The EURO EURO EURO FUND OF BOURSORAMA VIE RESER THE TRAIN OF 2%, RATE 2022 of 2.30% to 2.60% – Savings Guide, Boursorama Bank life insurance: opinions, return, offers 2023

Boursorama Bank life insurance, Société Générale online subsidiary

Contents

- 1 Boursorama Bank life insurance, Société Générale online subsidiary

- 1.1 The EURO EURO EURO FUND OF BOURSORAMA VIE RESER THE TRAIN OF 2%, RATE 2022 of 2.30% to 2.60%

- 1.2 �� Vise insurance: return of 3% minimum on the Euros Fund

- 1.3 EURO EURO FUND BOURSORAMA VIE

- 1.4 A high -performance offer of guaranteed capital products

- 1.5 Structured product

- 1.6 A full range of responsible products to diversify its investment in free management

- 1.7 Selection of 3 best offers for subscribing life insurance contracts

- 1.8 �� Newsletter Francetransactions.com

- 1.9 Question, comment?

- 1.10 On the same subject

- 1.11 Exclusive 2022 Euro rate: to read also

- 1.11.1 Evolution Life or Evolution Per (Assurances Bee): 250 euros offered to be seized before November 7, 2023

- 1.11.2 Life insurance / per postal bank (cashmere, vivaccio, . ): bonus 2023 and 2024 going up to +1.75 % on the Euros Fund

- 1.11.3 SCI CAPIMMO (PRIMONIAL): negative performance (YTD), a liquidity crisis in view ?

- 1.12 Boursorama Bank life insurance, Société Générale online subsidiary

- 1.13 Presentation of Boursorama

- 1.14 Boursorama’s life insurance offer

- 1.15 How to subscribe Boursorama Vie ?

- 1.16 Our opinion on Boursorama

The online bank markets Boursorama Vie, an accessible multi -support life insurance contract from 300 euros.

⚠️Attention, this solution is only accessible to Customers of Boursorama Banque. In other words, the subscriber must first open a bank account in the establishment.

The EURO EURO EURO FUND OF BOURSORAMA VIE RESER THE TRAIN OF 2%, RATE 2022 of 2.30% to 2.60%

The EURO EURO Fund exclusive equipping the Boursorama Vie contract again exceeds the 2% threshold to set up at 2.30% for the year 2022, 2.60% with the yield bonus.

Posted on Thursday February 2, 2023 by Denis Lapalus

�� Vise insurance: return of 3% minimum on the Euros Fund

You want to place without risk, while ensuring an appreciable return ? The offer of our partner Carac allows you to focus on the Euros fund with a Rate guarantee of 3% minimum for the year 2023 ! No obligation to focus on account units ! 500 euros are enough to take out the Carac life insurance contract

EURO EURO FUND BOURSORAMA VIE

The 2022 yield of the exclusive euro fund is among the best euros in the market in 2022. With a complete offer and enriched with new asset classes (private equity, real estate, structured products) and outstanding € 11 billion at the end of December 2022, Boursorama confirms its status as a 100 % online life insurance leader.

A high -performance offer of guaranteed capital products

The EURO EURO Fund exclusive accessible in Boursorama VIE presents an increase up of +70 % in one year, at +2.30 % without any account of account units, and even +2.60 % in the event of detention of more than 50 % of account units on December 31, 2022. EURO exclusive thus regains its level of performance of 2018. All rates published are clear management fees, gross social and tax levies.

Structured product

In addition, Boursorama launched a new support last December, the Sérénité Sérénité Coupon March 2025 savings fund, allowing beneficiaries to recover all of the initial capital as well as an unconditional coupon of 6.20 % gross after 2 years or 4.70 % net (or 2.35 % net per year) after levy contract management fees. Building on the success encountered since the launch last December, a new product of this type has been available since February 1. He will offer an unconditional coupon at 2 years old (February 2025) of 6.5 % gross, or 5 % net of costs (or 2.50 % net per year).

A full range of responsible products to diversify its investment in free management

Because these performances do not allow to compensate for the average inflation of +5.2 % over the year, Boursorama has enriched its offer of new potential performance engines. Customers in Boursorama life insurance (including holders of ex-contracts ING Direct Vie) now benefit from a full range and enriched with supports to diversify their investments: Euros funds, structured products with guaranteed capital, G Fund G Sustainable Growth , Sicav/FCP, ETF, Private Equity, real estate and listed actions.

The share of outstandings held by our customers in life insurance on funds article 8, article 9 and labeled ISR is now more than 80 %.

