Online banking – Mobile as you! | Hello Bank! , How to open a hello bank account: to read before subscribing!

How to open a Hello Bank account? All steps

To become a hello bank customer!, You will have to sign the Hello Bank account agreement!, By indicating your phone number and you will then receive a confidential code by SMS on your mobile that will have to be indicated. There is therefore no scribble to do with your mouse to make the signature but just to fill a code received on your mobile !

An online bank

for individuals

When the agility of online bank

Meet the know-how of BNP Paribas,

This gives hello bank!.

Until 180 € of advantages offered !

for all 1st

account opening

In vouchers for any

Banking mobility with Hello Start+

And also, the hello offers to 1 €/month for 6 months (2)

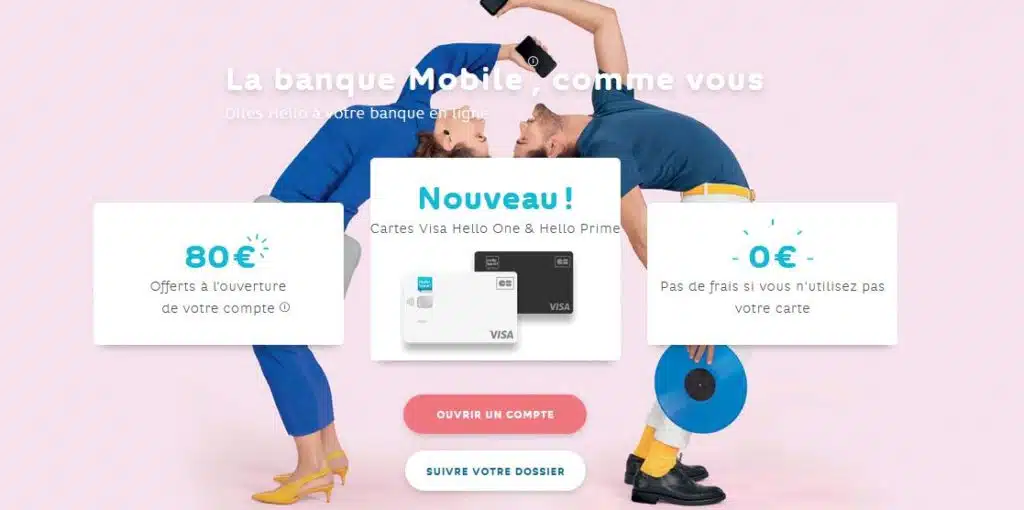

Until 180 € of advantages offered ! € 80 offered (1) for any 1st account opening + € 100 offered (3) in vouchers for any banking mobility with Hello Start+

And also, the Hello Prime and Hello Prime Duo offer at 1 €/month for 6 months (2)

Hello Bank!, The online bank that adapts to your projects ..

With Hello Bank!, You have a wide choice of online products and services to meet all your needs.

You want to know more about our products ?

It’s this way :

You already know us ? Take the plunge and open your account

Online banking in 5 minutes !

… it is also a 100 % online bank that does not forget

essential services

Reliability with its reinforced safety, all your interactions are secure.

Availability by cat, email or phone, you will always have an advisor with whom to exchange … from your sofa.

Adaptability A wide range of products and services to adapt to all your life projects.

And who gives you good deals all year round.

Right now, up to € 180 in advantages offered !

80 € offered (1) For all 1 st opening of account

+ 100 € offered (3) In vouchers for any banking mobility with Hello Start+

And also, the hello offers to 1 €/month for 6 months (2)

Hello Bank! It is the best of a traditional bank with the flexibility of an online bank

The advantage of being an online bank is to be able to benefit from rapid and simplified administrative procedures. Tell hello to our suggestions and browse Hello Bank! To consult all of our banking products and services.

Car Insurance

Auto insurance are card guarantees according to the formula and the additional options you choose. Thanks to the 3 formulas: third parties, third parties, all risks, you take out insurance closest to your needs and your budget and you stay on the right road !

A booklet

The booklet A allows you to feed your savings or that of your children without any management or account opening costs. What to live with a light spirit but the head full of projects !

