Opinion Ma French Bank bank account of the La Poste Group ✅, my French Bank: banking offer, prices, account opening

My French Bank & La Banque Postale online: offers, prices, account opening

What is a mobile bank ? A Mobile or neobank bank, is a new generation bank whose operations are done via an optimized application. Subscribe to a neobank only takes a few minutes, does not require proof of income and the bank card is free. Want to know more ? Find our comparison of the best neobanks.

Opinion and full account of the bank account in my French bank 2023

Presentation My French Bank and Reviews on the 100% French mobile bank

Launched in 2019, my French Bank is a neobank belonging to the La Poste group. My French Bank wants to be A mobile bank at low prices for all reconciling the advantages of an online bank and a traditional bank. As a result, my French Bank is available on the App Store (Apple) and Play Store (Google) while offering the services of a real bank thanks to the Banque Postale Bank license.

In 2021, the 100% mobile Bank MA French Bank has already won over 250,000 customers across France and wants to continue its progression by offering more and more young and less young services.

This is the reason why we were interested in this mobile bank that some call “My French Bank” or “Myfrenchbank”. First, we want to warn you that its exact name is “My French Bank”. But what is My French Bank’s customer opinion ? Who is my French Bank for ?

We are pleased to share with you a Guide, opinion & full test on the solutions proposed by the bank which is a subsidiary at 100% of the postal bank.

Discover without further delay, our detailed analysis on all of their services in order to have a impartial and objective opinion on the advantages and disadvantages Before subscribing to the bank solutions of the Ma French Bank app.

✅ Advantages to subscribe to the online bank account my French Bank

- My French Bank account opening in less than 2 minutes

- Bank account without any condition and without obligation

- French RIB (IBAN)

- Visa card with systematic debit

- No intervention commission

- Simple and intuitive mobile application

- Contactless payments With Apple Pay and Samsung Pay

- No costs on payments and withdrawals abroad around the world

- Insurance and assistance abroad

- SMS transfers at no cost whatever the bank account

- Creation of online prize pools without fees or commission

- Possibility to save

- A reactive and accessible customer service From Monday to Saturday from 8 a.m. to 10 p.m. via a non -surcharged telephone number (09 69 36 20 10) to reach an advisor

- Guarantees against breakage, flight, delivery problem. On your purchases as well as for your bank card and species: € 2/month

❎ Disadvantages of subscribing to the mobile account my French Bank

- There is no possible overdraft authorization

- No species and check deposit possible

�� Bank rates and costs associated with the mobile bank my French bank

My French Bank has of a unique offer at € 2 per month including a whole set of free services:

- International visa card with free contact with free systematic authorization

- Withdrawals in all free distributors in France and abroad (costs can be applied to certain DABs which are independent of my French Bank)

- SEPA transfers via free application

- SEPA transfers above € 3,000 made by an advisor: € 5

- Transfer by SMS all bank accounts (free) up to € 200 per SMS transfer and 5 SMS transfers per day

- Intervention committee: free

- Renewal of early card in the event of loss or flight: € 15

- Subject rejection for lack of provision: 16.50 € (maximum amount capped)

- Guarantees against breakage, flight, delivery problem. On your purchases as well as for your bank card and species: € 2/month

�� The withdrawal and payments ceilings for the cards of my French Bank

✔️ ceilings on behalf of original are from € 1,000 withdrawal over 7 slippery days and € 3,000 Payment over 30 sliding days.

✔️ ceilings on behalf of ideal of your bank card are € 1,000 withdrawal over 7 slippery days and € 5,000 Payment over 30 sliding days.

✔️ Ceiling for contactless payment: The maximum payment per transaction is 50 € with a maximum amount of 100 € over 4 slippery days for all contactless payments.

☑️ Reviews Ma French Bank of Connectbanque experts

To start our opinion on my French Bank, we can give a note and positive opinion to the Mobile Banking Offer of the La Poste group It offers a bank account without income conditions and without commitment at only € 2 per month. We therefore confirm that my French Bank is one of the best mobile banks for individuals According to Connectbanque’s opinion, in particular by being a neobank for all, without commitment and without hidden expenses.

First, we appreciate the fact that my French Bank offers only one price with a complete offer: A free systematic debit visa card, a French IBAN (RIB), withdrawals and payments in France and abroad without fees or commission.

