N26 or Revolut: Comparison of offers in 2023, n26 vs revolut: which neobanque to choose? Our comparison in 2023

N26 vs revolut: what is the best neobanque to choose in 2023

N26 vs revolut:

Banking services

Revolut or N26: Compare them to choose the right !

You wish to subscribe to N26 or Revolut, But you don’t know which one to choose ? You are in the right place to find out more �� !

What a banking application offers the best experience ? What is the best bank card between Revolut and N26 ? Which offer the most competitive costs ? What is the best bank account if you are used to paying for currencies ? Who has the most responsive customer service ? Which offers the best business account ? To these questions – and others – we give our answers in this complete file !

And we start immediately with a summary of our Revolut VS N26 comparison: ��

N26 vs revolut: the comparative match

What is the best bank between N26 and Revolut ?

N26 is the best bank if you are looking for an easy -to -use bank account, while Revolut will be relevant if you pay regularly in foreign currencies, or if you have savings you want to place in a strong currency (USD, GBP) in order to escape inflation. The N26 mobile application offers a simple and ergonomic interface, with little or even any frills. In addition, the costs are competitive, with a free basic account formula and a rise with several paid offers.

Here are the big differences between the two neobancs:

- �� Revolut advantage for IBAN and geographic availability: It should be noted that the N26 account has a German Iban only, while the Revolut account has since May 2022 available with a French IBAN. Note also that the Revolut account can be used in Europe but also in the United Kingdom, the United States, Australia, Singapore, Switzerland and Japan, this can be important

- ✈️ Interesting multidise account at Revolut: N26 is not a multi -duty account, but authorizes transfers to foreign accounts through Wise. Revolut offers a real multi-pointed account, with the possibility of holding several currencies in currencies.

- ��investment, trading and financial products : N26 does not offer financial services in its mobile app, while Revolut allows you to buy actions and cryptocurrencies directly in its app.

�� In the comparison N26 vs revolut, Revolut has an advantage when it comes to frequent international payments, transfers outside the SEPA area and foreign currency transactions. The British neobank has the most competitive offer on this market. N26 has advantages for local and more classic use: the costs are competitive on a daily basis.

N26 vs revolut: the complete comparison !

Now that you have a better idea of the possibilities of each neobank, let’s be interested in each of the key aspects of N26 and revolut offers: banking, cards, prices, security and customer service.

�� N26 vs revolut: banking services

In the comparison of banking services N26 vs revolut, Revolut is distinguished by offering a multi -pointed bank account, with several different currencies held on your bank account, while N26 only offers an account in euros. On paper, N26 and Revolut both offer current accounts (with IBAN), a debit card, push notifications and the possibility of making transfers (including international).

Here is a table that summarizes the main comparisons of banking services between the two neobancs: ��

N26 vs revolut:

Banking services

Bank transfer, CB

Bank transfer, CB

Euro + 30 currencies

Mobile app

Web interface

Here is point by point the differences between the two neobancs:

- ���� A bank account with IBAN FRANCEvsAIS at Revolut : If N26 and Revolut both offer current accounts with bank card and mobile app, it should be noted that N26 is a current account labeled only in euros, while Revolut offers a real multi -tedist current account, with the possibility of holding several different currencies through sub-accounts

- ���� British banking and Iban contact details possible with Revolut : The N26 account has a German Iban, while the Revolut account can have a Lithuanian, British or French Iban (possible since May 2022).

- �� Operations and subsistence under currencies at Revolut : If the N26 account is labeled only in EUR, it is possible to make conversions to pay in currencies (this is done through Wise). On Revolut, it is possible to read your account in EUR / GBP / HUF / CZK, and make operations and receive transfers in 30 different currencies

- ✔️ no cash management or checks in the two mobile banks : here no difference between the N26 and Revolut accounts, which can be supplied by transfer from another account or by bank card. None support cash deposits in France.

�� In choice N26 or revolted on the criterion of banking services, Revolut offers a better set : thanks to a French IBAN, the possibility of holding several currencies and the choice between several levels of services (Standard, Premium, Plus, Metal)), British neobank authorizes more possibilities.

The Revolut account can be used as much for everyday life as during your travel, professional trips and international transfers. It can even allow you to place your savings on strong currencies, in order to escape the effects of hyperinflation and the reduction of purchasing power in Euro.

