Hello Bank (2023) reviews: what is this online bank worth?, Hello Bank test: BNP Paribas all mobile banking – Les Numériques

HELLO BANK test: BNP Paribas’s all mobile bank

The highlighting of customer service is an essential point of the hello bank ecosystem, and there is something. The online bank of the BNP Paribas group enjoys a very good reputation. On the one hand, it is possible to have a physical contact point in any BNP agency in France even if the bank favors contact by phone or online, the hello team available from 8 a.m. to 10 p.m. on weekdays and from 8 a.m. to 6 p.m. Saturday.

Hello Bank! : our opinion on the online bank of BNP Paribas

Under the leadership of the BNP Paribas group, Hello Bank benefits from a banking network that has proven itself while having its own autonomy and offering services worthy of the best online banks on the market. With its very competitive offers, quality customer service and additional services, Hello Bank is clearly part of our references. Here is our full opinion.

Characteristics of Hello Bank !

| �� Opening prime | Up to € 180 offered: € 80 for any 1st account opening + € 100 in the event of bank mobility |

| �� Income ratings | 0 € |

| ��carte banking | Hello One, Hello Prime (Visa) |

| �� Initial | 0 € |

| ��Frais of account | Free |

| ��Parraine | Yes |

| �� Application | Android/ iOS |

| Mobile | Apple Pay / Paylib |

| ��3D Secure | Yes |

Hello Bank ! in a few words

You may have already heard or seen the famous formula ” Mobile like you ” somewhere. As you can suspect, it is behind these words that Hello Bank hides his philosophy. The online bank launched in 2013 by the BNP Paribas has experienced strong growth in recent years to the point of exporting itself to many European countries such as Belgium, Germany, Austria or Italy.

Due to the know-how of the parent company and the contribution of more than 2,000 physical agencies of the BNP Paribas network, Hello Bank has acquired the confidence of more than 3 million customers. In addition, in addition to the simplicity of its offer and the advantages of zero costs, banking products from traditional banks take a significant part of the customer experience. The redesign of its offer initiated in 2020, Hello Bank is trying to gain visibility while competing with the neobanques which it still tries today to stand out.

Two offers, including one free

There are two of this, Hello Bank began a complete overhaul of his offer. Exit the different card levels for current accounts, let’s give way to two offers with simple reading: Hello One and Hello Prime. The difference between the two accounts is mainly on the desired use: when the first is accessible unconditionally and free of charge, but with a limited margin of use, the other is intended for more complete use with an insurance and servic package premium, added value abroad, but necessarily more expensive. The latter also requests a minimum of 1000 euros in monthly income while the Hello One card is accessible to all. Here is the complete summary of the two offers.

- HEELLO One visa card

- Hello Prime Visa Card + Hello Prime virtual card

Hello Bank also offers specific offers for the accounts joined with two dedicated visa cards levels (classic and first), but we will focus on individual accounts for this notice.

| Hello One | Hello prime | |

|---|---|---|

| Price | Free | 5 € /month |

| Initial deposit | From 10 € | From 10 € |

| Type of flow | Systematic authorization | Immediate or delayed |

| Income conditions | None | 1000 € minimum |

| Payment abroad | Free and unlimited | Free and unlimited |

| Withdrawals abroad | Free and unlimited* | Free and unlimited |

| Payment ceiling | 1000 € /month | Between 1200 and 2500 € /month (depending on income) |

| Removal ceiling | € 400 /week | Between 500 and 1000 € /weeks (depending on the income) |

| International transfer | € 50,000 out Unlimited incoming | € 50,000 out Unlimited incoming |

| Account opening and closing | No fees | No fees |

*Free in all BNP Paribas and subsidiaries distributors

The advantage of Hello Bank on many of its competitors is the right distinction made between its offers. If Hello One is perfectly thought out for daily use or secondary use for small expenses, Hello Prime includes all the premium package that an online bank is entitled to offer for a very low monthly price.

In addition, the two offers benefit from a catalog ” zero costs “Quite substantial since in addition, whatever the offer, we are entitled to:

- No account holding fees

- No inactivity costs

- No commitment

- No termination fees

- No commission on operations

- No payment costs abroad (with card and excluding exchange costs)

There are still some nuances to know in the case of certain operations such as withdrawals. They are indeed free when they have been made from the more than 2,000 BNP distributors and on partner terminals – in addition to those of the Global Alliance network – in France and abroad. For the latter, the Hello One card still requests 1 euro per operation, making it a card that is difficult to travel to travel, especially in countries where cash payment is important.