Consumer credit

Consumer credit Hello Bank! It is a financing solution for each situation. Vehicles, travel, work or fittings, borrow up to € 75,000 to finance all your projects.

Life insurance

Hello life insurance! You support you in the creation of your savings to allow you to envisage the future as you understand.

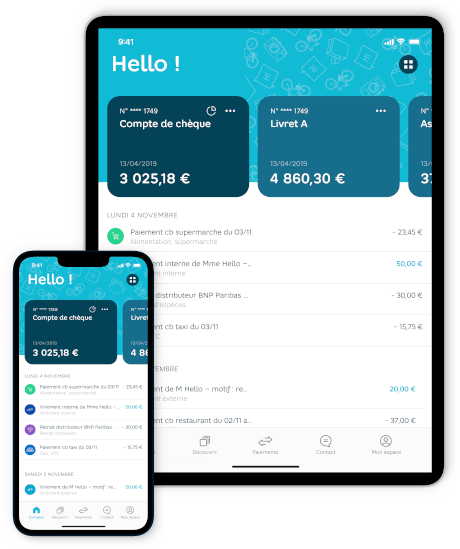

And a simple and intuitive app to manage your budget in the blink of an eye.

On a trip, with friends, in public transport: with the hello bank app!* You have all the cards in hand to manage your accounts according to your desires.

- A free application available on iOS, Mac and Android.

- A multi-professional interface that allows you to easily go from your particular account to your pro account.

- A dark fashion function to consume less energy and help save the planet !

If you too are seduced, join us by opening your online account.

Large form

speed

Simple and fast, Complete your information is a children’s game !

Signature

electronic

With the Online signature, You enter a confidential code received by SMS and voila !

Sending parts

supporting documents

Nothing’s easier ! A photo from your smartphone To download when you want !

Opening of

account

You make your first payment. Once your account is opened, you receive your Visa at your place.

Hello Bank! It is also an online bank for professionals

Discover the products and services offered by our online pro bank. Online bank pro becoming a professional customer

(1) The welcome bonus of € 80 offered is reserved for natural, capable, major, French residents, acting for non -professional purposes, opening a first individual deposit account or a first hello bank joint deposit account!.

This welcome offer is reserved for people who do not already, when opening the individual or attached deposit account, of a private or professional account at Hello Bank!. In the case of a joint account, it is enough that one of the two cotturies does not already hold a hello bank joint account!.

Only one bonus per person and per account. In the event of a joint account, a single bonus is paid to the said account.

The bonus of € 80 will be paid 20 days after the effective opening of the Hello Bank account!.

You benefit from a 14 -day withdrawal period. Each product/service of a group offer is available individually. Welcome offer governed by French law and not combined with any commercial or sponsorship offer in progress. More information on grouped offers and prices on HelloBank.FR (2) In the event of simultaneous subscription to the opening of the HELLO PRIME or Hello Prime Duo offer, the new customer (s) will benefit from a reduction in SA (their ) Contribution and will (settle) a contribution of one (1) euro per month during the first 6 months. At the end of these 6 months, the amount of the subscription as provided for in the contract will apply, according to the grouped offer chosen.

The subscription to the hello prime offers is reserved for people with a monthly net income (before tax) of € 1,000 for the hello prime offer and minimum € 2,000 for all the cotturies for the Hello Prime offer Duo.

You must have validated online your account for opening account no later than 09/10/2023. You will benefit from your advantages if the final opening of your Hello Bank account! (Confirmation by the account activation bank) is carried out at the latest within 30 days of the end date of the operation, ie on 09/11/2023. The opening of the account and the subscription of the grouped offer are subject to the eligibility conditions set by the bank and are subject to acceptance by it. (3) Offer reserved for all capable major customers, holders of a hello bank deposit account! And having subscribed via the bank mobility mandate to the free service of aid to the change of bank domiciliation hello start + within the first 12 months after the opening of their account. The voucher with a total value of € 100 can be used in the form of purchase codes of different values (of € 10 or 100 €) ordered from the stores participating in the operation. The period of validity of the voucher is 6 (six) months from the date of confirmation of subscription to Hello Start + and that of the code of 1 (one) months from the date of receipt of the electronic message indicating the purchase code. A single purchase code is issued by brand, according to available stocks. The codes are non -refundable. The purchase code is non -refundable and non -exchange for their monetary equivalent. For more information, you can consult the details of the conditions in the instructions for using a Hello Start purchase voucher +.

