Nickel: Return of experience & customer reviews, Nickel review in 2023: what is this local French neobank is worth?

Nickel: What is this local French neobank is worth

Nickel does not, however, skimp on solidarity operations, especially in this pandemic period. The Bank recently made a gesture for its private customers and partners, in particular by offering a Nickel Chrome card to the tobacconists of its network and health staff.

Nickel: Return of experience & customer reviews

Nickel is a real French success story. More than 2.5 million customers in just 8 years, as much as Fortuneo and Orange Bank combined ! Why such a success ? Is it deserved ?

➡️ I wanted to know more by trying the pioneer of French neobasters for myself. Here is my opinion and feedback on Nickel !

Our opinion in short on Nickel in 2023

- An account accessible to all in 5 minutes, without conditions

- Open to everyone (banking prohibitions, over -indebted, etc.) without proof of address or pre -existing bank account

- Possibility of collecting checks and depositing species

- Access to more than 6,500 points of sale for your deposits and withdrawals of species

- Open to 190 nationalities

- Sending species all over the world with Ria

- An ergonomic and practical application

- No 100% free offer: but only 20 €/year minimum

- No savings or investment

- No international transfers

- No virtual card

And take advantage of nickel chrome at half price or € 15 in savings by clicking here !

The French neobanque Nickel offers the essential services of a bank, through a clean offer and without hidden fees. Originally designed for all people with difficulty opening an account in France, Nickel has since expanded its features and is now aimed at the greatest number. Maybe you even ? ��

This is what we will see together through this full and detailed opinion ! ��

Nickel presentation: mobile bank for all ?

Nickel is a French neobank created in 2010 by Hugues Le Bret, ex-CEO of Boursorama, and Ryad Boulanouar, a brilliant electrical engineer. Originally appointed No Bank, she became a Nickel count when she was officially launched in France, in January 2014.

A account, a card and a RIB in 5 minutes

Nickel’s promise

The idea behind account nickel is to be able to provide an account without bank, accessible absolutely to everyone, even to banking prohibitions. Very quickly, the simplicity of the nickel account seduces. The little neobank finds its audience in France, and stirs up the lusts of the greatest… In 2017, the nickel account is bought by BNP Paribas and becomes nickel; while keeping its independence.

Profitable since 2018, Nickel was able to renew himself to expand his target (for example with a high -end nickel metal card and his young card for minors). But without ever denying the simplicity and accessibility that made its success.

An account and a card in 5 minutes, for real ?

Nickel allows you to open a current account without any conditions, except:

- To have a valid identity document.

- To have a functional mobile phone number.

- A camera on your phone, or a webcam.

- And 20 euros in cash.

And yes ! Unlike other online or neobank banks:

- No need for proof of address.

- No need for another bank account.

- You can open your account with cash !

- You can cash checks.

How to open your nickel account ?

Two solutions are available to open your Nickel account:

- Online via their website.

- Or directly in a nickel point (tobacconists and partner traders).

However, it is not possible to open your nickel account directly in the mobile application. The latter is only accessible after activating your card.

-50% on nickel chrome or € 15 in savings

My experience with Nickel

I have always been intrigued by Nickel so I wanted to test the opening of an account to see if the neobanque keeps its promises. So I went to their official website and I launched the stopwatch … let’s go ! ⏱

At first, I went to the nickel site with my identity document.

Once my passport has been downloaded, I was asked for a selfie. Taken with my computer’s webcam, my photo was recognized the first time. ��

Then I had to enter some personal information: marital status, residence address, heritage, etc … of the classic. The stopwatch indicates less than three minutes when I electrically sign the general conditions. So far, so good. ��

That’s it ! I received the SMS for the electronic signature, as well as a 5 -digit code for finalize my registration in a tobacco office. Besides, it is specified that this code is valid for 30 days. The stopwatch indicates a little more than 4 minutes. ��

As a precautionary measurement, I checked on the nickel site that my tobacconist is a partner Before you go there. Once there, I was a little lucky because I was the only customer and the boss was able to take care of me directly (thank you the month of August in Paris ✌).