The hello one card is also distinguished with instant transfers. They are also subject to commissions – still 1 euro – when issued from the Hello Bank web platform, or in BNP Paribas agency. They are however free from the application.

Note that in both cases, these offers are available in a duo version, very practical for the creation of common accounts. The characteristics remain the same in all cases, even concerning free on Hello One. Hello Prime Duo is listed at 8 euros monthly.

Finally, Hello Bank has recently had a business offer, an account designed for independent professionals (craftsmen, traders, liberal professions, freelancers, etc.). Listed at 10.90 euros per month, this account gives access to characteristics thought for pros such as the absence of costs on transfers and payments whether in euros or in currency, even in instant mode. Professionals are also entitled to a specific customer service Hello Team Pro, available 6 days out of 7.

How to feed your account ?

The advantage of an online bank compared to a neobank also comes from its mother network. In the case of Hello Bank, it is possible to take advantage of BNP Paribas agencies to deposit checks or species to supply your account. Welcome and practical functionality, it is even possible to scan a check via your smartphone with the application and to find the amount credited on your account after validation. Obviously, bank transfers are also possible and do not undergo any amounts of amount, except coming out abroad.

You have to wait before getting your card

Whether from your mobile or computer, registration at Hello Bank is fast and only takes ten minutes. The documents requested are more or less the same as elsewhere: two identity documents, proof of address, a RIB, the last proof of income and a scan of the handwritten signature. Once these documents have been sent, it will only take two days to receive a temporary Rib hello bank to which to make a first deposit between 10 and 300 euros necessary to validate the creation of the. But it is from here that the experience is tainted: four days after sending the first deposit, the account is validated. It is quite possible to access your customer account, but Hello Bank gives no news from the bank card. Finally, we received the card in registered letter 16 working days after the first steps to create accounts, without ever receiving any follow -up.

Initial deposit and overdraft management

Like most online banks, Hello Bank ensures a contribution to the new account from its new customers. This amount varies however depending on the income and is at the discretion of the bank, which is undoubtedly based on the information given at the opening of the account. Hello One is accessible unconditionally while the Hello Prime offer requires a minimum of 1000 euros/month for its subscription.

Welcome premiums

As a subsidiary of a traditional bank (BNP Paribas), Hello Bank adopts a strategic acquisition model that is just as much. If neobanques tend to abandon this aspect in favor of word of mouth, online bank does not hesitate to multiply special welcome operations. We are therefore counting on sums offered for the opening of an account – often spread over time – or the free of the Hello premium card over a given period. To find out the current offers, remember to regularly consult our good deals section or our dedicated comparator.

Sponsorship

In addition to welcome bonuses, Hello Bank also offers the possibility of sponsoring a loved one or being sponsored. The online bank offers 20 euros for each person who has subscribed to an account – whether hello one, bonus or joint – and 1 year of subscription to a hello prime card offered for the sponsored person.

Insurance, offers and services of Hello Bank !

Hello Bank is a partner of the Visa organization to offer all of its customers the insurance package that is its own. Obviously, the premium visa card – corresponding to the Hello Prime offer – has the highest level of insurance.

But Hello Bank, as is the case with Boursorama with Société Générale, has the advantage of having the support of the parent company BNP Paribas. Therefore, the bank is able to offer additional banking products which are usually reserved for traditional banks. It is therefore possible to subscribe to a consumer credit (fixed rate) or even a mortgage. The advantage of the first is that it is doable directly from the application or the web interface while the second still requests the support of a telephone advisor.

In addition to these products, Hello Bank also offers the opening of a savings book called Hello+. The latter is free, at no cost and scalable from 0.05 to 0.10 % depending on the amount spared.

Cashback to absent subscribers

Hello Bank does not offer a service cashback which is its own via a dedicated platform or feature. On the other hand, it is possible to go through the sites of cashback What are IGRAAL, EBUYCLUB or Swagbucks (others are available) who are online bank partners. We would have liked Hello Bank to offer his own platform, as is the case with some competitors.

What is customer service at Hello Bank is worth ?

The highlighting of customer service is an essential point of the hello bank ecosystem, and there is something. The online bank of the BNP Paribas group enjoys a very good reputation. On the one hand, it is possible to have a physical contact point in any BNP agency in France even if the bank favors contact by phone or online, the hello team available from 8 a.m. to 10 p.m. on weekdays and from 8 a.m. to 6 p.m. Saturday.

Apart from that, the Hello Bank site has its own virtual assistant called Helloïz. The latter acts, however, as a bot and is content to redirect customers to articles and links associated with research. Its advantage is to be accessible from the web platform, applications, Facebook Messenger and even on Google Home. The Hello Bank site also counts on a very active online forum which allows you to easily find an answer to a question. The Twitter account is also very active and responds quickly via private messages. On this, it’s almost a flawless.

