How to make an instant separate transfer at Hello Bank! Pro? | Hello Bank! Pro, transfers | Hello Bank! online bank

The transfers

(5) Delochered motto: Different motto from that of the country of the beneficiary of the subsidiaries concerned: BNP Paribas El Djazaïr in Algeria, Biciab in Burkina Faso, Bank of Nanjing in China, Bank of the West in the United States, Bici in Guinea, BMCI In Morocco, Bici in Senegal, Bicici in Côte d’Ivoire, Fortis Bank Turkey and Teb in Turkey, Urksibbank in Ukraine.

How to make an instant separate transfer at Hello Bank! Pro ?

How to make an instant separate transfer at Hello Bank! Pro ?

To make an instant separate transfer from your professional account, go to the “payments” section of your hello bank app!* or in the “make a transfer” menu of your customer area on the HelloBankPro site.Fr :

- Select “Make a transfer”;

- Enter data from your transfer;

- Choose the “Instant transfer” option (option proposed if the characteristics of your transfer meet the eligibility conditions, in particular an amount of the ceiling fixed by the bank and account of the beneficiary held in an eligible third -party establishment);

- Confirm the operation.

- The show of an instant separate transfer is free If you have subscribed to the Hello Business offer, ideal for crediting your suppliers in seconds ! Excluding offer, the cost amounts to € 1/transfer.

- The instant separate transfer is available 24/7 and its amount is limited to € 10,000 per operation **

- All the information and prices applied to the products and services of Hello Bank! Pro can be viewed in the Hello Bank Conditions and Prices Guide! Pro.

It helped me it didn’t help me

Help us improve the quality of this answer

The transfers

Your online transfers space: you can easily make unit transfers* (SEPA or international) or permanent to your accounts and to third -party accounts.

*Transfer (case of an occasional separate transfer)

In short

Advantages

- Free online for all transfers in euros within the SEPA zone

- Adding secure beneficiaries thanks to the digital key if you have activated it or a 6 -digit activation code, received by SMS.

- To your Hello Bank accounts!

- Towards external accounts (Hello Bank! or other banks in France or abroad) previously registered in your list of beneficiaries. (1)

Permanent transfers

Immediate transfers

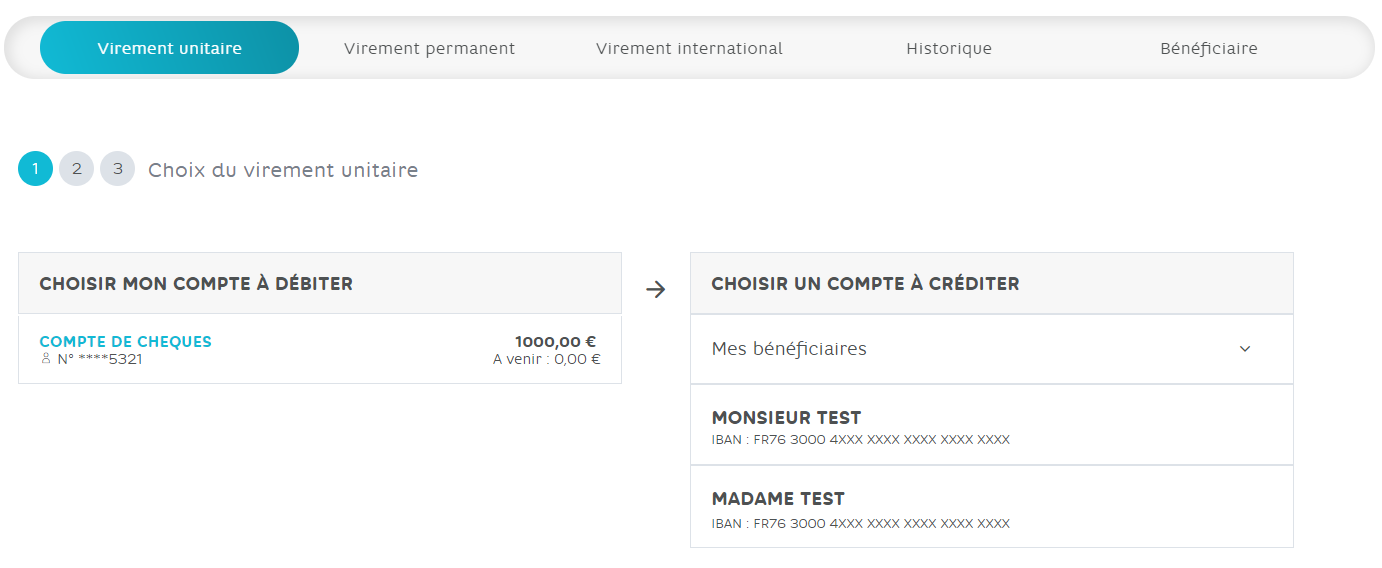

You wish to make a transfer, the amount of which can be immediately used by the beneficiary? It is now possible between Hello Bank accounts! and/or bnp paribas. For example, if in your list of beneficiaries, Madame Test is client BNP Paribas and Mr. Test is a hello bank customer!: If you make a transfer to one or the other on the date of the day, they will immediately be able to benefit from the funds that you saw them (to your beneficiaries holding accounts in the other banks, the delay in the transfer remains 2- 3 working days). Good to know : IBAN of BNP Paribas and Hello Bank accounts! Always start with FR76 3000 4xxx…

Did you know ?