How to open a Hello Bank account! ? All steps

You ask yourself How to open a Hello Bank account! ? If you are wondering about the process to be followed to become a customer of this online bank, know that we have just constituted a special file on the opening of each online bank of the market, of which Hello Bank!, So that you can visualize concretely how to open an account in any online banking establishment.

We will therefore see, in this file, how to open a Hello Bank account!, By indicating the procedures to follow and the conditions to be observed, while evoking the online banking mobility assistance service: Hello Start+.

How to open a Hello Bank account! ?

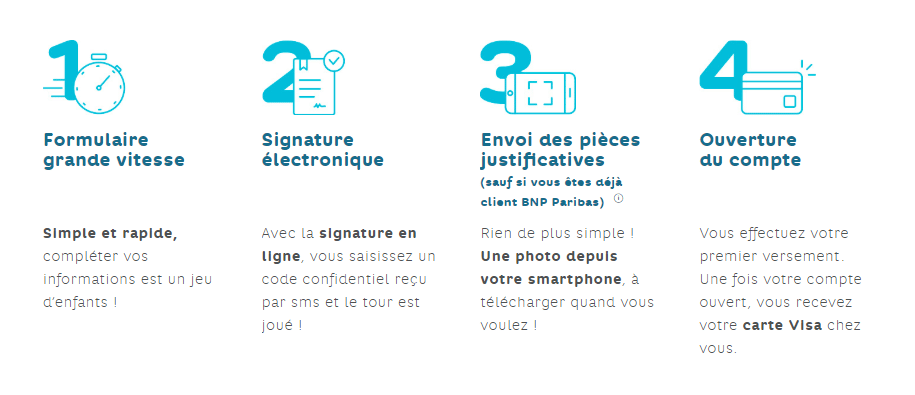

To open a Hello Bank account!, You will have to follow the following 5 steps ::

- Check that you meet the conditions required by Hello Bank!

- Fill out the online form

- Electronic signature

- Send supporting documents

- Activate your Hello Bank account!

Open a Hello Bank bank account! is a simple and quick approach that is carried out online, either from the online bank website, or from its mobile application.

After answering the question “how to open a hello bank account! », We will now look at the conditions required by the online bank to be able to open an account.

What are the conditions to open a Hello Bank account! ?

The conditions to open an account at Hello Bank! are the following ::

- to be a natural, major and capable person

- Reside on French territory

- Act as an individual or as an individual private entrepreneur

- Make a first payment of at least 10 € (300 € max.) to activate the new account

- Transmit all the necessary documents requested

Here are all the conditions requested by the online bank to be able to open an online bank account Hello bank!. These conditions are common to all types of account and bank cards offered by Hello Bank!.

How to open a Hello Bank account! ? The steps in detail

To open a Hello Bank account!, You will have to carry out 4 steps online: fill out the account opening form, sign the account agreement, send the supporting documents and proceed to the first payment to activate the new Hello Bank account!. We will therefore, in the following lines, detail these 4 steps.