And cryptocurrency ?

Depending on the position of BNP Paribas on the subject, Hello Bank does not offer a product allowing to invest in cryptocurrencies. To tell the truth, it is not even possible to transfer funds from a platform, Binance in mind. This positioning on cryptocurrencies still denotes with this principle of a bank based on dematerialized use, this is also the case of online banks like Boursorama or Orange Bank.

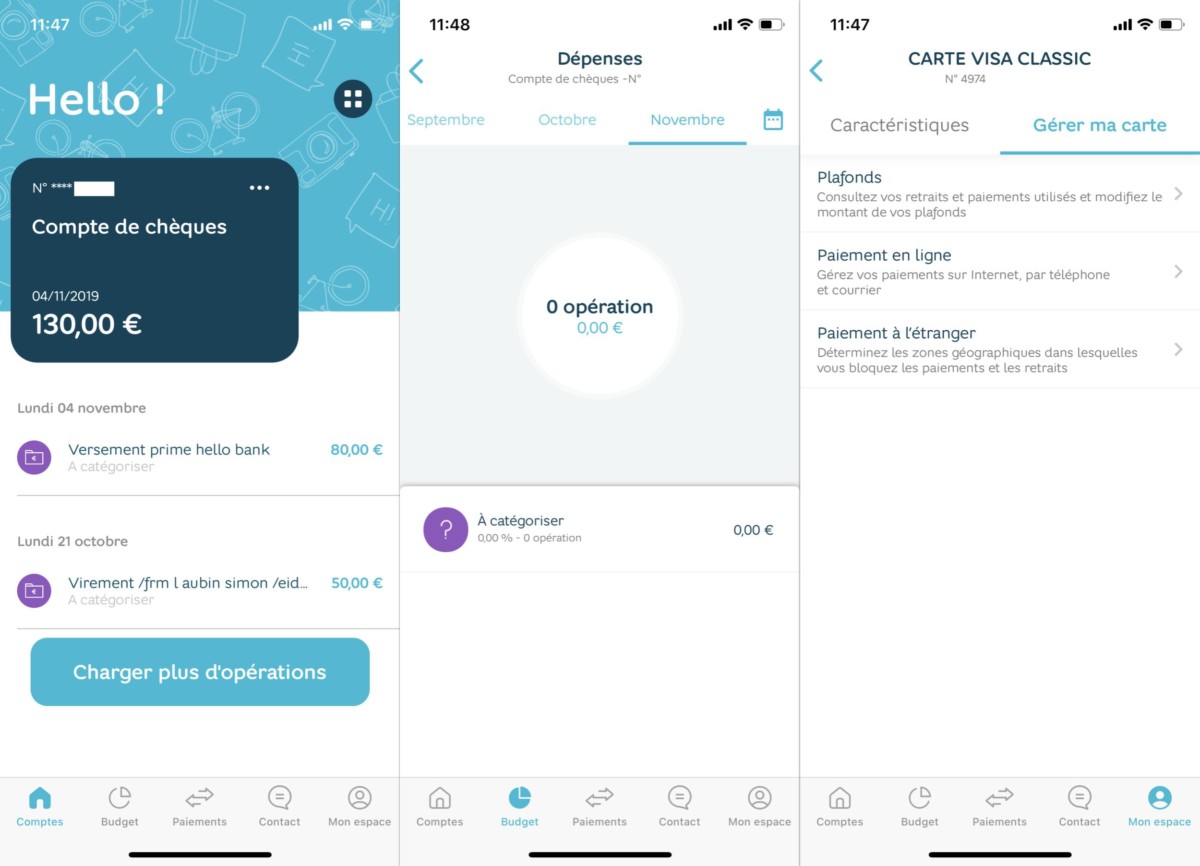

Our opinion on the HELLO BANK mobile application !

The customer experience of an online bank is necessarily dependent on its mobile application. Even if it is possible to manage your account via the web platform, the mobile experience remains at the center of the hello bank ecosystem, we can also say that the latter has only been attended. The hello bank application available on Android and iOS meets the main expectations and offers common characteristics while offering a clear, simple and non -invasive interface. The latter range from budget management to the categorization of expenses to the modification of ceilings and activations or not of online and abroad payments. Safety measures such as blocking the card or management of facial or digital recognition is also part.