Then he checked my identity and I set the 20 € of annual liquid contribution. In exchange for my ticket, the tobacconist directly gave me my card and my rib ! ��

Finally, the last step: activate the card. After the validation of the account by the tobacconist, I received in the wake the PIN code of my nickel card by SMS. I just have to make a first withdrawal or pay a merchant when entering the PIN code to definitively activate it. As I was in a tobacco office, I was able to do it in stride. ��

You don’t have a computer at hand ? The nickel points have terminals with integrated scanner for your identity document, allowing you to create your account directly on site. You can also manage it from the terminal, if you do not have a smartphone to download the application. Very convenient !

Result: promise held ?

Finally, Nickel keeps his promises : online registration or on a nickel terminal literally takes less than 5 minutes. Nevertheless, even if I was able to leave with my card activated “under my arm” the same day, The deadline to go to the tobacco office is not taken into account. But there, I quibble. ��

Nickel is currently the only mobile or online bank that allows you to open an account so quickly, with only an identity document and 20 € in cash !

-50% on nickel chrome or € 15 in savings

Our opinion on Nickel’s offer

Nickel’s proposal is ultra-basic but amply sufficient to pay and be paid. On the other hand, the nickel account is not free: you will have to pay, at least, from € 20 annual subscription, or € 1.95/month. We saw worse ! ��

We carefully analyzed the offers proposed by Nickel in 2022 and here are the important points to remember:

Nickel at 20 €/year

The basic offer of nickel is not free, but includes:

- An account opened in 5 minutes, with a functional card and RIB immediately.

- A MasterCard payment card, in immediate debit with the “contactless” option.

- Access to more than 6,500 partner nickel points for your deposits and withdrawals of cash, in metropolitan France and in the DROM-Coms.

- The possibility of collecting checks : a rare service for a neobank !

- The Nickel application To block/unlock your card and follow your account in real time.

- Mastercard insurance For your trips: advance medical expenses, repatriation, assistance ..

My Nickel at € 23.33/year

My Nickel contains the advantages of the standard nickel account and adds it A nominative and customizable card, With 5 colors and 6 region visuals of your choice: Corsica, Réunion, Brittany, Guadeloupe, Guyana and Martinique.

➡️ The annual costs are always 20 €/year, to which are added € 10 to make your personalized card, valid for 3 years (or € 3.33/year).

Nickel Chrome at 50 €/year

With Nickel Chrome You have, in addition to the advantages seen previously:

- Exclusive mastercard insurance and assistance During your trips: delays, cancellation, loss and theft of luggage, rental vehicles ..

- Free card payments abroad, unlimited.

- Withdrawals outside the cheaper separate area: € 1 against 2 € for Nickel Or My Nickel.

-50% on nickel chrome or € 15 in savings

Metal nickel at 100 €/year

Nickel’s high -end offer gives you access to:

- No withdrawal fees in France and in SEPA zone, Unlike other offers.

- Free payments and withdrawals outside the SEPA zone, unlimited.

- The cheapest metal card on the market : in front of Boursorama and Revolut.

- Understanding of species at no cost !

And for professionals ?

Nickel does not offer an account for professionals. But if you are looking for one, you can consult our comparison of professional banks online.

➡️ The hero finance notice on the nickel banking offer

Nickel’s banking offer is in our own quality and shines by its simplicity: an account opened very quickly, no hidden costs, and you only pay the services you use. This reminds me of the “right to account” packages of traditional banks, without the endless procedures and the intervention of the Banque de France ! Indeed, since 1984, it is a right to have a bank account, essential for everyday life.

Let’s analyze the nickel pricing grid in more detail and go in search of hidden costs ! If they exist. ��

-50% on nickel chrome or € 15 in savings

Our opinion on nickel costs

Important points regarding nickel costs:

- Account holding costs on all offers : 20 € per year.

- “À la carte” pricing: You pay the services you use.

- Almost no incident costs: Without an authorized overdraft and with immediate debit cards, difficult to do better to limit the risks.

- Species deposits are possible, but billed at each operation. With the exception of the first deposit for the opening of the account, with a maximum of € 250 or if you have a metal card.

- Ditto for checking : 3 € per discount.

➡️ The hero finance notice on nickel costs

Our overall opinion on nickel costs is rather positive : Apart from the annual costs of € 20 per year, common to all accounts, there is no hidden fees. Likewise, the absence of inactivity costs and the impossibility of having an authorized overdraft prevent any incident on the account.

Compared to a traditional bank, nickel prices are, in our opinion, much more advantageous. Just the contribution of your credit card will cost you more than a nickel account year -round. Without forgetting agios and intervention commissions, which do not exist in mobile banking.