In addition, with this price, you will benefit from a whole set of included and innovative services such as SMS transfers where you can send money to anyone and anywhere via a simple SMS. But also, you can create prize pools without any commission for your future projects as well as common accounts that you are in a relationship, with friends, roommates, etc. From the app for my French Bank. Which makes my French Bank an alternative to an account of a very complete and advantageous traditional bank according to our opinion.

My French Bank is A bank account for individuals without any income condition that can be ideal for students, people who start in working life, those who want to save money or banking prohibitions. This is the reason why you will never have an intervention committee at my French Bank !

You will not have the possibility of having an overdraft authorization. However, my French Bank allows you to obtain a renewable credit for possible hard blows that we do not recommend because the interest rate is far too high.

Customer opinion on my French Bank bank is also good because it benefits from an average note of 4.1/5 both on the Apple App Store and on Android Google Play.

To conclude this notice, we recommend the my French bank bank account as well, as main current account than as a secondary account especially for the exhaustiveness of the services offered for only € 2 per month.

We only regret that there is not The possibility of depositing checks or species on the my French Bank account despite the Postal Bank agency network as well as Orange Bank which does not rely on its network of Orange stores.

⭐ Customer reviews on my French Bank

To conclude our review page, we have analyzed customer reviews about my French Bank: we see a note 4.3/5 on more than 3,800 reviews On the specialized site and leader in customer reviews Trustpilot. And a note of 4.6 out of 5 on the AppStore with more than 11,970 reviews And 3.9 out of 5 on Google Play with more than 18,000 reviews.

These opinions and recommendations highlight the simplicity of account opening, the modernity of the application and the customer interface. What also emerges from these customer opinions is the ease with which they have managed to reach an advisor and the efficiency which he showed.

The only negative opinions are essentially linked to account closures therefore to special cases & exceptional situations of certain customers.

�� How to open a bank account my French bank ?

First of all, to open a my French bank bank account, you have to be 18 years old. This is the only condition for becoming a customer, and well heard, you must have access to a smartphone or a computer to create your bank account.

In a few minutes, you can open a bank account my French bank Without income condition and without commitment By following the following steps:

- Fill out the form by entering your name, first name, e-mail, age, sex, telephone number

- Provide the following supporting documents:

- Valid identity document (passport, identity card, residence permit)

- Proof of domicile (last tax notice or electricity, gas, telephony or internet access provider of less than 6 months or a certificate of home insurance)

- A bank identity statement (RIB) of a bank account with your name open in a banking establishment domiciled in France or in the overseas departments and regions (DROM), or in the Union Union

�� Opinion on mobile & innovative services with the MA FRENCH BANK app (prize pool, revolving credit, common accounts. ))

Create jackpots my French bank without commission

With the my French Bank mobile application, you will be able to create one or more Kitten (s) to collect money In order to carry out your projects whether with friends, for your child or family. What is interesting is that this kitchen creation service is free and without commission.

For information, it should be noted that the maximum amount amounts to € 250 per prize pool and € 1,000 per person over the slippery year.

Renewable credit offer My French Bank

As we have specified above, as a customer, you will not be able to have an overdraft authorization by opening a my French Bank bank account. However, if you are not prohibited banking (FICP), you can benefit from a renewable credit for occasional needs in this case. This “extra loan” banking product aims to carry out your short -term projects with TAEG (overall effective rate).

By possibly opting for this loan, there is still a study of your borrowing capacity. And you have a 14 -day withdrawal period.

✔️ Connectbanque reviews : We do not recommend this form of punctual credit whose interest rates are very high. If you still want to benefit from it, do not forget: “A credit commits you and must be reimbursed. It is important to check your reimbursement capacities before committing to you “.

Common accounts or “We share” joints of my French Bank

With the “We share” function of my French Bank, you can create A joint or common account for free from the mobile application whether you are in a relationship, with friends or between roommates. with notifications and monitoring of expenses in real time. This my French Bank bank service allows you to manage your common budget.

Savings “my piggy bank” with my French bank

This new way to save is available from the MA FRENCH BANK mobile application. Concretely, by opening a bank account, you can save each purchase, by activating this option for free which will allow you to save either by rounding, percentage or by determining a fixed amount.

