Our budget management tools – Finance for all, an Excel Excel Table Budget Free to Download and Fill

To download your Excel Family Budget Free Table

Contents

- 1 To download your Excel Family Budget Free Table

- 1.1 Our budget management tools

- 1.2 For further

- 1.3 To download your Excel Family Budget Free Table

- 1.4 How to use the table?

- 1.5 How to fill out this family budget table?

- 1.6 Video on how to use the Excel Budget Table

- 1.7 Alternatives to Excel file

- 1.8 Take advantage of the advice of a financial coach, Book your 1st free interview

Hello, I just downloaded your account management module (on Calc) because the one I created was too long to do. I will test it for a few months but given the configuration it seems quick and easy to use ! Thank you – I will not fail to document myself on the rest of your site which seems really complete ��

Our budget management tools

To make your personal and family budget with ease, you can use our budget calculation sheets, either in paper format, ready to print, or in Excel table format to be used on your computer.

Do not hesitate to return to us on your use of these budget management tools.

- Make a point on your income and expenses printable version (PDF)

- Get a point on your income and expenses Excel spreadsheet version

- Make your budget month per month Excel spreadsheet version

- Online version budget calculator.

For further

88 comments on “Our budget management tools”

Good morning,

You can use all the desired and appropriate applications, when you have little or no money,

These have little utility.

Nothing beats the increase in wages, allocs, pensions …and indexed to the inflatio.

Sincerely

Good morning,

I use your Excel ‘Budget’ spreadsheet. It’s a great tool ! However, I would need to add a few lines to better match my personal situation, but it is unfortunately protected in writing. Would you have a solution to offer me ? Thank you in advance.

The Lafinancepourtous Team.com said:

Good morning,

At the opening of the Excel file, a headband at the top of the table offers “activate the modification”. Then, in the “Revision” tab, click on “Remove the leaf protection”. You should then be able to add one or more lines to the spreadsheet, recording it with a new name.

Best regards.

The Lafinancepourtous team.com

Your site is simply wonderful !

I just have difficulty understanding why savings are counted as an expense in the budget. And I would tend to make a separate line for that.

THANKS !

The Lafinancepourtous Team.com said:

Good morning

Thank you for your comment ! For savings, it is indeed an expenditure (since it “affects” the budget), but you can very well make a separate line. All options are possible ! Best regards.

The Lafinancepourtous team.com

Good morning,

This website is a wonder. Regarding the available tools, it is a shame that a directly printable PDF version of the month version per month of the budget table is not available.

One that would look like the table present in the “Budget instructions” section of the brochure “The essentials on … Hold your accounts and make its budget”. With only the major income and expenses to keep it on an A4 sheet landscape sheet.

Income:

– salary and other income

– Pensions (retirement, food, disability)

– Social allowances

– capital income (rents, interests, etc.)

– Others

Expenses :

– Food

– Accommodation

– clothing, hygiene, beauty

– Health

– Transport and vehicles

– Taxes – Pensions

– Communication, culture and leisure

– furnishings and equipment

– Work

– Financial services

-Another it would also be interesting to talk about the pre-printed works existing in trade to help financial management such as the receipts and the family budget notebooks.

The Lafinancepourtous Team.com said:

Hello, you have a printable version on a month on our site, as well as an Excel spreadsheet that you can save on your computer. In this one, you can remove columns so that the file is shorter. Best regards.

The Lafinancepourtous Team.com

YES!

All right !!

No need to complicate your life with spreadsheets or apps .

Good morning,

I was interested in your site 2 years ago and since then I can perfectly manage my budget. I know where I am and I was able to analyze my expenses from the first year in a glance. Now I know where I’m going and I don’t worry.

The Lafinancepourtous Team.com said:

Hello, thank you for your testimony ! Best regards.

The Lafinancepourtous Team.com

Hello to finance for all? So for those who do not have a computer and who wish to use a support to manage their budget or other ?

The Lafinancepourtous Team.com said:

Hello, in our article above, you will find printable documents that will allow you to follow your budget. Best regards

The Lafinancepourtous Team.com

Hello, a big thank you for your spreadsheet “Budget” months per month which gives me a real boost !

I just wonder why the savings line is counted in expenses ? Thanking you in advance for enlightening me on this point.