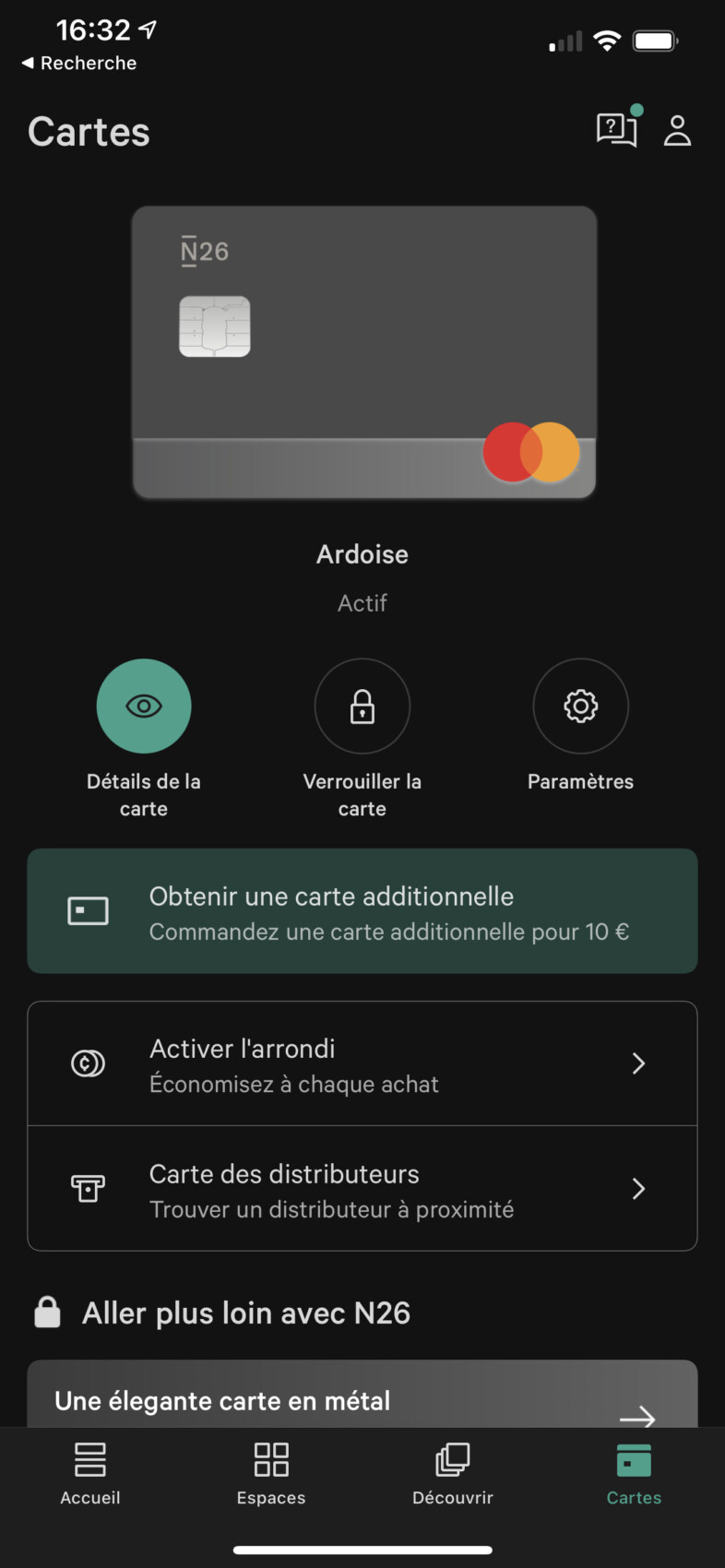

�� Revolut or N26: bank cards

In the comparison of bank cards between N26 and Revolut, The two mobile banks are tied. Both offer MasterCard cards with a choice from the standard card to the premium à la carte. The two neobanques offer contactless payment, via Apple Pay and Google Pay, and virtual cards. Where a difference appears is that N26 offers free payments in currencies whatever the bank card, against 0.5% at Revolut.

Here is a table that summarizes the main comparisons of the two ranges of bank cards: ��

N26 vs revolut:

Bank cards

Standard (free)

Smart (€ 4.99)

You (€ 9.90)

Metal (€ 16.90)

Standard (free)

Plus (€ 2.99)

Premium (€ 7.99)

Metal (€ 13.99)

Free up to € 1000 per month (2% then)

Free (€ 2 per withdrawal from the 5th withdrawal)

Free (then 2% from € 200 per month)

Free (then 2% from € 200 per month)

Yes (via Moneybeam)

Free

(€ 10 on standard offer)

Here are the differences between the cards of the two mobile banks, range per range:

- ��Revolut stands out with a better standard offer (standard mastercard): For N26, there is no monthly fee with a ceiling of 20,000 euros for payment and 10,000 euros for withdrawal. For Revolut, there is also no monthly fee, however the difference lies in better payment ceilings (100,000 euros/24 hours)

- �� A better offer “Gold»at N26 (Mastercard Gold card) : N26 offers its Mastercard Gold at € 4.99/month when Revolut offers his at € 2.99/month. The ceilings remain the same as for standard cards, to the advantage of N26 on withdrawals and cashback

- �� A better “premium” offerAt N26 (Mastercard Platinum card) : the N26 you card and the Revolut Premium card are suitable for people with higher requirements, whether for daily life or holidays. It includes all the advantages of N26 Smart / Revolut Plus, as well as a wide choice of insurance for daily life and travel.

- �� A better “metal” offerat N26 (Mastercard World Elite) : the N26 Metal card seduces with its cashback, its insurance and its free withdrawals worldwide. The Revolut card presents interesting innovations (guarantee extensions, customizable design).

Note on prices – n26 smart vs revolut more. If the cost of the monthly subscription of N26 Smart is higher than that of the Revolut Plus offer, we note that for use the N26 Smart formula is more advantageous in terms of withdrawal ceilings over 30 sliding days and prices by operations – especially on foreign currency payments. We looked at a point comparison by point between the two formulas: ��

N26 Smart vs revolut Plus:

Card comparison

Mastercard Gold

(Visa Gold on request)

1 free / month (0.5% beyond)

Free up to € 1000 (0.5% beyond)

3 free / month then 2 € / withdrawal

Free within the limit of 200 €/month or 5 withdrawals (then 2%+1 €/withdrawal)

Free within the limit of 200 €/month or 5 withdrawals (then 2%+1 €/withdrawal)

��In comparing Revolut and N26 cards, there is a slight advantage to choose N26 due to full travel insurance guarantees, Free withdrawals, better operating ceilings and especially an interesting cashback. Revolut offers an impressive diversification of these services, however it should be noted that its offers are much more suitable for professionals than to individuals.

�� N26 vs revolut: prices

In the comparison of prices between N26 and Revolut, the two neobanques are very close. The basic prices are very close: no monthly contribution, a quota of free withdrawals in euros. On the other hand, differences appear on foreign exchange operations. Revolut has the distinction of not taking any commission on the exchange rate from Monday to Friday with a monthly ceiling of 1000 euros per month.