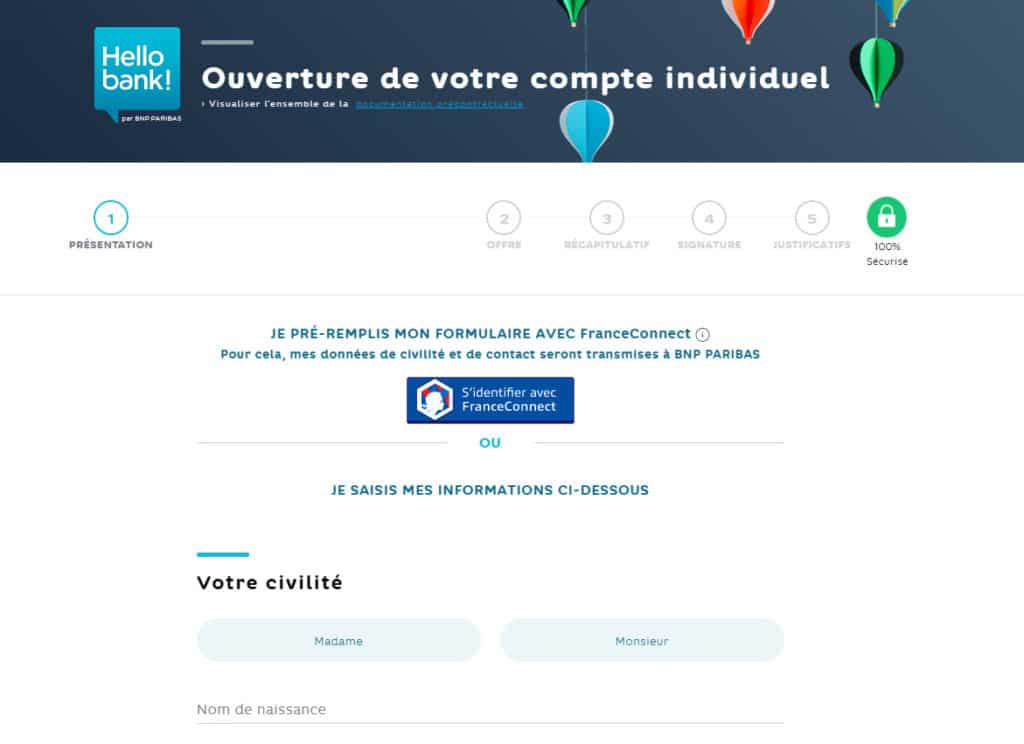

Step 1: Complete the online form

The first step to open an online account Hello Bank! consists of filling the form available on the site or application of the online bank. Hello Bank! will also invite you to verify that you are well eligible for the different offers from Hello Bank!.

Your personal information

A form of all that is most classic awaits you on the online bank website To open your account. Standard information will be requested as for example your name, first name, date of birth, address … The form is quite simple to fill out, nothing very bad.

On the other hand, be sure to be careful not to be mistaken in this information, because they will obviously be crucial thereafter for the creation of your Hello Bank account!. So take a few moments to check the spelling of the name, email etc., Especially if you open your account online from your smartphone (the T9 is not always our friend !)).

HEELLO BANK’s eligibility conditions verification!

This is to check if you are eligible from an administrative point of view at the opening of a Hello Bank account!.

You must of course ensure that you meet the basic criteria which are valid for the opening of a bank account in any online bank. To know :

- to be of age

- be resident in mainland France

- act as an individual or individual entrepreneur, privately

Check the Hello Bank conditions! For bank card offers

Then, it is a question of verifying the required conditions according to the offers of bank card.

For each hello bank offer!, Whether it is opening a current account or a savings account, individually or 2 (joint account), this is like most other online banks conditioned by criteria of income.

To save you time in reading these conditions we have summarized them in the form of a table: ��

Hello Bank! ::

Bank cards

Two comments are essential ::

- It is imperative to check the agreement of this information with your situation, failing which your file will simply be rejected ! Online banks are uncompromising on this aspect.

- At Hello Bank!, There is no compulsory monthly payment to make (as for example the case with ING). You can also, if you never have sufficient income, opt for an individual or attached account opening by making a savings payment.

Choosing your HELLO BANK bank card offer!

Then come the time to choose the offer, depending on your income or savings conditions.

You have the choice between 4 offers for the opening of a Hello Bank current account! ; These are 4 Visa bank cards ::

- The Electron Visa

- The Classic Visa

- The first visa

- The infinite visa

Two things to know again ::

- The first 3 are free for life, that is to say that their gratuitousness is not conditioned by a minimum of operations to do on such or such period as is the case with other online banks.