The Lafinancepourtous Team.com said:

Hello, savings is first of all an isolated expenditure of your budget for investment purposes. Income can then be received. Best regards

The Lafinancepourtous Team.com

Good morning,

I find it very simple and practiced the use of the Budget Detaille Month A month tool. However, I do not understand the usefulness of the balance on the start of the period for each month, the corresponding cells are also wreckled except the first which can be understood, but the others, I do not understand . In addition, the calculation formula is cumulation from one month to the next, and the annual total is equal to the sum of each cumulative monthly cell . Thank you for your help on this point . In any case thank you for this tool which apart from this little question fully satisfies me.

The IEFP Team said:

Hello, thank you for your encouragement! Best regards. The Lafinancepourtous Team.com

Hello, I just downloaded your account management module (on Calc) because the one I created was too long to do. I will test it for a few months but given the configuration it seems quick and easy to use ! Thank you – I will not fail to document myself on the rest of your site which seems really complete ��

The IEFP team said:

Hello, we thank you for your message. Best regards.

The Lafinancepourtous Team.com

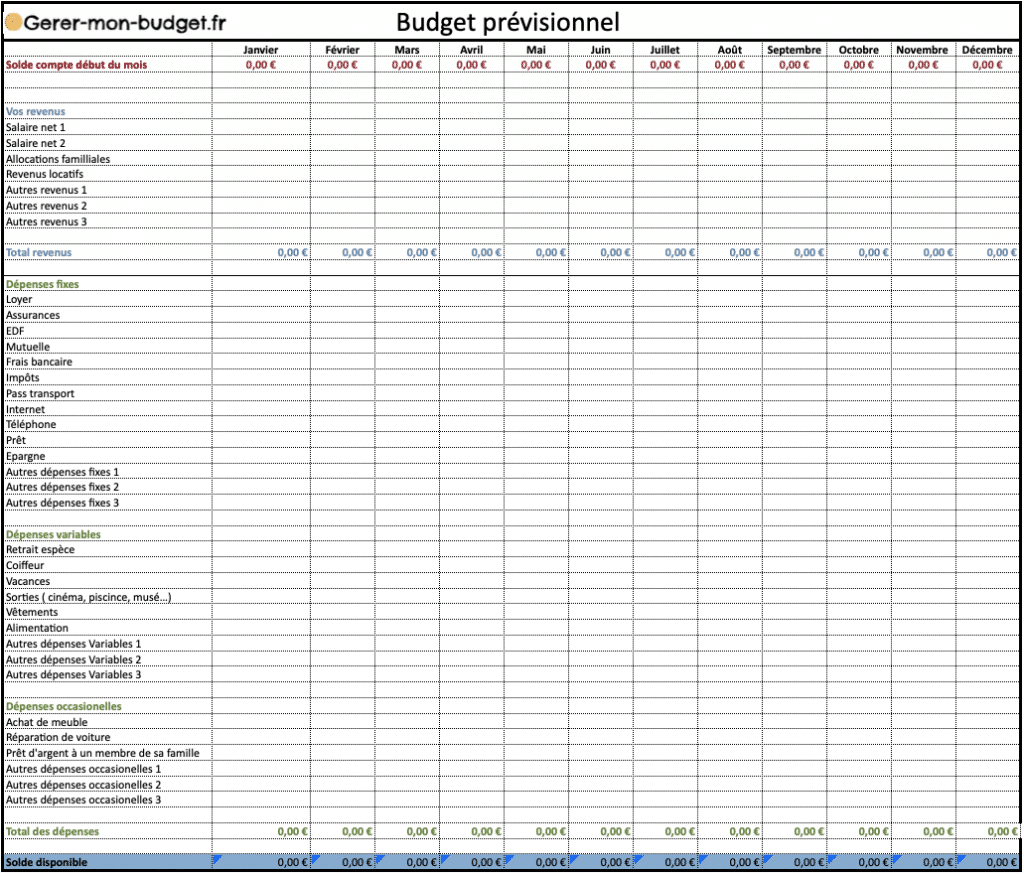

To download your Excel Family Budget Free Table

We know that it is important to keep your accounts regularly … It is even more true when you have a family budget to manage: school supplies, children’s sport, transport pass, food, clothes … all these spending stations, if they are not controlled, can quickly plunge your accounts ! In order to control your budget and have a view of all your different spending stations, you can use mobile applications, but especially your good old Excel spreadsheet ! Here is a model of Free Family Budget Excel Table.

In order to follow the income and expenses of your home, I suggest you download this Excel family budget table for free. You can use this Excel Budget table for your budget management. Expenditure stations and income should be adapted according to your own situation, you can modify the different columns. You can use this file for personal purposes, and above all share it !

