What are the conditions to open a nickel account? | Nickel, how to open an online nickel account or your tobacconist? | Nickel

How to open an online nickel account or your tobacconist

But this is not your only option !

What are the conditions to open a nickel account ?

What identity documents are accepted ?

- National French identity card (with an MRZ band) or identity card issued by a country of the European Union.

- Passport: more than 190 passports are accepted

- Residence permit issued by a French authority: residence permit or resident card.

Foreign students can open a nickel account provided that the mention “authorize your holder to work” is mentioned on the residence permit.

The driving license is not accepted.

When subscribing, you will have to send us a selfie as well as a photo of your identity document. Be careful to take the original document well and that it is in good condition, readable and visible in full in the photo. Otherwise, we will be forced to block your account while waiting to receive a new photo.

To open a young account (- 12 years old), consult our dedicated article.

How to open a nickel account

Online or at your to -by -law ?

Open an account with a tobacconist or in nickel point.

1. Go to your tobacconist or in a nickel point

2. Buy a box (20 €) containing your nickel card

3. Register on the terminal Nickel

4. Activate your account and card With your merchant and receive your RIB

5. Receive your PIN code by text message

It’s over: you now have a nickel account !

Good to know : When you open your nickel account you can directly deposit up to € 250 in cash to feed it. This 1st deposit is free !

An account open to everyone, even to banking prohibitions | Nickel

Nickel is the account for all ! Whether you are young, old, small, large, with or without money, you are necessarily welcome and even if you are banned banking. Nickel, this is not a bank account, it is the account for all !

We do not distinguish on your profile, on your banking history or other. What interests us is to offer you the simplest solution possible to pay and be paid, because for us everyone has the right to have an account.

What is a banking prohibition ?

A prohibited banking is a person who, due to repeated payment incidents, is registered in one of the files of the Banque de France. These people often end up with a banking ban, and find themselves unable to make an account opening and benefit from a bank card or account.

Payment incidents leading to a banking ban generally concern unofficial checks, unpaid credits or even an abusive use of the authorized bank overdraft. According to the payment incident you are facing, you are not on the same file of the Banque de France.

The different files of the Banque de France:

- FICP: National File of Credit Reimbursement Incidents to Individuals

- FCC: central check file

- FNCI: National file of irregular checks

How to know if I am banned banking ?

It is the banks themselves that ask the Banque de France to register in one of its files in the event of repeated payment incidents. Banks therefore have a duty to inform their customers if this situation occurs for one of them.

But how do I know if I am still banking ? To verify this, the simplest solution is to get in touch with the Banque de France. You can directly make an appointment at the Banque de France to examine your file on site. You also have the possibility of questioning the Banque de France on your banking prohibition by mail as well as in line, by applying on your online space on their website.

What are the consequences of a banking ban ? Banking prohibitions have the right to make an account opening and have a card ?

In the event that your payment incidents have led you to be based on the FCC or the FICP as a banking prohibition, know that the consequences will be variable according to the severity of your financial situation and the type of incidents made.

For a person in the central check file (FCC), the first repercussion is the ban on using and holding a checkbook; This in all the banks in which you subscribe to open a bank account. In addition, your bank has the possibility of modifying your banking offer and withdrawing your bank card in exchange for a payment and withdrawal card with systematic account authorization; So without possible overdraft. In more extreme situations, your bank may decide to close the customer account.

Regarding the FICP (National File of Credit Reimbursement Incidents to Individuals), appearing in the File does not necessarily mean that you are banned but rather that you are in a situation of over -indebtedness. Nevertheless, being based on the FICP can lead to the prohibition to contract a credit before the total reimbursement of current credits, the prohibition to be surety of a credit as well as the prohibition to make a credit repurchase.

How long will I be banned and how to get out of it ?

Once again, the duration of the filing depends on the severity of the payments of payments and the type of incident carried out. Each customer being in a banking prohibition has a different flicker period.

Registration for FCC for provisioning without a provision is of a maximum duration of 5 years. The customer has the possibility of avoiding being relieved if he regulates his situation in short deadlines. Regarding an abusive use of its means of payment, in other words, if you live widely above your means with a regular banking overdraft, you will be registered in the FCC for a period of 2 years.

FICP file for non -reimbursement of credit is also 5 years maximum. Again, this period differs depending on the circumstances. Nevertheless, you can easily shorten this duration by regularizing your situation. Likewise for over -indebtedness, your registration for the FICP is of a maximum duration of 7 years but you can get out by the simple reimbursement of your debts.

Noticed : Banque de France’s files are present to preserve the safety of banking establishments and people carrying out operations with individuals in unstable financial situations. However, these files are also created to support people in delicate situations, allow them not to worsen their situation and especially to help them find financial stability.

How to avoid being banned banking ?

A payment incident quickly arrived, but it can also be quickly anticipated and avoided ! Good financial health necessarily involves good management of its bank account, whatever the establishment in which you have your current account.

Here are some small tips to avoid being relieved Banque de France:

- Regularly monitor your accounts

- Use applications to manage your budget (Pilotebudget, Bankin, Linxo. ))

- Note essential expenses (invoice, rent, food. ) of each month so that you never miss the necessary or never exceed your ceilings for essential expenses

- Use a suitable banking service: without bank overdraft

- Recognize your bank directly in the event of an unexpected situation which would affect your financial health (example: loss of employment)

- Favor the economy to impulsive expenses

What banks accept banking prohibitions ? Where can they open a bank account ?