On the other hand, if you are looking for a 100% free neobank, you will rather have to turn to Revolut or Lydia, even if you have to ignore the deposits of checks and species. In addition, you will need to have another account already opened elsewhere … ��

-50% on nickel chrome or € 15 in savings

Nickel offers a full range of card, adapted to all budgets. Which card to choose and what are their differences ? Let’s see that ! ��

Comparison of nickel bank cards: which to choose ?

To help you make your choice, we have joined the credit card from a large French bank in our table (Cleo LCL). It’s a visa Classic, Equivalent to the Nickel Standard Mastercard.

Here is what to remember:

- We appreciate Mastercard insurance on all cards : they are at the standard level for the card Nickel classic and My Nickel. While Chromium And Metal Take advantage of insurance equivalent to a Gold or Visa card First, Excellent for traveling.

- The only difference between Nickel And My Nickel is the personalization ofthe map (color and visual of your choice). It will cost you 10 € for 3 years, in order to make a nominative card.

- Nickel Chrome And Metal are also quite similar, but the metal card offers you the Free withdrawals worldwide.

- To compare, A removal abroad of € 500 will cost you € 2 at Nickel, while it will cost you € 17.25 at LCL. This is almost the annual contribution of the Nickel account !

- We can regret the absence of blue gaps and mobile payment (Apple Pay or Google Pay).

- Finally, Basic ceilings may seem limited But it is possible to modify them after a month of seniority. ��

➡️ The hero finance notice on nickel cards

The range of cards offered by Nickel is simple and efficient : it allows you to have your money easily, and almost free of charge in the SEPA zone. Mastercard insurance included are appreciable, especially on the entry -level card.

Likewise, Nickel offers the cheapest metal card on the market, For free withdrawals and payments all over the world, in addition to the network Global Alliance BNP Paribas.

Nevertheless, if you are looking for a second -rate secondary account, other neobancs allow you to have a free payment card (like Revolut or Lydia), with innovative features as a bonus.