Here is a table that summarizes the prices offered by the two neobancs: ��

N26 vs revolut:

the rates

1 free / month (0.5% beyond)

Free up to € 1000 (0.5% beyond)

3 free / month then 2 € / withdrawal

Free within the limit of 200 € / month or 5 withdrawals (then 2%+1 € / withdrawal)

Free within the limit of 200 €/month or 5 withdrawals (then 2%+1 €/withdrawal)

Free on weekdays and 1% increase in weekends

– 1 free / month transaction, then 1 €

– 0.12% storage costs

Here are the main points to remember:

- �� A free basic offer at N26 as at Revolut : N26 and Revolut both offer a free account formula, called Standard. Each then offers to go upmarket, with 3 additional offers to benefit from more comfortable card ceilings in particular.

- ✈️N26 is cheaper to use on card payments abroad : N26 does not charge costs when you pay by card abroad. Revolut does not take commission on the exchange rate during the week either, up to a limit of € 1000/month. On the other hand, on weekends, public holidays and beyond the monthly ceiling of € 1,000, Revolut applies costs of 0.5% on foreign currency payments

- ��N26 is cheaper on withdrawals from DAB abroad : N26 does not charge costs for the first 3 withdrawals in the euro zone. If you withdraw money outside the euro zone, costs of 1.7 % will be invoiced. Withdrawals at the automatic counters with your revolut card are free up to € 200 (or up to 5 withdrawals) per month. Beyond this amount, the neobanque invoices costs of 2 %.

- ✔️ Cheaper physical card delivery costs at Revolut : N26 and Revolut both charge costs for the delivery of the card (5.99 € for revolut 5 and 10 € for N26). The two online banks also charge costs in the event of replacement of the card.

- �� Cheaper international transfers at N26 : The costs and exchange rates applied by N26 during international transfers are completely clear and transparent. N26 is indeed partner of Wise, directly integrated into the mobile application.

Note on prices – N26 Premium vs Revolut Premium: Revolut advantage which is more competitive than N26 in terms of the cost of its premium account formulas. We note that the three paid offers from the British neobank cost cheaper: N26 You is € 9.90 per month when Revolut Premium costs € 7.99. For metal offers, the N26 card is more expensive of 3 euros, € 17.90 per month.

��The comparison Revolut or N26 runs to the advantage of N26 for local use. N26 prices on basic operations in SEPA zone are significantly better than Revolut those. For the foreigner Revolut or N26 offer fairly different conditions, since Revolut proposes to hold currency sales, the N26 account being denominated in euros but authorizing payments in currencies.

Nevertheless the prices of operations abroad are a little cheaper in N26.

�� N26 or Revolut: Voyage

In the N26 comparison and revolut on travel, Revolut is a better choice if you accumulate business trips outside the euro zone. Its offer includes the possibility of benefiting from foreign currencies in sub-accounts. N26, and more particularly its N26 Premium offer, is to be favored if you are traveling in the euro zone: operations abroad are free and without ceiling.

Here is a table that summarizes the main points of comparison of the two neobancs in terms of operations carried out on a trip: ��

N26 vs revolut:

for traveling

Yes (from N26 you)

No fees (except weekends and holidays from 0.5 to 2 %)

Free up to 200 € / month

(2% beyond+1 €)

Yes (USD, HUF and CZK)

No multi -duty account

Standard and more: 0.5 % beyond € 1,000

Premium and metal: free

Here are the main differences that we can notice:

- ��️ Plus -supplied travel insurance guarantees at N26: From N26 You, you benefit from travel medical insurance up to € 1,000,000 in an emergency, including dental care and winter sports. Revolut also offers these kinds of guarantees, but hers are not as well provided as those of N26.

- �� Multidism management at Revolut: With Revolut, you can carry out change operations on your smartphone in a few seconds. It’s fast if you need to pay for example a service with the local currency (if it is supported by Revolut).

- �� more interesting conversions and changes at N26: To convert your expenses in euros, N26 offers MasterCard rates while Revolut offers the interbank exchange rate with a charge of 0.5 % for transactions greater than € 1,000 per month. Revolut prices vary depending on the currency and the frequency, and certain conversions will be more expensive if they are carried out outside the opening hours of the exchange market.

�� For foreigners Revolut or N26 are two quite different banks, but revolut advantage for its more flexible modalities in currency. Revolut provides very profitable complementary services for travelers, such as international profiles, exchange services, international payments at no cost and the cashback service with the Metal card. For large travelers, it is Revolut who is doing the best for use.