Thanks to the presence of the BNP Paribas group internationally, you can make your transfers on euros online or in a different currency from the motto of the beneficiary country to numerous BNP Paribas subsidiaries (2) on the Internet for only 3 €, in costs shared with the beneficiary. (1) All transfers made in favor of beneficiaries whose accounts are held outside France or Monaco (including to other countries in the SEPA zone) require the prior activation of the “International Transfer” option: you can activate This option directly online from your transmission space. (2) BNP Paribas El Djazaïr in Algeria, Biciab in Burkina Faso, Bank of Nanjing in China, BNP Paribas Egypt, Bank of the West and First Hawaiian Bank in the United States, Bici Guinea, BMCI in Morocco, Bici Senegal, Bicici in Ivory Coast, Fortis Bank Turkey and Teb in Turkey, Urksibbank in Ukraine, BNP Paribas Bank Polska in Poland.

SEPA Viaires*

SEPA transfer is a transfer in euros from one of the countries in the SEPA zone*.

Make a unit transfer

- In the “Accounts” space, choose “unit transfers”

- Select your account to debit then the account to be credited with your available accounts or the accounts of your beneficiaries

- Enter the amount and date of execution of your transfer

- Enter a reason (it will be communicated to the beneficiary of the transfer)

- Once your summary is validated, your transfer is taken into account and you can consult it from the history of transfers.

Attention : If you wish to make a transfer to the debit of your deposit account, check that your balance has a sufficient provision (take into account the operations in progress). If you wish to make a transfer to the credit of one of your savings accounts, do not forget that some of these accounts are capped.

If you wish to make a transfer to the debit of one of your savings accounts, do not forget that depending on the account type concerned, a minimum credit balance may be required.

For the protection of minors, it is not possible to debit the account of a minor by transfer via HelloBank.Fr. * Country of European Economic Space, Monaco, Switzerland and Saint-Martin).

Instant transfers

Need to pay an emergency service or reimburse a loved one immediately ? Do not wait for your beneficiary anymore. The instant transfer is available from your personal online banking space on the HelloBank site.fr or on the hello bank mobile app! The instant transfer is available from your personal online banking space on the HelloBank site.fr or on the hello bank mobile app!. You can also issue instant transfers to the accounts of your registered beneficiaries (excluding BNP Paribas and Hello Bank accounts!), provided that the payment service provider in which the beneficiary holds his account is eligible. These transfers are credited to the beneficiary’s account within 10 seconds* from the transfer of the transfer order by Hello Bank!.

*from the transfer of the order of transfer by the service provider of payment of the principal to the provider of payment service of the beneficiary. Delay of up to up to 20 seconds in the event of exceptional treatment difficulties.

International transfers

- Shortcut time periods (1 to 2 days) for the most used currencies: GBP, USD…

- An improved entry route to best support you

- Simplified fees

– Now 0 € For your transfers in the Currency of the Beneficiary

– 15 € In the event of missing data on beneficiaries or for “relocated” currencies (4)

– 3 € Instead of € 15 for transfers to the BNP Paribas (5) subsidiaries in a different currency from that of the beneficiary’s country

Good to know

To be able to benefit from this new offer, you must have previously completed your international beneficiaries with the requested data (for example, Routing number/ABA code and beneficiary address)-these may differ according to the recipient country. Let yourself be guided when entering your order !

A simpler and clearer seizure of your transfers

When entering your transfer order, you enter the amount in euros or the amount in the Currency of the Beneficiary’s country: the exchange rate that will be applied is automatically displayed to you.

More precise monitoring of the execution of your international transfer order

In your history transfers, consult the stages of the execution of your international transfer at any time.

Find the prices applied in the price brochure. (1) Subscription to remote banking services (internet, landline phone, SMS, etc.): free and unlimited, excluding communication cost or provision of internet access and excluding alerts by SMS.

(2) Except for weekends and holidays: over these periods, in the event of an unusual variation (+ or – 10%) of the exchange rate, BNP Paribas reserves the right not to execute the order of international transfer. The status of your operation will be indicated in the Historic section of the Transfer section of the HelloBank site.fr or the apps my accounts.

(3) List of 37 currencies accessible at 09/18/2023:

Europe : BGN (Bulgaria), CZK (Czech Republic), CHF (Switzerland), DKK (Denmark), GBP (United Kingdom), HUF (Hungary), they (Israel), Nok (Norway), PLN (Poland), Ron (Romania), RSD (Serbia), Sek (Sweden), Try (Turkey)

Africa : DZD (Algeria), Mad (Morocco), Nad (Namibia), Zar (South Africa)

Asia & Oceania : AUD (Australia), CNY (China), HKD (Hong Kong), INR (India), JPY (Japan), KRW (South Korea), NZD (New Zealand), PHP (Philippines), SGD (Singapore) , THB (Thailand), VND (Vietnam)

Americas : CAD (Canada), MXN (Mexico), USD (United States)

Gulf States : AED (United Arab Emirates), BHD (Bahrain), KWD (Kuwait), OMR (Oman), Qar (Qatar), Sar (Saudi Arabia)

(4) Delocated motto: Motue different from that of the country of the beneficiary

(5) Delochered motto: Different motto from that of the country of the beneficiary of the subsidiaries concerned: BNP Paribas El Djazaïr in Algeria, Biciab in Burkina Faso, Bank of Nanjing in China, Bank of the West in the United States, Bici in Guinea, BMCI In Morocco, Bici in Senegal, Bicici in Côte d’Ivoire, Fortis Bank Turkey and Teb in Turkey, Urksibbank in Ukraine.

Other transfers

Deferred transfers

With Hello Bank!, You can enter transfers with a different execution date up to two months maximum. Provision control is carried out on the morning of the requested execution date. If the day comes, the balance of your account is insufficient, the transfer will not be executed. You will be informed by email in your secure messaging. Delayed transfers are not counted in your “to come” operations.

Favorite transfers

To avoid having to grasp the characteristics of a transfer that you do regularly, you can save it in your favorite transfers*. * Only available for SEPA transfers.