Apart from the classic functions, we note the possibility of finding the BNP Paribas agencies via the activation of the GPS. For the Prime accounts, the virtual card can be used via the NFC function of your device and by linking its bank account to compatible payment methods like Apple Pay, Paylib. Like a Lyf Pay, Hello Bank even allows you to create prints with friends directly from the application, which avoids having to open several platforms to achieve it. Finally, as for N26, you can activate or not the live flow notifications.

More surprising, Hello Bank offers an application on MacOS. This takes up the design and outline of the web interface and simply saves copies of certain files-such as its RIB-directly on your computer.

HELLO BANK test: BNP Paribas’s all mobile bank

Nine years after its launch, the 100 % mobile subsidiary of BNP Paribas has diversified, but always offers for individuals a tight offer with two different accounts: One and Prime.

Presentation

Nine years after its launch, Hello Bank announced in March 2022 that it had attracted 700,000 customers in France, but the establishment is also available in Germany, Belgium and Italy. For this bnp paribas subsidiary, the positioning key is a complete banking offer, but as simple as possible so that its users can use it independently with their iPhone. Indeed, even if the bank offers an Android app, it prefers the apple firm by far with an application dedicated to iOS (like all the banks of our comparison) and another in MacOS. No mobile payment offer is available with Android.

Account characteristics

Apart from the professional offer called Hello Business and which is aimed at the self -employed, Hello Bank offers for individuals two offers, one and premium, both declining in solo or joint account, called Duo. The most basic offer, the One, is completely free, but linked to a systematic authorization card (that is to say that each payment, the terminal connects to the bank to verify that there is good money required on account). It grants access to the entire range of current, savings and credit products from Hello Bank, with the exception of virtual cards reserved for Hello Prime customers – and therefore the unauthorized overdraft. On the other hand, certain services such as instant transfers or withdrawals to distributors other than those of the group are paid (€ 1 in the SEPA space, 1.5 % of the amount outside the euro zone).

The Premium offer, named Hello Prime, is billed at € 5/month for an individual account and € 8/month for a joint account. That said, even if like hello one there is no minimum amount to deposit on the account to open it, nor obligation to domicile its income, this offer is reserved for people who have at a minimum € 1000 net of monthly income. It offers additional insurance, privileged access to customer service and a few additional services (authorized discovered and possibility of choosing a delayed debit card, a virtual card to pay on the web, or even to issue instant transfers without fees or withdraw from money anywhere at no cost).

The two accounts give the right to all classic services (checkbook, bank check), savings (PEL, CEL, LDDS, Bourse, life insurance, etc.) and credit for banks. At a time when this test has been carried out, Hello Bank is not yet interested in financial services proper from the web. Thus, it does not offer any service linked to cryptocurrencies, nor a system of aggregation of invoices or purchases in the app, as can do revolut with its Stays offer.

Note that if it is hidden on the site, there is indeed an offer for young people from 12 years old: Hello Bank Origins. Only a parent or representative holding a Hello Bank account can create it for his toddler, from his own banking interface. The latter will have a current account with a bank card with systematic authorization, with a € 500 expenses over 30 days and withdrawal of € 200 over seven days. Withdrawals are free all over the world, whatever the distributor chosen. Children can also access certain savings products such as a booklet A.

Application

To get the most out of Hello Bank, it is better to be in the Apple world than Android. Indeed, even if the app also exists for the latter, it is available in two Apple versions: one for iOS and one for macOS in case you do not want to go through the online site. Likewise, with Lyf and Paylib, Apple Pay is the only mobile payment solution offered by Hello Bank. Google Pay, Samsung Pay users and others will go their way.

These differences posed, the rest is identical. You will have services like “The digital key” To authenticate your payments or other banking operations from the application, the aggregation of the various bank accounts or the geolocation of the distributors of tickets. Note that if it is possible to make checks from the app, you can also deposit them in the automata of the BNP Paribas network – which is not the case with the other mobile bank of the mobile bank group, nickel. Management of expenditure and withdrawals ceilings, blocking of certain uses (international payment by geographic area, contactless payment or not, opposition to the card) and others are also accessible directly in the application. And if personalization of the card is not possible, it will be allowed before the end of the year to request a reminder of the PIN code directly in the app.

After -sales service

Hello Bank’s after -sales service is particularly classic: online help with an FAQ provided, and in the app the possibility of chatting with an email, cat or telephone advisor. Some services are accessible directly from the application page of the application before even authenticate: follow the progress of the opening file, oppose your card, challenge a levy, find a distributor or access the FAQ (the user is then returned to the website). However, all Hello Bank customers are not housed in the same brand. Those of the Hello Prime (paid) offer have privileged access to after -sales service 24 hours a day and 7 days a week at +33 1 40 14 10 10 10.