-50% on nickel chrome or € 15 in savings

We will now see what are the features offered by Nickel and its application. ��

Our opinion on Nickel’s features

Our opinion on the Nickel application

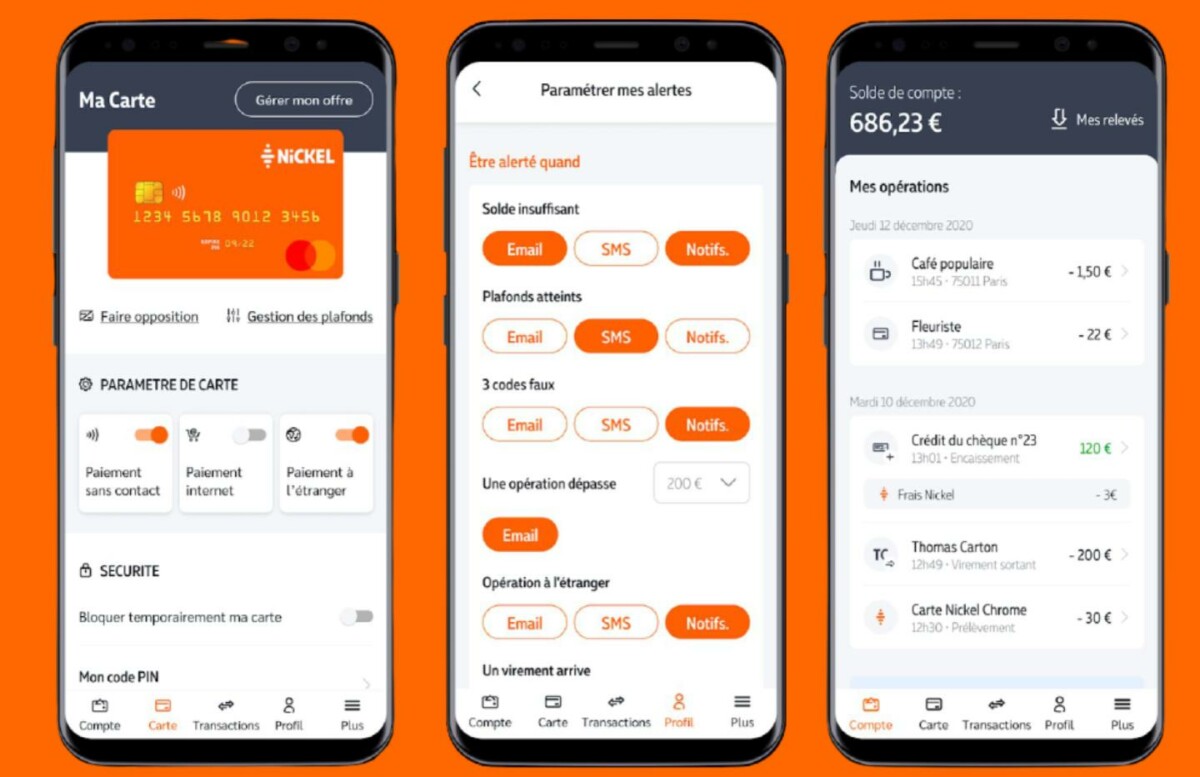

Nickel offers an application efficient and ergonomic, which focuses on essential features such as:

- Management of your card: blocking/unlocking, deactivation of contactless or consultation of the PIN code in case of forgetting, always practical !

- Monitoring your expenses and your budget in detail, with the possibility of programming SMS alerts.

- The possibility of making instant transfers, Even if they are charged € 1 per operation.

- Sending species to more than 150 countries with RIA : directly from your Nickel application.

- Total control over the nickel account of your child : whether you are a nickel customer or not.

Nickel customer reviews

✅ Apple Store’s opinions are good overall, with a note of 3.9 / 5 of 6,700 reviews. The Google Play version is a little better, with 4.1 / 5 on more than 38,000 reviews.

➡️ Overall, my opinion on the Nickel application is rather positive : it goes to the essentials and does not cling to features that some may find useless. You can easily consult the movements of your account, manage your card and send money, either by transfer (in SEPA zone only), or via their RIA partner, in more than 150 countries.

We will still highlight the absence of virtual cards. If you like innovative features, we advise you to look rather from Revolut or Lydia side.

-50% on nickel chrome or € 15 in savings

Nickel’s limits: borrow and save

Nickel is not a credit institution and is not intended to become so. The absence of authorized credit or overdraft is clearly wanted by the mobile bank. This offers you the security not to exceed your budget and not to pay incident fees, which can quickly accumulate.

If you are looking for an online bank capable of financing your projects, we invite you to consult our comparison of the best banks online.

Our opinion on nickel investments

No investment or investment solution but it is a choice assumed by Nickel : its offer is intended to be accessible to everyone and focuses on the provision of an account and a payment card. Nevertheless, some neobancs make the effort to offer very easy -to -access savings and investment solutions (Lydia and revolut in particular), but not the cheapest. If you want my opinion, it is better to invest directly with trading, PEA or cryptocurrency specialists.

Our opinion on nickel customer service

✅ Nickel offers customer service based in France. You can contact him by phone, email, or via social networks. From Monday to Friday, 8:30 a.m. to 7 p.m. and Saturday from 9 a.m. to 6 p.m.

Nickel advisers can help you regarding the use of your account, the application or modify your card ceilings. On the other hand, they cannot carry out operations for you, such as transfers for example.

If you are looking for an online bank that emphasizes the quality of customer relations and advice, look rather on the side of BforBank or Monabanq.

-50% on nickel chrome or € 15 in savings

Conclusion: When to open an account at Nickel ?

As a conclusion, our opinion on nickel is excellent ! It is a real tour de force and a small revolution in the banking world. Its unique and uncompromising offer allows millions of people to access an account with a RIB and a card, to pay and be paid. Especially since she is accessible throughout France, with only one identity document and € 20 in pocket.

But the real nickel stroke of genius in my opinion is to rely on the tobacconists for its distribution: You are sure to find a nickel point nearby, even in the provinces or the DROM-Coms. Unlike traditional banks, which are closing more and more agencies over the years ..

Last point to underline: Nickel is currently the only mobile bank to allow you to Place both liquid and checks on your account. And even, the only French bank account, to my knowledge, that you can open with cash !

An account for the excluded of the banking system, but not just them !

Obviously, the most “geeks” of us will clearly pass our way: unlike other neobancs, Nickel offers no innovative functionality. I find a little regrettable the absence of virtual cards, yet very practical for use.