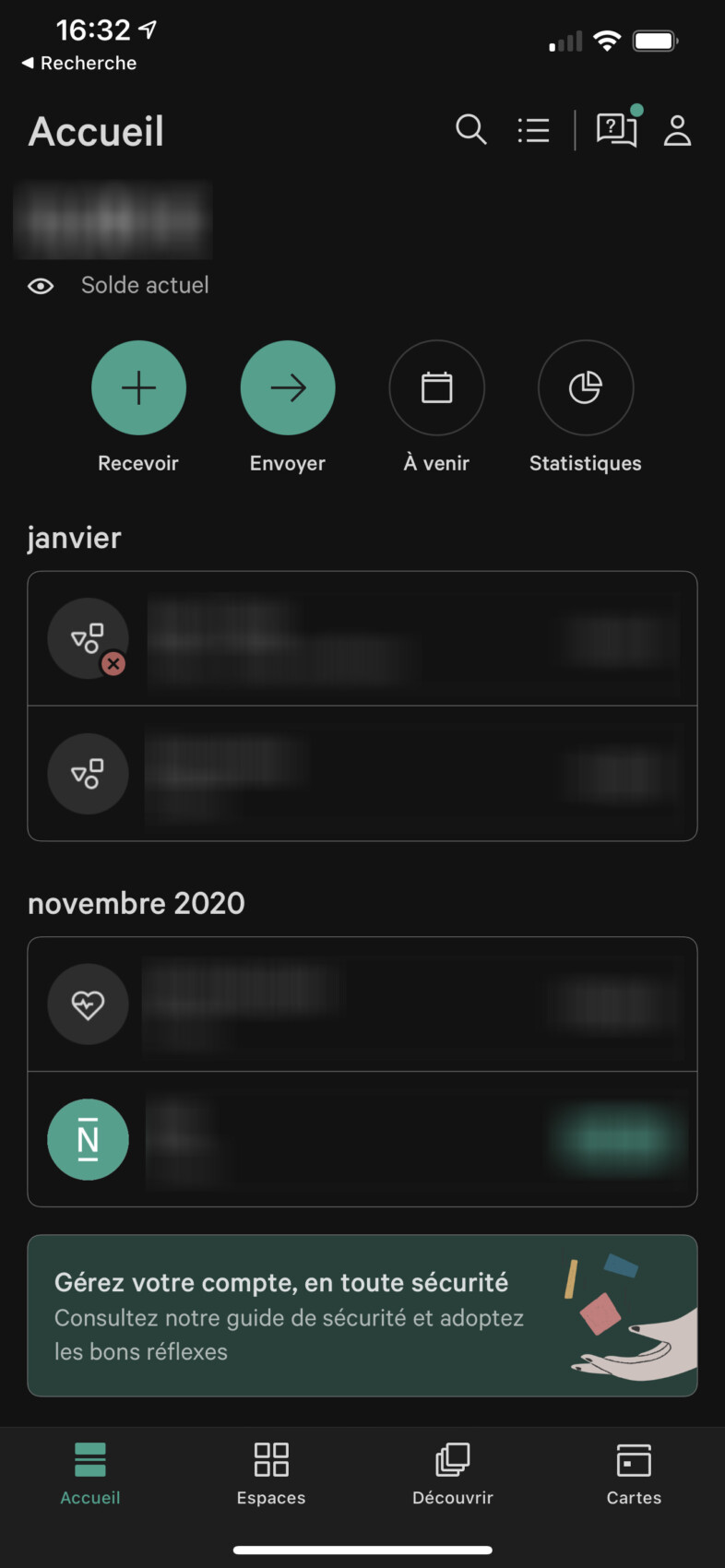

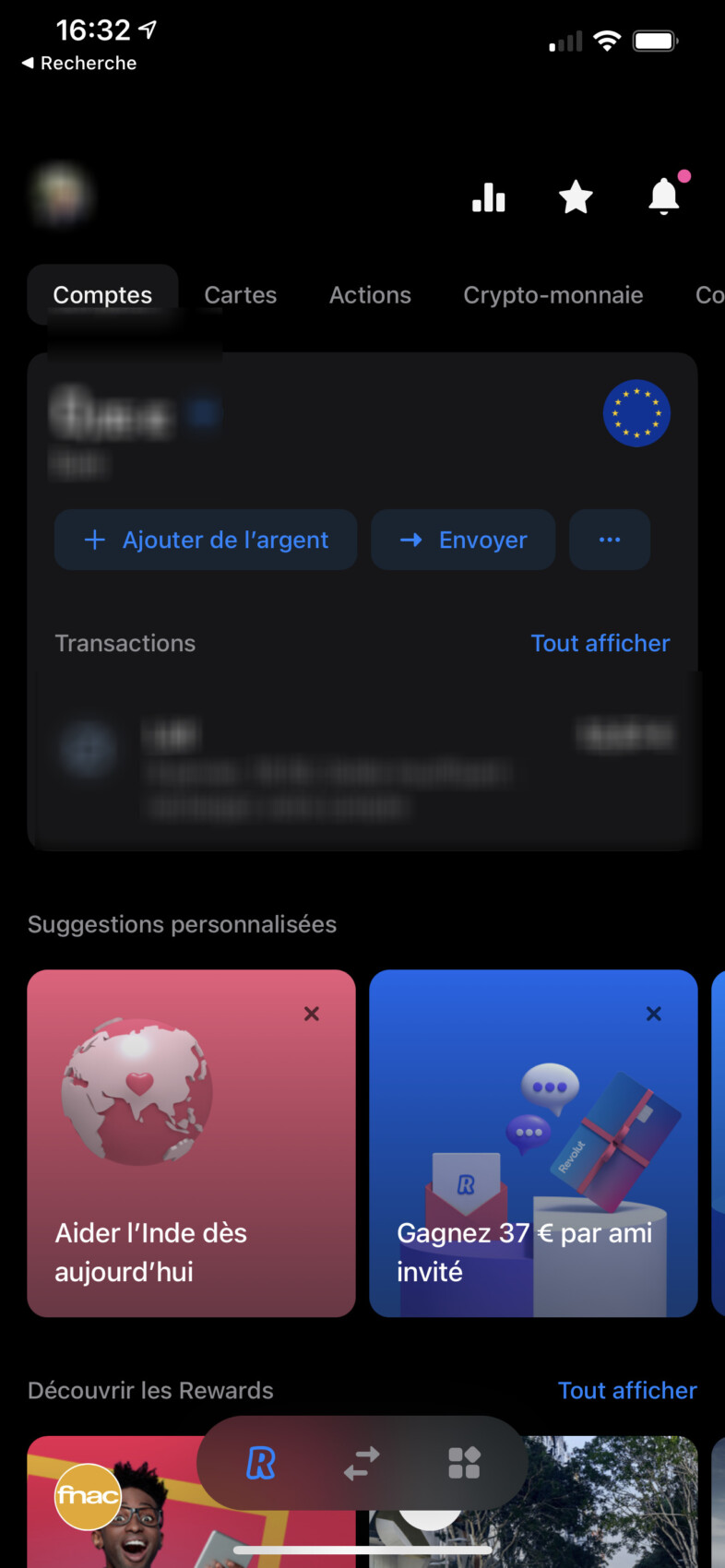

�� Revolut or N26: the mobile app

In the comparison of N26 vs revolut mobile apps, the N26 app is the best daily application. Strong point of the neobank since its inception, the N26 app is excellent for the daily management of a bank account. Everything was done to simplify navigation and ergonomics with a sleek and warm design. The Revolut application is more advanced with a richer interface, therefore a little more complex. It will appeal to trading and statistical data followers.