SMS transfers My French Bank

We want to present this functionality because we find it very innovative. The principle is simple, you can make transfers by sending a simple SMS. Of course, by carrying out this action you authorize my French bank to send an SMS to the beneficiary of the transfer.

How does it work ?

- From the my French Bank mobile application, you must choose the “SMS” transfers “section

- Then, you enter the amount (capped at 200 €)

- Finally, you can choose the recipient from your contact list or by entering the mobile phone number.

- The beneficiary receives the SMS from my French Bank with a link

- By clicking on this link, he must inform his IBAN

- Once validated, they receive money at the normal conditions of a separate transfer

�� The ideal account of my French Bank: a premium account, committed and which allows you to increase its purchasing power !

For the most demanding customers, my French Bank offers A premium account through a International visa card enriched in services:

- Higher payment and withdrawal ceilings: up to 5,000 euros over 30 sliding days and 1,000 euros withdrawal over 7 days.

- No costs on your withdrawals or payments around the world

- Extended insurance and assistance And this up to 4 close to your trips and trips abroad

- A priority with the My French Bank Customer Service

But my French Bank goes even further: the ideal account has a cashback program and vouchers allowing to increase your purchasing power:

- Cashback who will allow each customer to be reimbursed for part of their purchases with the Ma French Bank bank card from partner brands;

- Vouchers To be used online or directly in stores in various partner brands in my French Bank

Finally, the ideal account of my French Bank allows you to be engaged with one of the following 2 foundations depending on the bank card chosen:

- A White card For the Foundation, Break Poverty, whose main mission is the fight against poverty

- A green card To support the GoodPlanet Foundation that has been working towards the environment since 2015

These personalized cards are billed € 5 at the opening of the account only: this amount is then completely donated to one of the two foundations.

The ideal account is billed in the form a single monthly package of € 6.90 without obligation and without hidden costs.

�� Westart: the bank account for minors of my French Bank

You are looking to empower your child regarding their expenses ? Or you just want to be able to manage your money with a unique package ?

Proposed by my French Bank, the Westart account is The Bank Account for an ideal adolescent To start as minors according to our opinion. In reality, Westart is a special account for 12-17 year olds With everything you need, even tutorials to guide you !

To put it simply, with this account that will cost only 2 €/ month Your teenager has:

- A credit card to his name

- An application To manage your account (with double parent / teen interface)

- Of the’Secure pocket money

- Possibility to have and do SMS transfers & mobile payments

- The ability to achieve one’s own expenses abroad free of charge

In our opinion, what is really practical with this account is that The teenage side and the parent side are very distinct with a dedicated app for everyone But just as fun. What give the meaning of the realities of his expenses to his child without guiding him too much and all this live since the Westart application of my French Bank.

For the teenager, the westart account of my French bank is a bank card, an application and the possibility of paying abroad at no cost (including Apple Pay and Samsung Pay). He can also block access to the card time to find it directly on the application !

To reassure the parent, this account of my French Bank is totally modular according to your desires with ease, without authorized overdraft and with automated services.

Vouchers To be able to open a Westart account of my French Bank are not numerous, you only need:

- The parent’s identity document

- The identity document of the child beneficiary of the Westart account

- Copy of the family book or extract of birth certificate of less than 3 months

You can either subscribe to the offer directly on the Internet, on the application if you are a customer my French bank or in a post office offering the Westart offer.

My French Bank & La Banque Postale online: offers, prices, account opening

Launched in 2019, my French Bank changes the game on the ultra-competitive market for mobile banks. Leaning against the postal bank, she detonates with an all -inclusive banking service at low prices. On the program: reduced bank charges, an ergonomic and intuitive application, zero costs abroad. We will explain everything to you.

✔️ Current account

✔️ Teenage account

❌ Joint account

❌ Pro account

❌ Savings

✔️ Real estate credit and personal loan

❌ Stock market- Original card: € 2.90/month

- Ideal card: € 6.90/month

Google Play: ⭐ 3.3/5

Apple Store: ⭐ 3.9/5- Opening in a practical post office

- Offer for the whole family

- Interesting cashback

❌ No international transfers allowed

❌ Lack of customer service responsiveness by chat

❌ No mobile payment via Google Pay

❌ Regular bugsUpdated data September 2023

Which is my French bank ?