And even if it means offering a “bank without bank”, why not downright offer purchase and payment in cryptocurrencies, like Binance or Revolut ? ��

On the other hand, Nickel is really ideal and unique for Anyone who experiences difficulty opening a bank account in France, like foreigners, fixed homeless or banking prohibitions.

But not only ! Students can find the perfect mobile bank to control their budget, Without any risk of debit on the account. The same applies to people who have to regularly receive or send species, For the sake of discretion or by necessity (family abroad for example).

-50% on nickel chrome or € 15 in savings

What alternatives to nickel ?

The French neobank has an atypical offer but the absence of certain services (savings, authorized overdraft, credit, etc.) could be prohibitively. Here are some interesting alternatives:

- For cash deposits : Monabanq, Sogexia or Bunq.

- To invest in the stock market : Fortuneo, Bforbank or a specialized broker.

- To travel abroad at no cost : Fortuneo or Revolut.

- For credits : see our comparison of the best banks online.

Faq

Can American residents / citizens open a nickel account ?

No, Nickel is not available for American citizens or residents.

What does it take to open a nickel account ?

To open a nickel account, you only need a valid identity document (identity card, passport, residence permit), a mobile phone number and 20 euros.

How to open a nickel account ?

The opening of your nickel account is possible online or directly with a nickel tobacconist, thanks to the terminals with integrated scanner.

How to place money on a nickel account ?

Several possibilities are available to you to feed your Nickel account:

– in cash, in a tobacco office or a nickel point

– by check, sending it by mail

– by transfer, using your nickel rib

– by credit card

Can we pay everywhere with Nickel ?

Yes. The Mastercard Nickel card is accepted in more than 200 countries.

Can we open two Nickel accounts ?

No, it is not possible for one person to have two nickel accounts.

Antoine was heritage advisor and private banker before joining Finance heroes. He puts his service and his experience in the banking environment at your service.

Comments

December 31, 2022

Received an email nickel bnp paribas

Booklet 4.95% Capital blocked 12 months

Is this a false or a scam ?

thank you for your reply

Good morning,

It is surely a scam, Nickel does no canvassing and does not offer savings booklets.

January 28, 2023

I would like to know why the RIB Nickel is not accepted for the youth warranty at the Local Mission

Good morning,

It is to the local mission that this question must be asked. ��

Furthermore, you can remind them that discrimination in RIB is prohibited in France.

Is it mandatory to validate the postal address and if so how ? In the tobacco office, I was warned that I must receive a letter at my postal address with the code to validate the address. And without this code my account will be blocked. But I received nothing. I sent the proof of address via nickel form. No news.

THANKS

Good morning,

I invite you to contact Nickel customer service by phone so that they can help you validate your account.

February 22, 2023

I got my account hacking at the end of November 2022: 700 euros! Nickel confirmed to me that I was going to be reimbursed within 3 to 5 weeks, after having completed the reimbursement file at the police station . I have still not been reimbursed despite several calls to customer service and send an email to the Nickel mediator!!What to do ?

February 24, 2023

Good morning,

If you have made a formal complaint with the mediator, it has a legal period of 90 days maximum to answer you. In the event of a very complex file, an additional time may be necessary. You are then informed by the mediator.

February 26, 2023

Travel insurance for me and my children I must travel and I have not taken out insurance from the loan company seen that I have the nickel card is that I am insured if I want to modify my ticket and those children thank you

Compt nickel closing by nickel without espical porqua after 5 years used ��

I bought a nickel card in a tobacco desk. To then open my account on the internet and therefore be able to supplement it and make it work, the site asks me for my identifier (written behind the card that was given to me) and my family name but once I tell them application replies that she does not recognize me. Unable to contact someone by phone. You must obviously have already opened your account and therefore be able to inform it at the level of the phone answering machine to have access to an advisor otherwise the answering machine always sends you back to the website with which we do not get out of it. I sent an email message to Nickel without having had no return. In short, I spent 20 euros and I am unable to operate my account. Either it is a scam or they are really not to the point in terms of customer service. I’m afraid of having lost 20 euros.

Nickel: What is this local French neobank is worth ?

If it can be considered as the very first French neobank, Nickel offers a very different model taking the form of a local payment account, much more than a real bank. But beyond its accessibility, is Nickel to recommend in the face of the rest of the banking offer in France ?