![]()

If you like paper and want to do your accounts with a sheet and a pen, you can download my Excel file in PDF format by clicking here: Download the Excel Family Budget file in PDF format

How to use the table?

The file is in format .XLSX, you therefore have several possibilities to open this table. Here is the software you can use: Microsoft Excel, Apple Numbers or free software like Google Sheets and Libreoffice.

How to fill out this family budget table?

To fill this Excel budget table, nothing could be simpler ! You just have to fill in the dedicated boxes (the calculations will then be done automatically):

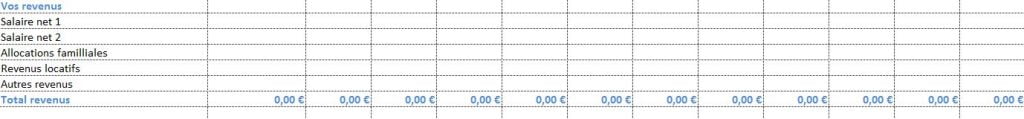

- The balance of your account at the beginning of the month: this is the amount you have on your account before you have all your expenses and reach your income.

![]()

- In this part, you must meet your net income after taxes. These are all the sources of money that you receive every month: salary, rental income, social assistance, food pensions, dividends … in the event that you are married, also enter the income of your spouse (e).

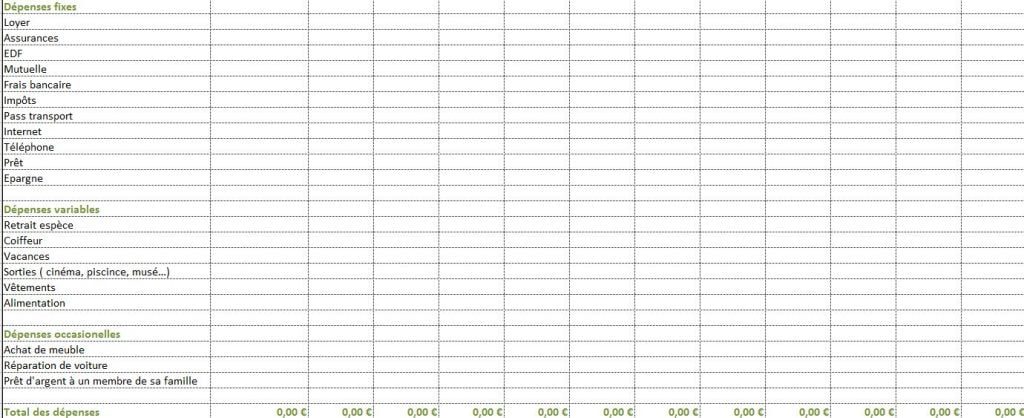

- In this part, you must complete your fixed, variable and occasional expenses: rents, insurance, bank charges, taxes, internet, loans, etc. Fixed expenses are those which are paid by direct debit. Variable expenses are all expenses that have no fixed amount from one month to the next: vacation, races, outings … Exceptional expenses are all the expenses that are not expected: unforeseen expenses like repairing your car, changing a television, health costs … You must add all the charges that pass to your account. Do not forget to add your savings. Why did I put savings as a fixed expense ? Because savings must be thought as such. It is recommended to place 10% of its income at least 10% of its income.

- The calculation of the balance (income – expenses) is done automatically, once you have filled the different boxes in the table. The balance must be positive: if this is not the case, then you must review your expenses. Start with the most important spending stations and try to lower your charges as much as possible.

![]()

Video on how to use the Excel Budget Table

I also published a video that explains how to fulfill the Excel Budget table well.

By loading this video, you accept the privacy policy of YouTube.

Learn more

Always allow YouTube

Alternatives to Excel file

Budget management application

If you do not have excel or are not very comfortable with this software, you can go through a budget management application. I recommend Linxo. With this secure application, you have access to all your accounts on a single space, you can even make transfers, create budgets and receive notifications as soon as your account is under a defined threshold. In addition, the application is free !

Budget simulator

You can also use my budget simulator that I make available to you which allows you to calculate your online budget quickly and easily.

If you have elements that you want to see me add, if you see tracking tracks in the file, do not hesitate to react in the comments, I will be happy to answer you !

Take advantage of the advice of a financial coach, Book your 1st free interview

After taking stock of your financial situation, our financial and budgetary coaches, will support you to offer you:

- a budgetary strategy

- Personalized financial recommendations.

- The first personalized financial assessment is completely free and without obligation.