Launched in July 2019 by the Postal bank, My French Bank is a digital bank made in France all of a big. Under her airs of neobank, she remains a network of network and relies on the postal and post office offices. Its banking offer without income conditions at low prices aims Young and technophile customers. It relies on two offers, entry and mid -range, and an innovative banking application to go to the elbow with the behemoths, N26 and Revolut.

What is a mobile bank ? A Mobile or neobank bank, is a new generation bank whose operations are done via an optimized application. Subscribe to a neobank only takes a few minutes, does not require proof of income and the bank card is free. Want to know more ? Find our comparison of the best neobanks.

Original: the mobile account at a low price with my French Bank

With a low -cost banking offer, my French Bank is betting on the transparency To conquer the ultra-competitive market for mobile banks. If the other neobanques offer a free bank card with limited banking services, my French Bank opts for a Complete offer at low prices, backed by Innovative services.

The original card by my French Bank

Original my French Bank

€ 2.90/month✔️ No income condition

�� Welcome offer ::

�� Card type ::

International visa card with systematic authorization

�� Speed ::

✔️ Immediate debit | ❌ Delayed

☂️ Insurance cover ::

✔️ Visa Classic insurance

⏳ Overdraft ::

��️ Withdrawal ceilings ::

�� Payment ceilings ::

�� Withdrawal from euro zone ::

�� Withdrawal outside the euro zone ::

✔️ Free and unlimited

✈️ Payments abroad ::

✔️ Free and unlimited

�� Mobile payment ::

❌ Google Pay

✔️ Apple PayUpdated data in September 2023

Ideal: the premium card of my French Bank

My French Bank has a facelift and comes out a Ultra-Premium offer For its more demanding customers. On the program, we find all the services of the original offer. In addition, there is a design and customizable map, an extended insurance font, more comfortable payment and withdrawal ceilings, but also, an offer of cashback, ultra practical to save money.

The ideal card by my French Bank

Ideal my French Bank

✔️ No income condition

�� Welcome offer ::

�� Card type ::

International visa card with systematic authorization

�� Speed ::

✔️ Immediate debit | ❌ Delayed

☂️ Insurance cover ::

✔️ Visa Insurance Premier

⏳ Overdraft ::

��️ Withdrawal ceilings ::

�� Payment ceilings ::

�� Withdrawal from euro zone ::

✔️ Free and unlimited

�� Withdrawal outside the euro zone ::

✔️ Free and unlimited

✈️ Payments abroad ::

✔️ Free and unlimited

Updated data in September 2023

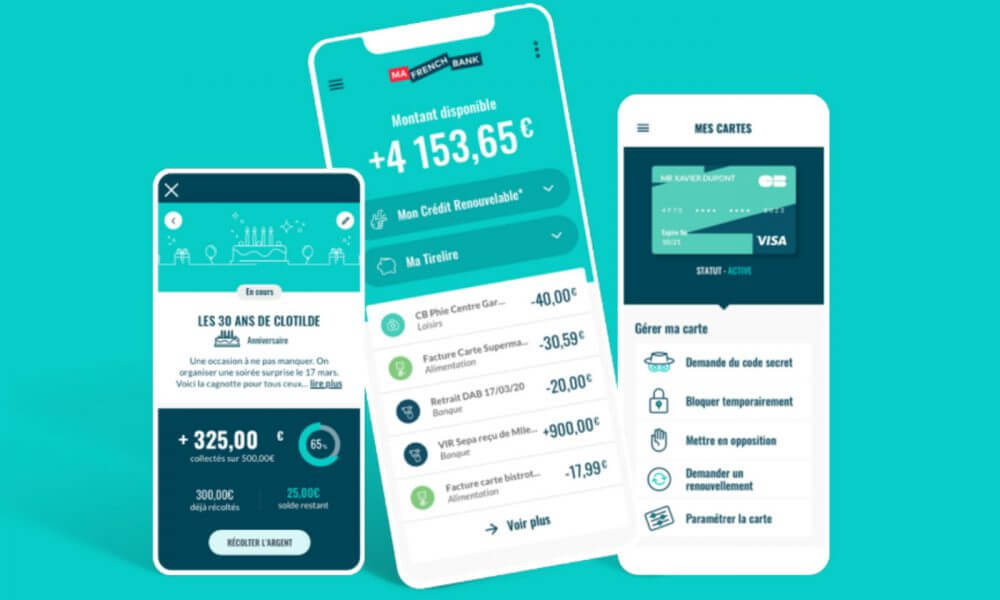

A mobile application at the cutting edge

My French Bank is a 100% mobile bank is based on a Innovative mobile application, thought to be able to carry out all of your operations since your device.