Selection of 3 best offers for subscribing life insurance contracts

| TOP | Offers | DETAILS | KNOWING + |

|---|---|---|---|

| �� 1 |  |

Lucya Cardif (cardif life insurance) 200 € offered for 5.000 € paid. | �� Learn more |

| �� 2 |  |

Evolution Life (Assurances Bee) 250 € offered for 5.000 € paid. | �� Learn more |

| �� 3 |  |

Avenir power (overcomer) 300 € offered for 8.000 € paid. | �� Learn more |

| Promotional offers are subject to conditions. | |||

�� Newsletter Francetransactions.com

�� Subscribe to our daily letter. More than 90.000 readers trust the Francetransactions newsletter.com to better be informed about savings and investments. Free letter, without obligation, without spam, whose unsubscribe link is present on each shipment at the bottom of the email. Receive every day, from 9 am, the information that counts for your savings.

Question, comment?

�� React to this article the Euro exclusive Euro Fund publish your comment or ask your question.

On the same subject

Best life insurance 2023

Best life insurance 2023: comparison and classification of rates 2022, performance 2022 with bonus.

Life insurance: top and flop of euros funds, the best and the worst performance 2022

The year 2022 marks the return of funds from funds in euros. However, all euros funds do not shine by their performance. Top and flop 2023 funds (. ))

Boursorama (Boursorama Vie)

Boursorama Vie life insurance contract, provided by Generali Vie, distributed by Boursorama Banque. Gross yields, then net (social security contributions and management fees) of funds in euros: (. ))

Exclusive 2022 Euro rate: to read also

Evolution Life or Evolution Per (Assurances Bee): 250 euros offered to be seized before November 7, 2023

NOVELTY ! The life insurance contract acclaimed by the financial press, evolution, provided by Assurances, offers a welcome offer of 250 euros offered, under (. ))

Life insurance / per postal bank (cashmere, vivaccio, . ): bonus 2023 and 2024 going up to +1.75 % on the Euros Fund

NOVELTY ! La Banque Postale offers a return offer on Euros funds, for the year 2023 and 2024, equipping its life insurance and PER contracts (. ))

SCI CAPIMMO (PRIMONIAL): negative performance (YTD), a liquidity crisis in view ?

NOVELTY ! Fears for the SCI Capimmo of Primonial ? Adored by savers since the 2010s, the SCI faces a sharp drop in the value of its assets in (. ))

2001-2023-Savings guide © My Savings Online

Boursorama Bank life insurance, Société Générale online subsidiary

Boursorama Banque is the leader of online banking in France. With more than 3.7 million customers, the Société Générale subsidiary is distinguished by very attractive prices and a complete banking offer.

Very active on the stock market offer, the group also offers a Boursorama life insurance solution which is positioned well in our comparison of the best life insurance. What are the characteristics of this life insurance contract ? Costs, yields, management methods: let’s examine its assets and possible limits ��⚕️

Presentation of Boursorama

Boursorama is a stock market information portal and an online brokerage site. Boursorama Banque is the commercial brand that takes care of the Distribution of banking products and services. The whole belongs to Société Générale which acquired it in 2005.

| Parent company | Societe Generale |

| year of creation | 1995 |

| General manager | Benoit Grisoni |

| Number of clients | 3.7 million |

| Effective | 852 |

| Managed outstanding | 50 billion |

| Products and activities | Daily bank Saving Retirement Insurance financial informations |

| Life insurance contracts | Boursorama Life |

A little history :

Online market information pioneer, Boursorama is first of all a Boursorama site.com which broadcasts news and stock market prices. The pure player was launched in 1998 by the start-up Lorraine finance net at the time of the internet bubble.

In 2002, the entity was sold in Fimatex, a subsidiary of Société Générale. Its activities are diversifying in online brokerage, After the acquisition of Selfrade, then the bank, with the launch of a savings booklet.

In 2005, the brand developed its bank account offer and became Boursorama Banque. There followed international development and a total acquisition of shares by Société Générale in 2014. The online bank continues to enrich its offer of banking products and services (Life insurance, mortgage, PEL, etc.)).

His very aggressive pricing strategy positions her as The cheapest online bank on the market. She is now a leader in number of customers, far ahead of the competition, even if the profitability threshold has not yet been reached.

Key operation and figures:

Online bank belongs to the Galaxy of Société Générale. Boursorama Banque has governance council and board of directors. The latter has two prerogatives.

- Exercise of surveillance with regard to the management of the company’s activities.

- Development of strategic orientations and ensures their implementation.

The Boursorama portal is positioned on three activities:

- Online bank with more than 3.7 million portfolio.

- Online brokerage with almost 600,000 Open Stock Exchange accounts.

- Stock market information with nearly 47 million monthly visits.

