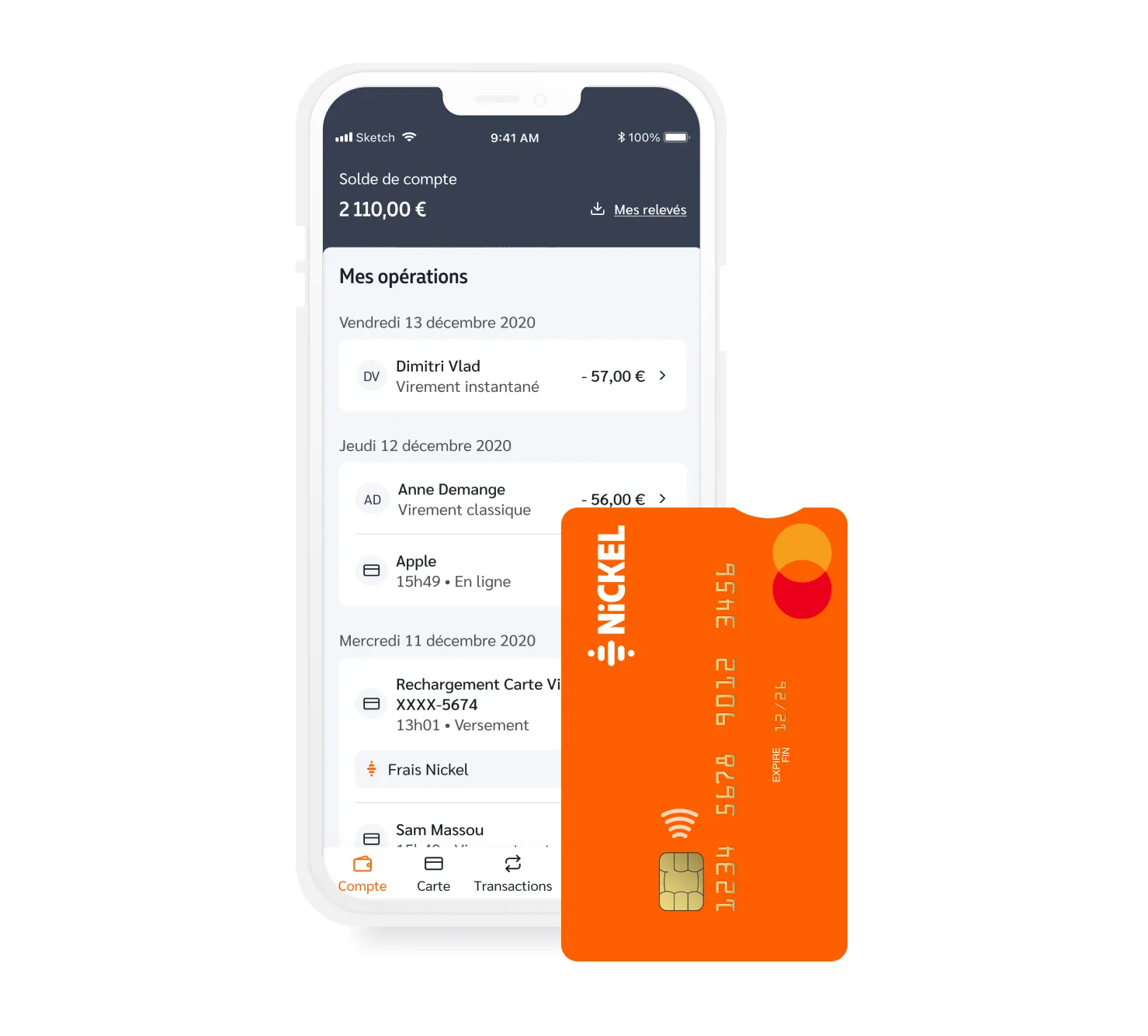

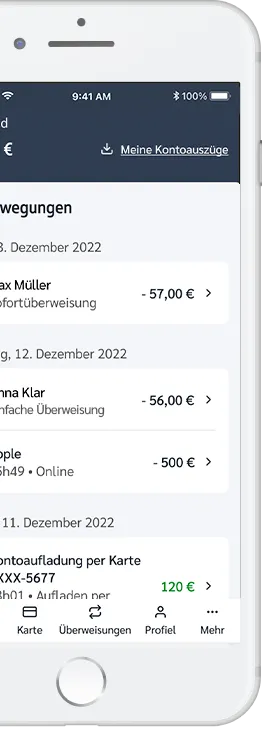

Follow your operations

on your phone- 1

Download the Nickel mobile application available on iOS and Android - 2

On your application:

• Follow your operations in real time

• Make your transfers

• Block/unlock your card and much more !