There is only the last bank card, the infinite visa card, which is paying with a price of € 240 per year. Details also that the latter formula will imply the obligation to domiciliation of income at Hello Bank!. - You will benefit from the Welcome HELLO BANK offer! 80 € only if you are doing the process of opening a Hello Bank account! with a first visa or a classic visa. The Electron and Visa Infinite Visa cards are not subject to this promotional offer.

Step 2: Validate your request by signing your account agreement online

The second stage of opening of current account Hello bank! is to make you validate your request to open an account hello bank!. It will be a question of consulting the account of account opening of the online bank and then to sign it.

The account agreement is a contract signed between you and the bank when opening a bank account. It summarizes all the information on the operation of your bank account (means of payment, procedures, prices, bank incidents, etc.).

To become a hello bank customer!, You will have to sign the Hello Bank account agreement!, By indicating your phone number and you will then receive a confidential code by SMS on your mobile that will have to be indicated. There is therefore no scribble to do with your mouse to make the signature but just to fill a code received on your mobile !

Step 3: sending measures hello bank!

Third step to open a Hello Bank account! : sending administrative documents. You have two possibilities to send them:

- either by scanning them

- either by photographing them (correctly) with your smartphone

For the parts to be provided, they obviously depend on your situation, But as the magnifiers of our detectives are sharpened, we will give you the list of elements to be provided that apply for all cases:

- proof of identity (identity card, passport, residence permit)

- Proof of address, your choice: Internet supplier invoice, water bill, invoice or electricity or gas timing, valid home insurance certificate, fixed telephone bill of less than 6 months, last notice of tax notice property or housing year N-1

- A proof of income:

- Last taxation or non-imposing notice

- Last salary slip

Know that you can find all of the administrative documents for the opening of a Hello Bank account! During the registration phase. We postpone it here: [administrative parts opening of hello bank account!

Step 4: Payment of the minimum hello bank! for activation of the account

The fourth and last step to open a Hello Bank account!, The activation of the account that is done through 2 main stages:

- The reception of the RIB of your new Hello Bank bank account! After sending administrative documents

- making your first transfer between € 10 and € 300

- receipt of your bank card and your HELLO BANK customer access codes! by mail

After sending administrative documents, you will receive an email within two weeks accompanied by the RIB of your new account, Which will mean that your bank account Hello Bank! has been validated !

You will then have to make a transfer of the minimum amount to finalize the opening of the Hello Bank account!, namely a payment between € 10 and 300 €. Nothing will obviously prevent you from putting more than this sum if you wish.Once this operation is carried out, you will receive a few days after your bank card and your HELLO BANK customer access codes!. Your account and card will then be operational !

How to open a Hello Bank account! With Hello Start + ?

To open a Hello Bank account! With Hello Start +, just fill out the Hello Bank banking mobility form!.

You will see it during step 1, you will be able to subscribe to the Hello Start service offered by the online bank Hello Bank!. This free service aims to facilitate your change of bank by dealing with everything related to administrative procedures to domicile your transfers and samples from the organizations concerned. We explain to you how it works !

How hello start works ?

So if you check the bank mobility option when registering at Hello Bank!, The bank will take care of changing banking domiciliation with the various interlocutors, namely:

- Your former bank to whom hello bank! will transmit the mandate of banking mobility within 2 days

- The latter will then send all the information relating to your transfers and samples to Hello Bank! (employer, rent, electricity, etc.) within 5 days

- Hello Bank! Then transmits your new bank details to the interlocutors concerned within 5 days and the organizations have their turn 10 days to take into account your new bank details !

What are the advantages of Hello Start ?

This simple and fast service thus saves a lot of time With regard to administrative procedures to domicile your transfers and samples from your current account. And all for free.

Note that the service is customizable, in the sense that you can choose to domicile at Hello Bank! All your debtor / credit organizations or just a part.

Online bank can also take care of closing your old account if you want to change “total” domiciliation.

You can follow in real time the progress of the procedures taken by Hello Bank! as well as those made by interlocutors linked to your transfers and samples.

Our additional resources:

A suggestion or the desire to give your opinion on our special file “How to open a Hello Bank account! »» ? Put us a little comment, we will be happy to answer you or bounce back on your remarks.