Here is a table that synthesizes the features of the two applications: ��

N26 vs revolut:

Comparative mobile app

Yes, separate transfer, CB or stripe)

Yes, separate transfer, CB or stripe

Touch ID, Face ID, Fingerprint

Touch ID, Face ID, Fingerprint

Yes (between N26 customers via moneybeam)

Here are the main differences noted between the applications of N26 and Revolut:

- ��Plus of ergonomics and a sober style on the N26 app: The N26 application is much more sober and refined. The colors are limited, which contrasts with the visual richness of the Revolut application. The information provided on the N26 application is therefore limited in order to maintain maximum clarity. Revolut, for its part, provides visuals, colors and additional images to classify payments, and you can even arrange your addresses to suggest or reject a location

- ⚙ More additional features on the Revolut app: N26 is in simplicity, while the Revolut application offers advanced prospects for money management (smart savings, investment, etc.). The two apps suggest the freezing of the cards to avoid fraud as well as planning

- �� Aliitment the N26 account or revolted by transfer : At N26 as at Revolut, you will have to use a transfer from another account, a bank card or stripe to supply your account

�� N26 advantage with its sober and unadorned application. She will delight bankers who are not trying to cling to too busy information. In addition, it also offers interesting features such as budget planning. As for the Revolut app, it is designed like a trading application.

You will therefore have quite interesting suggestions for investments. This seems to appeal to customers, which is why the Revolut application is credited with a better score on the App Store and Google Play.

�� N26 or Revolut: Security

In the security comparison between N26 and Revolut, Revolut part with a slight advantage over N26 thanks to a license from the Banque de France granted to its Revolut France branch, When N26 operates with a license of the German Financial Supervisory Authority (Bafin). The neobank is then a member of the German deposit protection system, which covers up to € 100,000. Revolut is also approved by the EU and supervised by the Lithuania Bank. In any case, N26 and Revolut are both perfectly protected online accounts with all possible security overlay.

Here is a table that sums up the main features on the safety of the two applications: ��

N26 vs revolut:

Fund security

Lithuania bank ����

Regarding the match for reliability and security between N26 and Revolut, here are the main lines to remember:

- ✔️ an ACPR banking license for Revolut: N26 operates in France with a German banking license, while Revolut operates with a French license since May 2022 (which is why it issues a French IBAN).

- �� Excess protection of your data in the two mobile banks: N26 and Revolut both offer biometric authentication (facial and fingerprint) as well as the possibility of freezing and temporarily unlocking your card via the application

- ��Stacularity satisfactory in N26 as in Revolut: For online card transactions, N26 and Revolut have the 3D Secure device on their physical and virtual cards (3D Secure = an additional authentication layer when paying online))

- A very secure N26 or revolut application: Mobile Revolut or N26 applications have innovative features to protect access to their bank account and the use of their means of payment

�� In terms of security, Revolut or N26 offer impeccable security on their respective apps And there is not much to blame the two mobile banks on this aspect. Both applications offer guarantees for managing your funds. The two fintechs generally offer the same security features such as the possibility of blocking the card via the application or the use of the fingerprint to unlock the app.

Nevertheless, Revolut offers unprecedented functionality, namely GPS protection.

�� N26 vs revolut: customer service

Between the N26 and Revolut customer services, N26 customer service is more interesting thanks to the presence of telephone assistance, But only for premium members (paid). For basic offer customers, the only possibility is to contact customer service by email or cat. At Revolut, only the cat in the application is available for all users. In terms of variety and availability, N26 stands out for its competitor.

Here is a table that sums up the customer service of the two neobancs: ��

N26 vs revolut:

customer services

7 a.m. to 11 p.m

(7 days a week)

What you must remember :

- ��N26 offers more varied communication channels: N26 appeals by integrating the possibility of contacting customer service via a telephone call (reserved for customers Smart and +)). Revolut offers cat as a privileged communication channel, for all customers

- ��N26 and Revolut are two ultra-reactive mobile banks: At N26 as at Revolut, operators are reactive. The two neobancs are credited with positive opinions on their customer service, with quick and reliable responses

�� The Revolut VS N26 comparison in terms of customer service shows a slight advantage for N26. The big plus of the German neobank: it offers its paid customers a dedicated telephone line, with reactive and reliable operators. Revolut for his part has chosen a fairly simple policy, it is to emphasize the cat service in the mobile app.

The neobank compensates for this lack of variety by rapid and reactive support for complaints.

�� Revolut and N26: customer reviews

In the comparison of customer opinions between Revolut and N26, Revolut BEneficent of better customer feedback than N26. On Trustpilot, Revolut customers attribute an average note of 4.4 out of 5 (based on more than 110,000 opinions). N26 receives “only” 3.4 out of 5 (on the basis of more than 22,000 reviews). These scores must be put into perspective by taking into account that revolut already has more than 16 million customers, against 7 million for N26.

Here is a table that sums up customer reviews: ��

N26 vs revolut:

Customer reviews

3.4 out of 5

(22,000 reviews)

4.4 out of 5

(115,000 opinions)

3.7 out of 5

(119,000 opinions)

4.4 out of 5

(1.9 million reviews)

4.8 out of 5

(90,000 reviews)

4.8 out of 5

(145,000 opinions)

What must be remembered according to the opinions of customers compared between N26 and Revolut:

- ⭐ The more appreciated revolut mobile application: N26 seems to have a less good ratio in terms of customer satisfaction compared to its mobile app, with an average note of 3.7 out of 5 (119,000 opinions). Revolut customers display a better ratio with an average score of 4.4 out of 5 (1.9 million reviews)

- �� A Trè Customer Services reactive both at N26 and Revolut : N26 and Revolut have in common to have a very responsive customer service, appreciated by users.