Discover Apple Pay: your iPhone also becomes your nickel card

Take advantage of all the advantages of your nickel card using Apple Pay on your iPhone, Apple Watch, iPad and Mac. Apple Pay is easy to use and works with the devices you use on a daily basis. Your card data is protected: they are neither stored on your device nor shared during payment. Use Apple Pay for your shopping in stores or on the Internet: it’s practical, secure and confidential.

88% satisfied customers *

* based on our 2022 NPS of more than 50,000 responses

Very happy

I am very happy with their services, withdrawals abroad are not expensive, and customer service has always been kind with me.Magalie D. – trustpilot

Nickel review (2023): Is this without bank account made for you ?

At the beginning of 2023, the nickel account proudly announced that it has exceeded the 3 million customers to his credit. Acquired in 2017 by BNP Paribas, the company has continued since its strong growth in France and across Europe. Below, we invite you to analyze in detail the nickel services offer. Our opinion on nickel will follow below.

Nickel congratulated himself on being the first “bank without bank”. In this case, you have to go to one of the 6,800 partner tobacconists in France and overseas to open an account and manage your cash flow. It is also possible to do it directly online, via the Neo-Banque website. A mobile application (iOS and Android) also allows access to your account and carry out its operations.

Opening an account in 5 minutes

French RIB

Standard mastercard

Specific deposit in 7,200 tobacconists

Annual costs: € 20 • Initial deposit: 0 €

Check deposit: ✘ • Species: ✔

Monthly card cost: 0 €

Euro zone withdrawals: € 0.5 at a tobacconist, € 1 in DAB • Payments EURO: free

Currency withdrawals: € 2 per transaction • Currency payments: € 1 per transaction

In a few minutes, and with a contribution of € 20 per year, the customer receives a current account (with a French RIB) and a payment card. It is not possible to be simpler. This offer is accessible to no less than 190 nationalities: it is therefore not necessary to be French to claim a nickel account. Other cards, more premium or personalized, are available for a higher contribution.

Furthermore, Nickel is distinguished from neobancs Revolut and N26 insofar as it gives a French RIB: it is useful for those who want to make collection (like a salary) or samples. As a bonus, the Nickel account accepts up to 190 different passports to open an account if you are foreigners. People in banking prohibition are also welcome at Nickel. To enlighten you more, we will give you our opinion on the Nickel account.

Nickel account: that includes the offer, concretely ?

Whatever your situation, you can very easily open a nickel account with the tobacconist and get a RIB and a payment card. Unlike traditional bank accounts, the procedure takes only a few minutes. It’s a good way to have an account and manage your money with ease. Nickel is one of the greatest successes in the fintech in France.

Nickel, it’s a current account and a card, without condition

The nickel account was founded in 2014 by the financial company of electronic payments. She wanted to develop a solution that allows people in financial difficulty to stay in the system by taking advantage of an easy access account. Nickel notably accepts people in banking prohibitions and all those who have been denied access to conventional banks. They just need to justify their identity and provide a phone number to access an account and the nickel card.

Quickly, the Nickel brand realized that its audience was wider than people in financial difficulty. Today, a third of users are people who simply wish to resume their budget in hand, and another third party are people “who open a second account”, explained the delegated DG, Marie Degrand-Guillaud. In parallel, 190 foreign passports are accepted to open a nickel account. An excellent point while most banks and online banks are more strict.

Over the past few years, the Nickel account has seen its customer base grow exponentially. At the beginning of 2023, it reached 3 million customers and it is not ready to stop. The company that says it is actively continues to recruit new tobacconists who are as many relays for its offer. It targets 10,000 tobacconists by 2024 to cover most of France, including places abandoned by traditional banks. She hopes to weave a strong local network, including in French deserts where traditional banks have disappeared. The latter have not even left a ticket distributor: the tobacconist and the nickel account can replace them.

A few years after its creation, the Nickel account is bought by the BNP Paribas group for an estimated amount of 200 million euros. The Confederation of tobacconists, on which the success of the offer is built, remains a minority shareholder up to 5%. The banking group thus expands its presence beyond its online bank Hello Bank! With a new service, more contemporary.

In 2018, the Nickel account unveiled a new offer to respond to the evolution of its customers. This is a premium card (nickel chrome) which is available for 30 € more per year (and which we only order on the internet) with very specific advantages. Last year, a nickel metal card also appeared for a contribution of € 80 more per year. We are going to look lower in our Nickel review page. We will also come back to the standard offer which is available for young people aged 12 to 17.