Nickel characteristics

| �� Opening prime | None |

| �� Income ratings | None |

| ��carte banking | MasterCard |

| Initial ��Depot | None |

| ��Frais of account holding | None |

| ��Parraine | Yes |

| �� Application | Android/ iOS |

| Mobile | None |

| ��3D Secure | Yes |

Nickel in a few words

Nickel is a French neobanque born in 2014 under the leadership of the financial payments (FPE) and its founders Ryad Boulanouar and Hugues Le Bret, respectively Electronic and Financial Engineers. The primary goal was to provide each customer with an inexpensive bank account in just a few minutes, to activate with their nearest tobacconist, and this, without condition of deposit or income. The neobank is addressed to the basis of a well -defined audience: people in banking, students, precarious or even in the process of divorce needing a simple extra account to set up. All this is made possible thanks to a quick opening in any partner tobacco shop. Today, Nickel has more than 2 million customers from all walks of life, even if we do not live in France (more than 160 countries).

The big peculiarity of Nickel is that it is a payment institution, so it cannot speculate with the money of its customers as a conventional bank.

Nickel and the FPE were bought in 2020 95 % by the BNP Paribas group. The Confederation of tobacconists is a minority (5 %).

Nickel prices

Nickel does not have a free account, but the basic contribution is very low: 20 euros per year for access to an account, the equivalent of 1.6 euros per month. The nickel account gives the right to a classic MasterCard card. Nickel is also very transparent on his prices and does not offer any hidden costs, even if they are relatively numerous and expensive as part of a basic account:

| Nickel | My Nickel | Nickel Chrome | Nickel Metal | |

|---|---|---|---|---|

| Card rates | 20 € /year | € 22.50/year | 50 € /year | 100 € /year |

| Initial deposit | None | None | None | None |

| Income conditions | None | None | None | None |

| Withdrawal costs in France and SEPA zone | – € 1.5 per operation (in France) – € 1 per operation (excluding France) – 3 free withdrawals from a tobacconists and nickel points. The following remain at a price of 0.5 €/withdrawal | – € 1.5 per operation (in France) – € 1 per operation (excluding France) – 3 free withdrawals from a tobacconists and nickel points. The following remain at a price of 0.5 €/withdrawal | – € 1.5 per operation (in France) – € 1 per operation (excluding France) – 3 free withdrawals from a tobacconists and nickel points. The following remain at a price of 0.5 €/withdrawal | – Free in France and SEPA zone -3 free withdrawals from a tobacconists and nickel points. The following remain at a price of 0.5 €/withdrawal |

| Payment abroad (excluding SEPA zone) | € 1 per operation | € 1 per operation | At nochy | At nochy |

| Withdrawals abroad (excluding SEPA zone) | € 2 per operation | € 2 per operation | € 1 per operation | Free |

| Payment ceiling | 1,500 – 3000 € /month | 1,500 – 3000 € /month | 1,500 – 3000 € /month | 1,500 – 3000 € /month |

| Removal ceiling | 300 – 800 €/ week | 300 – 800 €/ week | 300 – 800 €/ week | 300 – 800 €/ week |

The My Nickel, Chrome and Metal accounts, respectively at 22.50, 50 and 100 euros per year, are not so essential, even within the framework of a main account, apart from the Mastercard insurance, the fault of, advantages not so far from the basic offer.

Other costs are this time attributable to all accounts. We note for example the supply of the account by bank card from the customer area (2 % of the amount), the receipt of check (3 euros per deposit) or even, more surprising, the exceeding of 60 SMS alerts per year ( 1 euro for 10 additional SMS). Depending on the use that can be made of a nickel account, these costs may have a significant impact on banking experience.

How to feed your account ?

Like almost all neobancs, Nickel allows you to supply your account from any external account via the RIB and in a non -capped manner. On the other hand, it is impossible to record an external account to make rapid transfers: these take on average between 24 and 48 hours.

In addition to transfers, it is possible to collect checks from the application via a very practical dedicated system. The collection period is however very long and can take up to 15 working days.

Finally, you can also feed your account with cash directly in a partner tobacco office. However, you should know that this operation is the subject of costs: 2 % of the amount deposited and capped at 950 euros in cumulative on 30 days calendar. On the other hand, the balance is added in real time to the account.

Open an account at Nickel

1 account + 1 card + 1 rib in 5 minutes, that’s what nickel promises when we connect to your site. As it stands, although one could put on the timing, it must be recognized that Nickel holds his word. You should nevertheless know that 2 steps come to fit into the process. The first validation is done on the site with the provision of a recto -sided photo of the identity card, some personal and professional information. The whole thing must be validated by a facies verification via webcam or by the camera of a smartphone.