With its 852 employees, Boursorama Banque manages 50 billion outstanding and welcomes a high recommendation rate of 90 %. The online bank prides itself on providing its customers with more than a thousand free features.

Boursorama’s life insurance offer

The online bank markets Boursorama Vie, an accessible multi -support life insurance contract from 300 euros.

⚠️Attention, this solution is only accessible to Customers of Boursorama Banque. In other words, the subscriber must first open a bank account in the establishment.

The payments and the funds offered:

Free or programmed payments can be denominated:

- in euros on the EuroSima fund or the exclusive euro fund ;

- in account units (shares, bonds, real estate, etc.);

- in commitments giving rise to the constitution of a provision of diversification (CRI@NCE generations funds)).

Euros funds are controlled by the insurer Generali Vie. The EuroSima Fund secures the capital invested without taking any risks. The exclusive euro fund is distinguished by a Committee predominantly real estate.

Management methods:

The insured has the choice to manage his investment alone (free management) or to entrust this task to professional companies (controlled management).

1.Free management:

The customer has total freedom in the distribution of his funds between the various supports. It benefits from great flexibility of action from its online customer area (payments, arbitrations).

2.Mandate management:

The customer delegates the management of his capital to no additional cost to the prestigious Edmond management companies of Rothschild Asset Management (France), Lackrock IM, Carmignac Management, Axa IM, Amundi, DWS Investment, but also Pictet Funds, Goldman Sachs, Société Générale or Schroder IM, etc.

Boursorama Vie and Generali Vie offer Five mandates defining the risk profile desired by the saver:

- defensive;

- balance ;

- reactive;

- dynamic;

- offensive.

Range of investment media:

Boursorama Vie gives access to an ultra -dynamic multi -support offer:

- 400 supports in account of which :

- 3 OPCI;

- 1 SCPI;

- 38 VIFS titles (CAC 40 actions).

Boursorama offers very complete online information to understand the supports and choose those that correspond to the developed strategy. These resources are in the form of historical graphics or by a classification by Morningstar stars.

Dynamic management options:

Several arbitration options are available for free to refine the investment strategy:

- programmed free payments which make it possible to invest at a pace and a predefined amount;

- Partial redemptions scheduled To recover its capital from the fund in euros to a predefined amount;

- arbitrations in order to proceed to a regular transfer of part of the capital from the pocket of the Euros fund in the pocket in units of account;

- The dynamization of capital gains (Free management only) which makes it possible to invest the participation in the profits of the fund in euros (gains) on the units of account;

- securing capital gains (Live funds only) to protect the gains obtained from a predetermined level by flexing them on the Euros funds with guaranteed capital.

Boursorama life insurance costs:

The life insurance contract is very competitive in terms of prices. The costs at the entrance and the payments are zero. Boursorama also does not apply exit costs or arbitration fees. Regarding contract management, the costs are set at 0.75 % for euros funds such as account units.

Other costs may apply if necessary:

- 1 % of the amount for the automatic arbitration option of Securing capital gains ;

- Maximum 15 % of the credit balance of the participation account in the results linked to the Growth Fund Générations Crois@NCE SUBSIVE.

In key information documents (DCI), Boursorama Banque specifies costs that affect contract performance:

Punctual costs:

Entry costs 0% The impact of costs that the insured pays when entering his investment. This is the maximum amount to pay; The insured may pay less. Exit costs 0% The impact of costs incurred when the insured leaves his investment at maturity. Recurring costs:

Wallet transaction costs -0.23 % to 2.46 % The impact of costs incurred when Boursorama buys or sells investments underlying the product. Other recurring costs 0.82 % to 4.49 % The impact of the costs that Boursorama takes every year from the contract to manage investments Accessories costs:

Commissions related to the results 0 % to 4.36 % Boursorama takes this commission from investment if the product surpasses its reference index Profit -sharing commissions 0% REQUIREMENT OF BOURSorama life insurance according to Euros funds:

The rate served in 2022 by the EuroSima funds is 1.30% (Against 0.75 % in 2021 and 0.90 % in 2020)). The performance of exclusive euro funds amounted to 2.30 % (Against 1.35 % in 2021 and 1.43 % in 2020)). This performance reaches 2.60 % in the event of detention of more than 50 % UC on 12/31/2022.