- ✔️ Revolut annex services bring added value to many customers : If N26 is limited to banking services, including a consumer loan Younited Credit, Revolut seduces with its equity investment services, ETF and Cryptos

�� By examining customer reviews compared N26 vs revolut, Revolut reviews suggest that Revolut is a mobile bank overall more reliable than N26. The points most appreciated by Revolut customers are: mobile app, customer service, investment services (very recurrent) and finally the possibility of holding several subsistence in currencies.

�� N26 Business vs Revolut Business: the pro account

In the comparison of pro accounts between N26 and Revolut, Revolut does better with a revolut business offer which is open to auto-entrepreneurs but also to companies, associations and liberal professions. We note, however, that its prices are higher compared to those of N26, especially in terms of withdrawals. N26’s professional account is aimed at self-employed only (exercising in individual enterprise).

Here is a summary table of business offers: ��

N26 vs revolut:

Pro accounts

What you must remember :

- �� Free Business Business Offers but limited in both cases : N26 and Revolut each offer a free business offer called “Standard” and “Free”, nevertheless they quickly show their limits for an entrepreneur.

- �� A larger number of legal forms accepted by Revolut: If N26 targets only individual entrepreneurs, Revolut is aimed at companies, associations, in addition to individual companies.

�� By comparing Revolut vs n26 on their professional account offers, Revolut does better by contacting not only to self-entrepreneurs but also to companies and associations. With its three Free, Business Development and Business Growth offers, it offers a range of offers suitable for companies of all sizes. However, you should know that it has a price (up to € 100 per month !)).

Revolut or N26: what to remember to choose !

In the N26 vs revolut comparison, the choice ultimately depends on your needs. Globally, Revolut offers a better offer With a French IBAN, the possibility of storing several currencies, and the choice of many levels of service (standard, premium, plus, metal). The revolut account can be used for daily transactions, but also for holidays, business trips and transfers abroad.

��Revolut also does better than N26 on prices. We note that the three payment offers of the British neobank are cheaper: N26 You, you pay € 9.90 per month. For Revolut Premium which corresponds to the offer equivalent to that of N26, it will cost you € 7.99. The N26 card is 3 € more expensive for metal offers, at € 17.90 per month.

�� It is on the mobile application that N26 is distinguished, with an app that is both simple and easy to use. It will appeal to those who do not want to be overloaded with information. It also has practical features such as budget planning. The Revolut application is created in the style of a commercial application. Therefore, you will receive truly relevant investment recommendations.

This seems to suit customers, since the Revolut application is better rated on the App Store and Google Play.

��N26 is also better than revolut in terms of customer service. Indeed, the German neobank provides a telephone line dedicated to its paid customers. Operators are also fast and reliable. Revolut has chosen a simple philosophy by focusing on the cat function in the application. The neobanque compensates for this lack of diversity by offering customer service in many languages.

Finally, if you want to have more detailed information on each neobank, you can consult the review of N26 and the revolut review to get a more precise idea of the advantages and disadvantages of each of them ! ��

A suggestion or the desire to give your opinion on the comparison between Revolut and N26 ? Put us a little comment, we will be happy to answer you or bounce back on your remarks ! ��

N26 vs revolut: what is the best neobanque to choose in 2023 ?

You may already plan to go to a 100 % online bank, but you have never been able to make a choice among the many platforms. We have screened the strengths and weaknesses of N26 and revolved in this versus in order to better guide you in your choice.

Let it be said, neobancs and online banks have clearly taken space in the French banking landscape in recent years and their ascent is not about to stop. These new ways to think about the management of your agent is based on a 100 % mobile concept via a dedicated application and unique offers. We have therefore selected the two most important players in the sector in France, namely N26 and Revolut. But which neobank to choose ? This is what we will try to determine in this versus.

N26 vs revolut: account opening time

The advantage of having a 100 % dematerialized bank is above all that the account creation process takes less time than a conventional bank or some online banks. In addition, the elements requested and the input conditions are generally very reduced.

Registration at N26 takes less than 10 minutes, directly via the application. The only real condition for opening an account is to justify being at least 18 years old. After providing his identity papers by scanning his card or passport via the camera of his phone, then entered some usage information and the choice of his card, the account is validated directly without waiting for verification with the ‘banking establishment. After 3 to 5 days, we receive the card (after having paid 10 euros for shipping costs) and it is directly ready to be used. It should be noted that N26 is accessible without initial deposit or income condition, it is even possible to create an account by being prohibited banking, which is not the case for all neobancs.

Revolut also relies on speed and simplicity of registration. There too, in less than 10 minutes, it is possible to fully create your account and get your card. The application will then ask for a recto -back photo of his identity card, his contact details and a photo taken with the selfie device on his phone. You then have leisure to choose the card at your convenience. Revolut requests costs of 6 euros to receive your card, but this shipment is free for premium and metal levels. All within an announced period of 9 working days (sometimes less).

In both cases, the registration is fast and with disconcerting ease. The sending of cards varies depending on the periods and undoubtedly other independent factors, but overall, we are on similar timings. In addition, in both cases, it is possible to use your virtual card just after registration by there links to mobile payment systems such as Google Pay or Apple Pay.