Our opinion on nickel in 7 points:

- A single bank account

- Without income condition or domiciliation

- Open to 190 passports

- A current account and a debit card

- Simple and competitive pricing

- 6,800 partner tobacconists

- Nickel Chrome card for abroad (30 € per year)

Increased market on the market

In a few years, the French French landscape has been turned upside down by new players. Between online banks and neo-banks, more than 22% of French people have an account with a dematerialized player. The Nickel account is placed at the crossroads between these actors and the more traditional network banks since it benefits from a physical presence via the network of tobacconists.

This physical presence is an advantage since customers can deposit species and checks there – which is not the case with actors like Revolut or N26 (see our opinion N26 here). The latter have overlooked physical presence, like the majority of online banks. As you will see below on this Nickel review page, this physical / online hybrid offer is probably the best compromise.

That said, this model has not succeeded in all market players. The simplified C-ZAM account, invented by Carrefour and relayed in supermarkets to decide to put an end to its activity in 2020. A similar formula that does better is that of my French Bank, which is found in traditional post offices. That said, it does not meet the expected success either.

Nickel was from the start a guaranteed cardboard ��

Halfway between a bank, an online bank and a neobank, Nickel has serious arguments. Its model allows you to benefit from the best of each world:

- An ultra-accessible mobile offer

- A physical presence in tobacconists

- A card without income condition

- A card for adolescents

- An offer for banking prohibitions

- 190 Passeports accepted

- A full range of cards

- A French RIB

To open an account, two solutions:

- From the website

- On a nickel terminal located at 6,800 French tobacconists

Complete Nickel account test

To do well whether the nickel account is done or not for you, we offer you a small scenario. We have indeed tested the offer in its entrenchments. At the end of this section, you will be able to know our opinion on Nickel.

What is included in the Nickel account ?

In our opinion, Nickel was from the outset of network banks thanks to an offer centered around simplicity. In this case, the offer revolves around a current account and a payment card. The standard formula costs € 20 per year, but it will also have to have a few additional costs on certain unusual operations.

Rest assured, the tariff grid of the nickel account is only in 12 lines: there is no bad surprise. This pricing is more competitive than any bank. In France, a customer pays an average of 215 euros in bank charges per year. With Nickel, you have a tenth of the price for an already interesting service.

For people who travel abroad, the company has launched a card called Nickel Chrome (it is not invented), for an additional contribution of € 30 per year. In the end, it comes back to 50 € per year for the full formula (20 € + 30 €). The Chrome offer is more protective since the latter allows you to benefit from insurance and guarantees abroad as well as reduced costs in the event of medical operations outside the SEPA area (Euro) and internationally.

The Premium Nickel Chrome card is subscribed only online. It is then delivered to the customer within 15 days. Those who subscribe to the classic offer from a tobacconist (or on the web) immediately recover their payment card, which has no equivalent to other online and neobank banks. Of course this payment card is a bit special: it is not personalized on behalf of the customer but they are the official holders.

The third card, called metal, is as its name suggests in metal (14 gram stainless steel). We will come back in detail to it, but note that this is the highest range at Nickel with a contribution at € 80 per year (in addition to the default 20 €). With this payment card, you will have the right to even more protective insurance and the possibility of paying and withdrawing money for free. It surfs on the trend for metallic cards like Revolut, N26 or Boursorama Banque.

How to open a nickel account ? Eligibility and Conditions

The nickel account is one of the most open neo-banks on the conditions of the conditions to subscribe. To be eligible for the nickel offer, you have to be at least 12 years old (and up to 17 years for the young offer) and be major for the classic offer. Registration can be done as well on the web and at a tobacconist. Again, for the Nickel Chrome and Metal version, you have to show proof of identity and give your phone number. That’s all.

Unlike an offer like my French Bank which demands that the customer already hold a first account in a traditional bank, the nickel account does not ask for it. In other words, this account may be the only account you have. You are also eligible for this formula even if you have been relieved by the Banque de France (i.e. If you are prohibited banking). This is the great asset of Nickel accounts. They can be opened by anyone and walk in all situations. A real antidote to banking exclusion.

Documents to provide when registering at Nickel:

- An identity document of identity card or passport

- A phone number

Only your identity document is compulsory since if you open a nickel account with one of the 6,800 tobacconists of the network, you just have to present an identity document. In the event of a live account opening on the web, just load a photo of your identity document on the site. There is no need to print and send documents by post. It is the same principle as in all neo-banks. This procedure takes a few minutes at most. It is far from what we find in a network bank or in an online bank.