It is sometimes complex for a banking prohibition to find a bank which accepts it and which corresponds to it. Indeed, traditional banks are often reluctant to open a bank account to a person filed at the Banque de France and can refuse you without more reasons. So which bank to choose for its account opening ?

If you absolutely wish to subscribe to a large traditional bank (and benefit from basic banking services) and all those you have contact refuse you, you have a solution: contact the Banque de France and launch a law procedure account. This law procedure will allow you to be assigned to a bank in the desired district, without it being able to refuse you.

But this is not your only option !

Indeed, there are many online and neo-banks that serve the same banking services as conventional banks and which accept banking prohibitions (including Nickel). These payment establishments are often without income and without overdraft in order to be able to include the greatest number. At Nickel, we think everyone has the right to account, Whatever its level of income ! The deprivation of bank account night in the smooth running of your daily life: unable to have a French RIB, withdrawals of impossible species, setting up of transfers, checking of checks. Everyone needs an account !

Online or not, is Nickel a service adapted to banking prohibitions ? Can we open an account at Nickel by being banned banking ?

Nickel inclusion values concern everyone, even banking prohibitions. The subscription to Nickel is open to everyone, regardless of your financial health (income, assets. )).

Nickel is the perfect account for banking prohibitions ! Indeed, Nickel offers you to open an account in 5 minutes in more than 7000 tobacconists and point of sale. No need to go into a bank and fight for the opening of an account, finished the long administrative procedures, Nickel accepts you without any income condition or initial deposit. Everyone has the right to have an online account, prohibited banking or not.

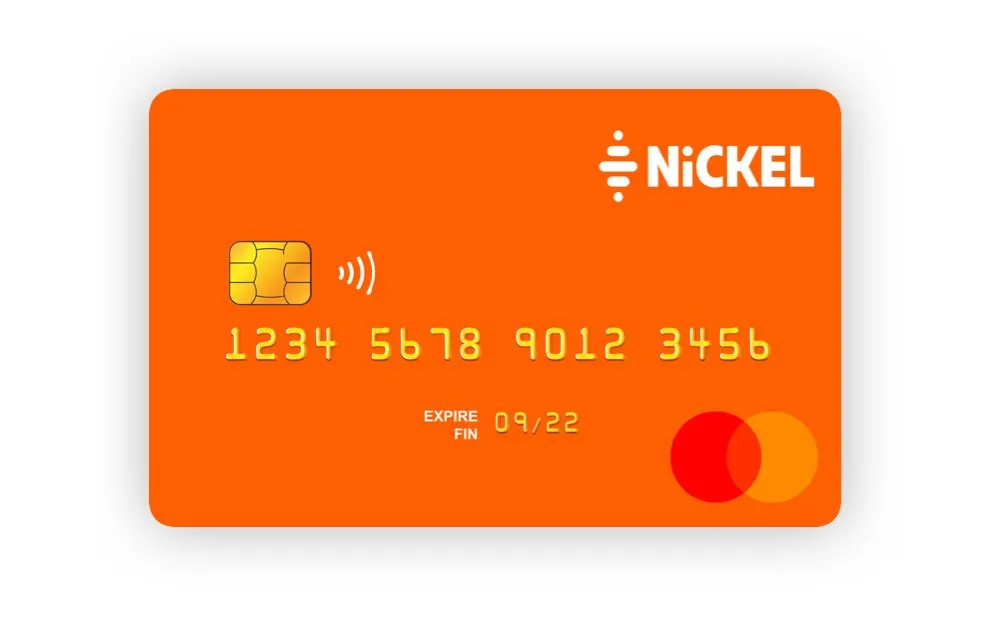

Thanks to Nickel, you will get a Mastercard card with systematic authorization to pay everywhere in a secure manner and withdraw money, a current account to make your transfers or samples and a French RIB. You can follow the balance of your account as well as all your operations in real time on your customer area or your nickel application.

The nickel offer is without discovery banking, you no longer run any risk of exceeding your budget, having agios, and ending up with problems of bank payments. So what are you waiting for ?

What documents are necessary to open a nickel account and how to open an account in France ?

You can open a nickel account with one of our 6,600 tobacconists and nickel points of sale, or directly online from the Nickel site.eu. In the case of an online subscription, simply fill out the form and then go to a tobacconist to recover your MasterCard card and activate your account.

You will need a valid identity document (identity card, passport, residence permit), a telephone and an email address, 20 euros. No need to prepare a complete file and waste time elsewhere, find all the information on nickel subscription.

Nickel is the account for all ! Join the movement and simplify your daily life by enjoying a simple, accessible current account and tools to follow your operations in real time (web, app, SMS) for only 20 €/year. Go directly to the bottom of your home in our network of 7,000 tobacconists and nickel points

About

- Who are we ?

- Mag ‘Nickel

- Partners and social

- Press

- Recruitment

- Cookie settings

- Cookie use policy

- Third -party personal data use policy

Help

- How to open an account ?

- Practical sheets

- Help / FAQ

- Contact us

- Legal Notice

- Legal documents

- Personal Data Policy Customers and Prospects

- Security

Deaf or hearing ?