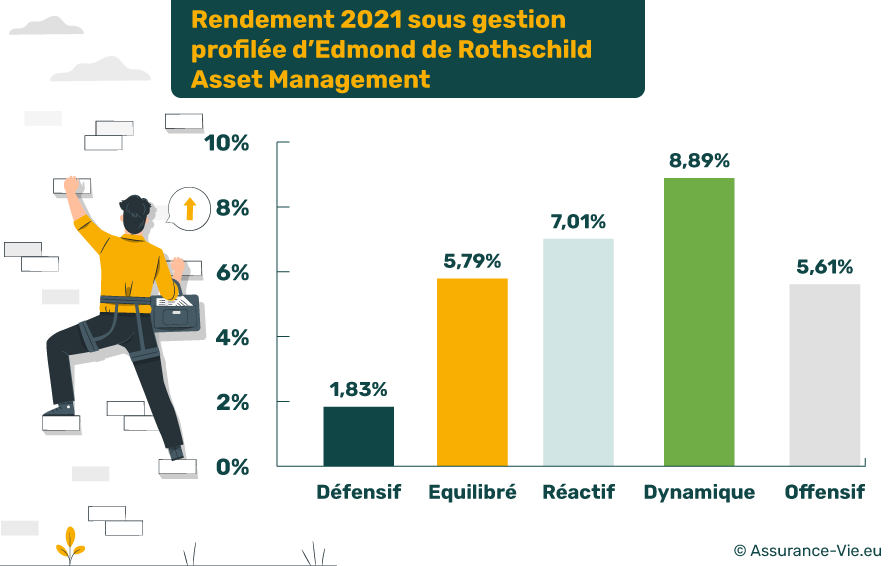

For information, here are the 2021 performances of profile funds for the Boursorama Vie contract (managed management):

Edmond de Rothschild Asset Management:- Defensive: +1.83 %;

- balanced: +5.79 %;

- Reactive: +7.01 %;

- Dynamics: +8.89 %;

- offensive: +5.61 %.

SYCOMORE AM:

- Defensive: +5.00 %;

- balanced: +8.20 %;

- Dynamics: +12.10 %.

How to subscribe Boursorama Vie ?

If you are not a customer of the online bank, the subscription to Boursorama Vie implies there open a bank account. In the event of concern, you can reach an online bank advisor by phone on 0 800 169 075.

If you are already a customer, Everything is going online. You must follow the steps from your online customer area accessible on your computer, tablet or smartphone via the mobile application. From this personal and secure account, you can manage your contract:

- carry out operations (payments, buyouts);

- make arbitrations;

- Consult your contract;

- follow up operations and their history;

- observe the performance of the selected investment media.

��Is you want Open a Boursorama life insurance contract for your child, You must join the online banking sales service on 0 800 169 075 Monday to Friday from 9 a.m. to 8 p.m. and Saturday from 8:45 a.m. to 4:30 p.m. (excluding holidays).

��For inform you about the online bank’s offer If you are not a customer, you must compose the following phone number: 0 800 09 20 09 (free service and call) Monday to Friday from 9 a.m. to 20 H and Saturday 8:45 a.m. to 4:30 p.m. (excluding holidays).

✉️The postal address of the registered office is as follows:

44 Street crossing

CS 80134

92772 Boulogne-Billancourt CedexOur opinion on Boursorama

✅ Our opinion on Boursorama is very favorable. Online bank belongs to a large solid group which is reassuring. She is market leader And offers a very wide panel of financial products (daily bank, savings, investment, credit, insurance).

Its customer service is regularly awarded. THE Fully digital course allows great autonomy and obvious flexibility. The interface of the mobile application is neat which facilitates navigation.

Regarding life insurance, his contract is also rewarded each year by the specialized press. Accessible from 300 euros even in mandate management, Boursorama Vie does not require no entry fees, on payments or arbitrations. Capital is entrusted to prestigious management companies, with five possible profile mandates.

The range of supports is very rich (actions, real estate, etc.)). This diversification capacity makes it possible to adapt its strategy according to its objectives. Above all, Boursorama does not impose an investment in account units Unlike many other market solutions.

❌ Boursorama limits concern Disadvantages of 100 % online. Some prefer to have the support of a human council. However, online banking experts can be reachable at any time, with large time slots and by multiple channels.

Regarding life insurance, it is difficult to find faults. However, it is necessary to emphasize the application of management fees on the euro fund as on account units up to 0.75 %. This cost is not necessarily advantageous, but still remains in the market average.

Another slightly more negative observation: the Low yield of the EuroSima Fund. What encourage a share of its capital in account units or favor the exclusive euro fund more invested in real estate, therefore more efficient. Be careful, the yields of the past do not hold future yields.

The idea of placing part of your savings in a new life insurance seduces you. To find out if the attractive offer of Boursorama Vie is competitive, use our online life insurance comparator.

This free tool delivers you in a few clicks several solutions corresponding to your objectives. You just have to study them with the opportunity to chat with an expert to feed your reflection.