It will then be necessary to pay an annual subscription of € 20 to use the nickel service for a year. On each anniversary date, the customer will then be taken from the same amount to continue using their account and payment card. This is the same principle for the Nickel Chrome card, which must be taken out exclusively on the Nickel website. For the latter, you must add 30 € per year to the 20 € of conventional costs (i.e. 50 € per year in total).

Nickel plays the transparency card, and the company explicitly displays the amount that is donated to its tobacconists for each operation. Below, you can see precisely how much the tobacconists will win on each of the account activations made by its network. By capitalizing on the transparency of costs, the nickel account legitimizes its prices – and this strengthens our opinion on positive nickel. As you can see, the price is correct: nickel is very competitive on this point.

How to supply the nickel account with money ?

The Nickel account is purchased in four different ways: by bank transfer, by bank card, cash deposit or check for check. These last two options are not offered in any other neo-banque (n26, revolut …), which gives real strength to the offer of the French nugget. When you open an account at Nickel, you immediately receive unique bank details (IBAN / RIB) which then allows you to feed the account with a bank transfer. This can be a punctual transfer as a classic transfer.

Methods to supply the Nickel account:

- Wire Transfer

- By species deposit

- By check

- By credit card

Posting species is possible in one of the bebunists partner. With this network, Nickel can be congratulated by being the second largest network in France, in front of certain traditional banks. That said, to credit your account with species, the network invoices 2% commission on these latter. The Nickel account has limited cash deposits to € 250 per week (or € 950 per month).

Since last year, the checking of check is also possible. To do this, it will be necessary to go through the online or postal platform. Nickel requests a commission of € 3 per deposit. On the Internet, the process is simply and quickly with well detailed instructions.

Nickel account check ceiling:

- Make up to € 1,500 in check

- Up to € 3,000 per month

Finally, the last way to feed your nickel account is the bank card. It is this method that is the most used in neo-banks. From the mobile application (or the website) of the bank, it will be necessary to add a second card (from a third -party bank) to carry out an operation. Again, Nickel also invoices 2% commission on each deposit.

In the case of cash deposit and the deposit by bank card, the funds are immediately available on the Nickel account. This is not the case with the transfer, which generally requires between 24 and 48 hours to reach the account. That said, fueling your account with species is becoming increasingly rare (even online banks no longer offer it), this is a positive point in our opinion for Nickel.

Nickel payment cards in 2023

Now let’s go to this Nickel review page on the list and our opinion on payment cards. While traditional banks do not hesitate to charge this product, Nickel offers a simple and understandable payment card. Again, the price grid is only 12 lines and you will not have surprises or hidden costs. Whether the basic formula or the Nickel Chrome version, payment cards are international.

It will allow you in particular to:

- Simple and fast payments

- Reduced (and fixed) costs abroad

- Guarantees and assistance with Nickel Chrome

- App to configure it at will and at no cost

The MasterCard World Network

Nickel offers its customers stamped cards from the MasterCard logo. Equivalent to that of Visa, these cards allow you to pay for purchases with more than 30 million partner merchants worldwide. It is also more than a million distributors that holders of a nickel card can use. Depending on the area you are, withdrawals will be free or not. The two Mastercard cards are international, they will not block when you go abroad.

The bank cards of the Nickel account in 2023 are immediate debit cards with systematic authorization. Whenever a customer performs an operation (payment or withdrawal), the account balance is automatically verified. If the balance is not enough, then the transaction is declined. A way to never find yourself in mistake. Besides, the card does not allow overdrafts.

Nickel knows that a third of its customers are people who want to “control their budget”, so it is not in its projects to develop on overdrafts and credits, explained the Deputy Managing. In our opinion, Nickel is a good option to avoid the risk of overdraft (and agios), but that is not the only solution. Some online banks such as Monabanq (with its online visa card) and all neo-banks are based on a system with systematic authorization.

Use of the card abroad

Abroad, the nickel card is more advantageous than the majority of neo-banks, online banks and other traditional banks. For what ? Because the nickel account invoices a fixed amount by operation, and not a variable commission. By default, all payments are free and unlimited across Europe. Outside, they are free with the Chrome nickel card and the metal card, and they are € 1 with the classic nickel card.