The second step is to go directly to a tobacco or partner point of sale of the bank for the final opening of its account. After the supply of your identity card and the 20 euros of the first contribution, the tobacconist publishes the card of your choice, the operation takes only a few minutes.

Then just go to the bank’s web platform or the application and enter the identifiers located on the back of the card.

Nickel also has an offer dedicated to adolescents aged 12 to 18 and includes a standard mastercard bank card with systematic authorization, all offered for 20 euros per month and pilotable by parents via the application.

Initial deposit and overdraft management

Apart from the subscription to obtain your account and your card, Nickel does not ask for any initial deposit on all of its accounts. You can therefore use the account once it is created at your to-Buralist without having a balance.

Nickel accounts, on the other hand, have the impossibility of being debtors. Thus impossible to obtain an overdraft authorization. If a payment exceeds the balance of the account, the payment will simply be refused.

Welcome premiums

Nickel not being a neobank like the others and even less an online bank, it offers no welcome bonus for a way for an account opening.

Nickel does not, however, skimp on solidarity operations, especially in this pandemic period. The Bank recently made a gesture for its private customers and partners, in particular by offering a Nickel Chrome card to the tobacconists of its network and health staff.

Sponsorship

The nickel sponsorship offer allows customers to get a premium in reward when they advise their loved online. Everything is done via a sponsorship code system available from the customer area. For a sponsored godchild, the godfather obtains 3 euros:

- 1 godson = 3 euros;

- 2 referrals = 6 euros;

- 5 godchildren = 15 euros;

- 15 godson = 45 euros.

The bank does not give any limits, it is therefore theoretically possible to earn up to 3000 euros per 1000 sponsorships.

Insurance and services at Nickel

The accounts at Nickel are linked to the MasterCard organization. Its customers are thus dependent on the insurance package associated with the chosen card level. Note all the same that the basic nickel account does not offer additional insurance, only nickel cards chrome and nickel metal have them. The first offer a classic insurance policy for travel (flight delay, loss of luggage, etc.), in the event of theft of equipment and for fraud for purchase on the Internet. But it is with the Nickel Metal card that the exclusive insurance is the most numerous, thanks in particular to the contribution of Europ Assistance for travel in addition to the guarantees included with the corresponding Mastercard card.

Nickel also offers a partnership with RIA allowing its customers to send money very simply and since the application in more than 150 countries. The service works in the hair with perfect integration and with the currency corresponding to the country of reception.

Cashback

Nickel has been offering a system of cashback making it possible to obtain a percentage of reimbursement on purchases made via partner signs, in store or online. This is not a platform specific to the bank, but just the integration of the Mastercard organization platform called ” Travel Rewards »». This program will therefore only be intended for globetrotters and wealthy customers making purchases in one of the partner stores. None is located in France: this concerns, for the majority, luxury stores and restaurants.

One has the impression that this program of cashback has been added to inflate the list of services without having any real interest in the main target of the bank.

Customer service

From the application, it is possible to obtain access to the nickel support directly via chat, email or by call. Despite everything, the availability of advisers can vary depending on the schedule, which can be very disabling in the event of travel abroad. On the other hand, the answers are well personalized and the tone is cordial. It is also possible to obtain assistance from the social networks of the bank such as Twitter or Facebook with much better responsiveness.

And cryptocurrency ?

Nickel is in no way a bank thought for investors in cryptocurrency or any speculative values. No support in this area is therefore to be put to his credit.

Our opinion on the Nickel mobile application

Like any good self-respecting neobank, Nickel has set itself very early on a functional and exclusive application that does not take the form of a web-app. Even if it remains simple in its presentation, in particular by taking up the orange, black and white colored codes of the bank, it thus gains in readability, in fluidity and it is rarely taken in default.

On the current account page, the display of expenses is rather clear and well prioritized thanks to an effective categorization of expenditure with visuals corresponding to each type of purchase. We are even entitled to a fairly precise horoding, a specificity not so common on this type of application, well seen ! In addition to payment or transfer notifications, it is possible to fully configure its alerts (insufficient sales, affected ceilings, etc.) whether by notification, email or even SMS.

We also regret the non-load of mobile payments via Google Pay or Apple Pay.