There are tools for keep your budget easily and features for Configure your bank card, monitor your budget Or spare.

Google Play: ⭐ 3.3/5

Apple Store: ⭐ 3.9/5✔️ Apple Pay

❌ Google Pay�� Budget management

✔️ Real -time balance

✔️ RIB download

❌ Consultation of the card code

❌ Personalization of the card code

✔️ Categorization of expenses

❌ Sub-accounts

✔️ Expenses statistics

❌ Pockets

❌ Digital safe

❌ Virtual card

✔️ Modification of ceilings�� Design and ergonomics

✔️ Elegant design

❌ Speed of loading

✔️ Accessibility of main functionalities

✔️ Easy to hand✔️ Identification by fingerprint

✔️ Identification by facial recognition

✔️ 3D Secure

✔️ Opposition Bank Card

✔️ Blocking/Unlocking of the card❌ Secure messaging

✔️ Telephone line

❌ Chatbot (virtual assistant)

❌ Online catUpdated data September 2023

My French Bank: the ideal bank card for traveling

Notice to globetrotters, the two offers of My French Bank bank card will become your favorite travel companions !

Indeed, the My French Bank card is an international visa card to enjoy withdrawals and payments at no additional cost all over the world.

A payment service abroad unequaled at this price among competing mobile banks: Revolut as N26 limit withdrawals, even on more premium offers.

From then on, my French Bank is positioned as one of the most interesting mobile banks to travel.

Another advantage of My French Bank bank card, This is accompanied by all Insurance and assistance guarantees of the Visa Classic card : early return, repatriation, etc.

A standard insurance pack which usually increases the note in traditional banks. For those who wish to be 100% protected abroad, the ideal offer allows you to benefit from insurance and assistance guarantees from a Premier visa.

Also, the original bank card from my French Bank testifies to a Excellent value to seduce regular travelers and international profiles.

Traveling with a neobank: our comparison

Original my French Bank

€ 2.90/month

N26 Standard

0 €/monthRevolut Standard

0 €/month✔️ Visa Classic insurance

❌ No insurance coverage

❌ No insurance coverage

Until 200 €/month and 5 withdrawals/month at no cost

Up to 3 free withdrawals per month

1.70% of the amounts withdrawn

✔️ Free and unlimited

✔️ Free and unlimited

✔️ Free and unlimited

Updated data in September 2023

My French Bank prices: how much it costs ?

For the price of the card, the customer can benefit from many services at no additional cost. True to the pricing policy of neobanques, my French Bank has reduces its bank charges to the bare minimum : only Exceptional incidents potentially the subject of pricing.

My French Bank offers Optional insurance at a broken price with his partner Lovys: means of payment insurance, Smartphone protection and even Home Insurance are offered in addition, always at mini prices.

Original my French Bank

€ 2.90/month☑️ Current costs:

�� Account holding costs: € 2.90/month

�� Inactive account holding costs: �� NC

☑️ Fraits abroad:

�� Withdrawal in euro zone: ✔️ Free * 0.90 €/withdrawal excluding distributor of the Postal Bank

�� Withdrawal outside the euro zone: ✔️ Free

✈️ Payments abroad: ✔️ Free

☑️ Fees on payment incidents:

��️ Intervention committee: ✔️ None

�� Authorized discovered: ❌ No authorized overdraft

�� Unauthorized discovered: ❌

☑️ Fresh on transfers:

�� Instant transfer: ❌ Unavailable

�� SEPA transfer: ✔️ Free

�� International transfer: ❌ Unavailable

☑️ Insurance guarantees:

- �� Death / Disability Guarantee

☑️ Assistance guarantees:

- �� Medical repatriation

- �� Hospitalization abroad

- �� Replacement driver ❌ �� Too bad or theft of the rental vehicle

- ⚖️ Legal aid abroad

☑️ Other services:

- �� Kitten: to manage your projects and gifts with several

Ideal my French Bank

☑️ Current costs:

�� Account holding costs: € 6.90/month

�� Inactive account holding costs: �� NC

☑️ Fraits abroad:

�� Withdrawal in euro zone: ✔️ Free

�� Withdrawal outside the euro zone: ✔️ Free

✈️ Payments abroad: ✔️ Free

☑️ Fees on payment incidents:

��️ Intervention committee: ✔️ None

�� Authorized discovered: ❌ No authorized overdraft

�� Unauthorized discovered: ❌

☑️ Fresh on transfers:

�� Instant transfer: ❌ Unavailable

�� SEPA transfer: ✔️ Free

�� International transfer: ❌ Unavailable

☑️ Insurance guarantees:

- �� Death / Disability Guarantee

- �� Transport delay guarantee

- �� Luggage delay guarantee

- �� Loss or Luggage Luggage Guarantee

- �� Civil liability guarantee abroad

- �� Rental vehicle warranty

- ��️ Interruption/travel cancellation guarantee

- ❄️ Snow and mountain guarantee

☑️ Assistance guarantees:

- �� Medical repatriation

- �� Hospitalization abroad

- �� Replacement driver

- �� Too bad or theft of the rental vehicle

- ⚖️ Legal aid abroad

☑️ Other services:

Updated data in September 2023

The other banking products of my French Bank

�� Save clever: the booklet of my French Bank

My French Bank dust off the savings book and allows you to simply save, in three different ways:

- The round : From an expense of € 15, the bank rounds up the amount spent at 5 euros higher and puts the difference on the side.

- The percentage : each expense, a customizable percentage of the amount will be spared.

- The fixed amount : with each payment, a configurable amount will be fired on my piggy bank.

�� Borrow with my French Bank: its renewable credit

The MA French Bank Renewable Credit allows customers to benefit from a funding envelope in the event of an unexpected.

As of April 1, 2018, the revised TAEG was to 17.00% with a revisable debtor rate of 15.70%. The customer can also subscribe simultaneously to ADI insurance (Death insurance, disability) and Ape (Employment loss insurance) in TAEA 6.28%.

What do we call Adi ? Stage ? ADI or disability death insurance is a borrower insurance that all banks must offer. This insurance reimburses the credit contracted by the borrower In the event of death, disability or illness causing a loss of jobs.

APE or Loss Employment Insurance is a borrower insurance covering the borrower in the event of a job loss. To benefit from it, you must meet many conditions such as: being on permanent contract in the same company between 6 and 12 months old and being under 60 years.How to open a my French Bank account ?

My French Bank is no exception to tradition and, like its competitors, mobile banks, offers a device ofaccount opening of disconcerting simplicity, Ultra fast and zero paperwork warranty.

However, the Mobile bank made in France stands out since you can Open your online account but also in a post office.

Open a my French Bank account: 4 top time steps

�� Fill out the form

Fill out the form indicating:

- First and last name

- Address

- Professional, family and financial situation

- Phone number

- Smartphone type: IOS or Android

�� Customize your package

Choose between the original offer at € 2.90/month or the ideal premium offer at € 6.90/month.

Indicate if you want to subscribe to one or the other of the insurances offered by my French Bank.

You can also indicate whether you are interested in a renewable credit or by banking mobility

�� Transmit the requested documents

The necessary documents requested:

- A first proof of front/back identity : identity card, French or foreign passport or residence permit

- A second proof of identity, Different from the first: identity card, French or foreign passport or residence permit but also a vital card, a student card, a tax notice or a resident card

- A bank account number

From the app, photograph and upload your supporting pieces: child’s play ! If you don’t have them with you the moment T, do not panic: you have almost 30 days to resume your file.

✍️ Sign your contract electronically

After downloading all the documents, sign your contract electronically and make a first payment of € 50 to validate the account opening. That’s it !

How to contact my French Bank Customer Service ?

For Contact my French Bank, You have several channels:

- Live Chat of the Application

- Telephone service: at ☎️ 09 69 36 20 10 (at the cost of a local call) of the Monday to Saturday from 8 a.m. to 10 p.m

- Via Instagram or Twitter social networks

Need to oppose your card ? Use the dedicated function on your application or contact the ☎️ 09 69 36 20 10 (price of a local call) of Monday to Saturday from 8 a.m. to 10 p.m

Read more on my French Bank