Winner: draw

The best online banks

The cheapest bank

Up to 150 € offered For the opening of an account with the BRS150 code

The best online bank

Up to 180 € offered : € 80 for any 1st account opening + € 100 in case of banking mobility

The most modern bank

Up to € 230 offered + 100 € of vouchers offered

N26 vs revolut: the price of cards

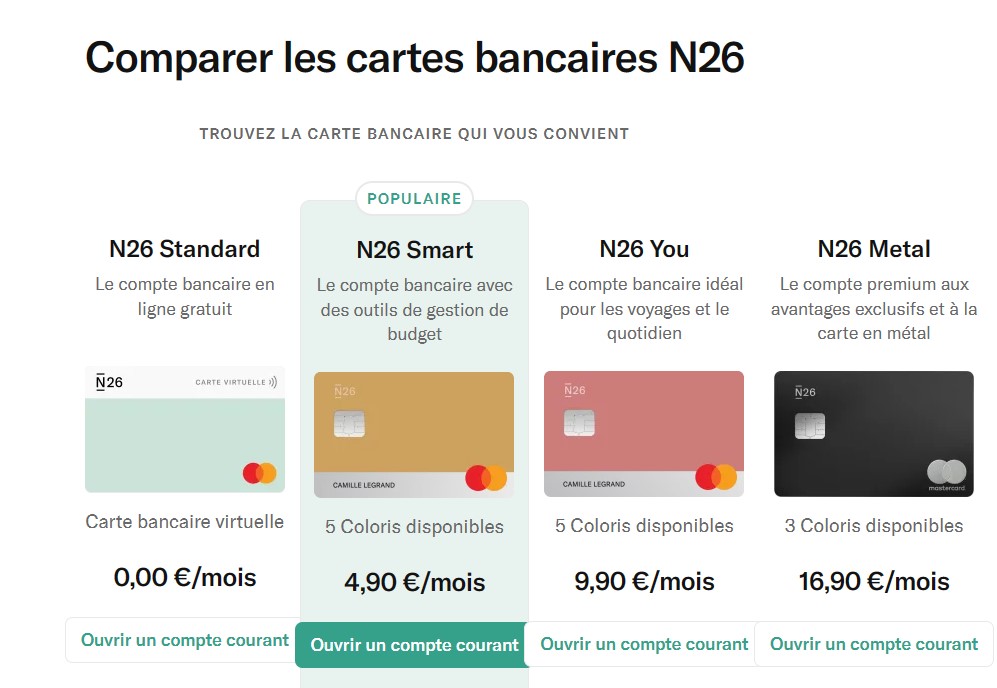

Like most online banks, N26 offers 4 levels corresponding to a type of card, price and services via MasterCard cards. The standard level is accessible for free, but it is a virtual card only usable from your phone and via NFC for contactless payment. The latter does not provide any insurance and withdrawals are limited to 3 free per month. You don’t know which bank card to choose ? follow the leader.

The Smart card is accessible for 4.90 euros per month and offers up to 5 free withdrawals per month, the possibility of opening up to 10 sub-accounts in addition to payments without fees abroad. The YouS card offers a more complete service with, in addition, free currency withdrawals and travel/mobility insurance coverage. Finally, the Metal card represents the most complete offer, for 16.90 euros monthly, you have the right to previous counterparts in addition to a more complete protective pack including purchases and smartphones (loss, breakage, flight).

You can refer to the N26 price grid in order to have all the elements at a glance.

In all cases, payments abroad are completely free and generate any additional costs. On the other hand, if you want to recharge your account instantly via the bank card from your main account, you can only do it only once a month, then 3 % will be invoiced afterwards.