Withdrawals have a different price policy. In the SEPA zone, any withdrawal will be billed for € 1 (except for the metal card, they are free) and € 1.5 in France. Apart from this area, withdrawals are charged € 2 for customers holding the classic card, and € 1 for Nickel Chrome customers and are always free with the Metal card. It is less than the average of online banks, which charge approximately 2% of the amount withdrawn.

In a classic network bank, it takes 5% of the total amount. Note that neo-banks are sometimes free, but the withdrawal ceiling (or the number of withdrawals) is limited. At home, it will be necessary to migrate to a premium offer (from € 9.90 per month) to be able to obtain higher ceilings. With the nickel card, the cost is completely independent of the amount of withdrawal, which should be obvious.

What are the costs at Nickel ?

In our opinion nickel is right to congratulate yourself from having a pricing grid which “holds in 12 lines”. No more extracts from banking prices, punctuated by asterisks that penalize you with each operation. Here it’s simple and transparent. Regarding payments, they are free and unlimited in the SEPA zone. With a standard card, it is also possible to withdraw without paying a commission thanks to the implementation of the three free withdrawals per month at a tobacconist affiliated to Nickel.

Nickel has several additional services which are considered specific to certain customers, and rare. For example, there is the impression of a rib with a tobacconist (€ 1 of which 0.5 cents are back to the tobacconist). There is also the deposit of species (2%), the exceeding of 60 alert SMS for the balance per year (€ 1) and the sending of the secret code of your card in case of forgetting (€ 1). If you are abroad, the prices are advantageous if you opt for the Nickel Chrome card.

Bank costs at Nickel:

– € 10 in case of more than two samples rejected during the month,

– € 1 for rib printing at a tobacconist,

– € 1 for a return of the secret code of your card,

– 3 € for the collection of a check,

– 2 % of the amount if you deposit cash with a tobacconist,

– 2 % of the amount if you feed your account by bank card (rather than by transfer)Nickel is not Apple Pay / Google Pay compatible

In France, mobile payment remains a marginal trend but which continues to make followers. The pandemic favored the development of contactless payment with the smartphone. The most popular solution is none other than Apple Pay. The latter allows iPhone holders to record their card directly in a mobile application. It is then the phone that replaces the card (thanks to its NFC technology) for contactless payment.

If 99% of French bank cards were compatible with Apple Pay by the end of 2019, this is not the case for cards issued by the Nickel account. Neither Apple Pay, Neither Google Pay, nor Android Pay are available for neo-Banque customers. It will be necessary to use your physical card (or species) to adjust your purchases. Nickel could do better on this point.

But it is a bias (we imagine economic), and in our opinion nickel still benefits as long as its users are not too sensitive to it. As a reminder, Apple invoices the costs of the costs each time one of their customers uses the Apple Pay service. It is for this reason that traditional banks are rather reluctant to these mobile technologies.

Our opinion on nickel: is the without bank account made for you ?

Now is the time to conclude this presentation by giving you our impressions. In our opinion nickel benefits from both the advantages of a network bank and those of an online bank. The Nickel account thus offers more flexibility than a neo-banque or a simplified bank account, while having a very limited cost. He has also managed to find an economic model when all his competitors break his teeth on profitability.

Withdrawals are free within the limit of 3 per month at the tobacconist (€ 0.50 beyond), costs abroad are particularly low, and the contribution starts at only € 20 per year for the basic offer. Beyond Nickel also offers more premium third parties-up to an offer with Metal Bank Card Barded with reinforced insurance and delivering advantages such as free withdrawals in SEPA zone. For the rest, in our opinion nickel has the advantage of its immense simplicity.

Opening an account takes only a few minutes, and only requires your identity document for proof. Icing on the cake you can also cash checks and liquid as with a conventional bank account – but without any condition to open it. Even a person filed at the Banque de France can open such a account.

In our opinion, Nickel is the only neo-banner to be able to rely in 2023 on a also broad physical distribution network. This allows you to easily manage your account with a tobacconist (who will not come to judge his customers as a banker would) with the possibility of making deposits and withdrawals at home live. In parallel, Nickel offers all digital solutions (computer, mobile) to make transfers and payments by card.

Nickel is therefore an excellent product that knows how to respond to varied profiles. With more than 3 million customers currently, this formula has largely proven its relevance and its market (the establishment is second in the online banks ranking, just behind Boursorama Banque). She is now launching the Spanish, Belgian and Portuguese market with great hope of doing as well as in France. Recently, the account has also joined Mayotte to position itself on all of the overseas departments and regions.

Opening an account in 5 minutes

French RIB

Standard mastercard

Specific deposit in 7,200 tobacconists