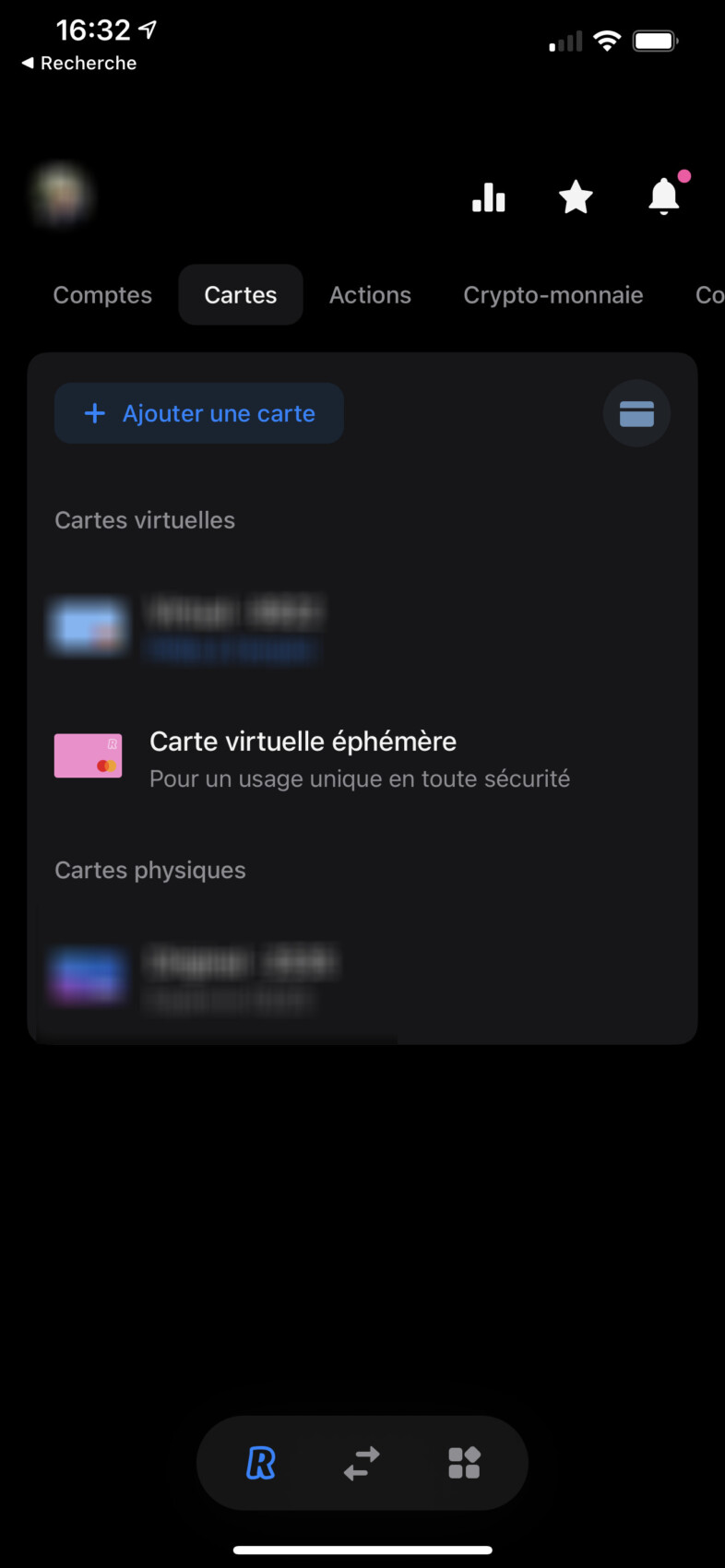

On the revolut side, several levels are also offered. The standard offer is free and offers payments at no cost as much as the other cards. However, it is necessary to do with a virtual card and contactless payments via telephone. The “plus” offer at 2.99 euros monthly offers the same services, but with a physical card if you are not ready to move on to the whole dematerialized. These last two cards, however, limit withdrawals at no cost to 200 euros maximum per month.

It is only from the Premium card (7.99 euros per month) that you can have access to higher services and protections (free money transfers, unlimited and cashback changes) and the metal card At 13.99 euros per month, corresponds to the highest level with the maximum of options, protection on travel and purchases as well as a priority support wherever you are in the world. Revolut recently, Revolut has also been offering an ultra card. The latter billed no less than 45 euros per month is intended for easy customers looking for as little compromise as possible. In addition to the platinum card, beneficiary customers have free access to premium offers from certain partners (Deliveroo, WeWork, NordVPN, etc.), up to € 5,000 of reimbursement on trains, flights and Hotels, total travel coverage and exclusive investment options (stock market operations + drop in expenses).

Another advantage from Revolut is the possibility of recharging your account for free. By connecting your main account from another bank to your revolut account, you can transfer money instantly and without additional costs.

You can consult the full price grid to get an idea.

Overall, even if prices and options are similar between the two banks, Revolut still stands out thanks to its significantly lower prices, a larger range of cards and more account services.

Winner: Revolut

N26 vs revolut: applications

N26 offers a very complete application, probably the best in its category. Everything has been controllable since the latter. In addition to taking a complete look at its accounts, the application has a visual difference between its different levels of spending and money back to distinguish everything very quickly. It is also possible to change your PIN code compared to that of the smartphone, to lock your card in a few seconds, to activate or not online payments, in short, a lot of personalization of your banking experience.

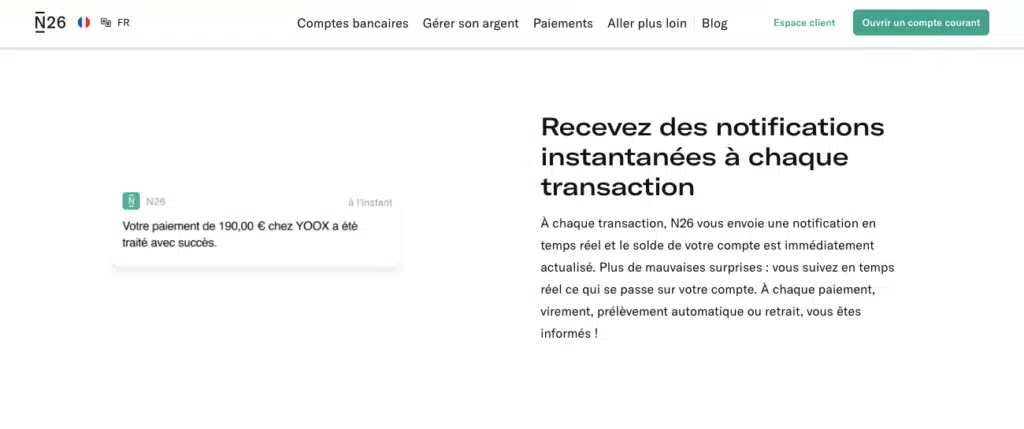

The application also allows the creation of virtual piggy banks in order to prepare a vacation or an important purchase. Finally, the N26 cards are compatible with Google Pay and Apple Pay to pay with its smartphone or its connected watch on the compatibleless contactless terminals. We also note the fact that any transaction causes real -time notification.

For its part, the Revolut application is just as provided, if not anymore. It allows a good number of card settings, such as defining a monthly expenditure limit or deactivating online payments. Other features are also available, such as the possibility of rounding up your purchases and placing the sum in too many as a tips in a dedicated piggy bank. The main page allows you to see your latest transactions at a glance, there is also a certain speed between the time of expenditure and display from the application, which is important on a daily basis. We also have the right to specific additional services for Revolut such as hotel booking, cashback management or cryptocurrency trading and raw materials.

A very practical feature is the creation of ephemeral virtual cards for unique purchases and avoid hacking as much as possible. Finally, the British neobank allows you to pay without contact via your smartphone with Apple Pay and Google Pay compatibility.

Difficult to designate a winner in the application part as the two neobanks offer solid services, which is an imperative for this type of product exclusively turned around the mobile. We have still noted greater facility and ergonomics in account management on the N26 side account, especially for a classic current account. Revolut has however taken a lot in advance in recent months by offering a number of substantial features which even go far beyond the simple conventional banking offer. It’s up to you to see what best suits you according to your needs.

Winner: Revolut

Verdict

N26 and Revolut are both part of the best online (or neobank) banks on the market today. In both cases, if you are rather mobile (specially internationally) and you like to keep a constant follow -up of your expenses, then the two offers will satisfy you. On an accounting plan, it is nevertheless Revolut which is ahead of N26. The online bank of British origin offers more latitude on the card prices on the price of card, but above all many unpublished features for an online bank, especially for those who love to manage its budget, its expenses and its investments from a single platform.

N26 puts on its simplicity with a more readable application and absent entry conditions. Above all, it should be noted that the choice should be made according to your needs