Helios – Discover the testimonies of our customers, Helios reviews: the neobank of greenwashing?

Helios reviews: the neobank of greenwashing

“No bank is completely perfect, completely green; We have identified alternatives that stand out and offer credible guarantees on their desire to respond to the climate emergency, including Helios.»»

Helios customer reviews: simple, complete and ethical

Thousands of people have already decided to engage in the depollution of their money. Find out what they like at Helios and why they left their bank.

Thank you for your support !

Error : Enter a valid email address

Excellent alternative to polluting banks, very practical apps and reactive customer service, new features arrive every month. Like that ��

Julien, customer since March 2021

What customers say

Thank You! Your submission has been received!

Oops! Something Went Wrong While Submitting the Form.

What experts say

“No bank is completely perfect, completely green; We have identified alternatives that stand out and offer credible guarantees on their desire to respond to the climate emergency, including Helios.»»

Founder and CEO of Reclaim Finance, affiliated to the friends of the Earth, winner of the Goldman for the Environment.

What the media say

“To finance ecological projects is the idea behind the Helios bank”

“Helios raises 9 million to build a green European neobank.»»

“Helios, the eco-banner who aims to become the first sustainable bank in Europe.»»

See all publications

Video customers

Convinced ? Join us in 8 minutes

It’s simple, fast and without commitment

Registration in 8 minutes

confirm your identity

Your account is validated

You receive your card for free

Thank you for your support !

Error sending your email

Together, depollu the bank

Helios is a new committed and transparent banking model, which directs its customers’ money to investment environmental investment projects. Helios offers several products (the sustainable current account, the young account, the common account and the future account to save), an international payment card, all the daily banking services and a dedicated advisor, all available from a customer area on Smartphone and on computer.

Follow behind the scenes

Co-constructing projects

- Terms and conditions

- Privacy Policy

- Legal documents

- Copyright 2023 Helios. All rights reserved

Helios reviews: the neobank of greenwashing ?

Helios is a neobank positioning itself as an “Ecobank” advocating a banking ecosystem favorable to the preservation of the. But behind speech and ambitions, Helios is really recommendable compared to a more classic neobank ?

Helios characteristics

| �� Opening prime | NONE |

| �� Income ratings | NONE |

| ��carte banking | VISA |

| �� Initial | 30 € |

| ��Frais of account | NONE |

| ��Parraine | YES |

| �� Application | Android/ iOS |

| Mobile | NONE |

| ��3D Secure | YES |

Helios in a few words

Like many neobancs that have launched in recent months, Helios is part of this caste of new banking brands that started its activities during the year 2020. The particularity of Helios is to bet on an activist discourse focused on ecology, ethics and sustainable development. However, it is far from being the first to orient itself on this niche, we think in particular of Tomorrow, also German neobank, a land decidedly conducive to gender.

A noble speech but which is sorely lacking in clarity

Like a certain Vivid Money or other fintech brands, Helios does not have its own banking license, but collaborates with Solarisbank, a Baas platform (Bank as a service) whose banking license it shares. It is therefore almost 100 % dependent on this organization with regard to the concrete management of money from its customers. However, even if a partnership between Helios and Solarisbank prevents the latter from taking into account the customer deposits of the first in its assessment, as well as the guarantee that these will be reserved for green investment. And if we want to believe in the discourse of the neobank, it is difficult to believe that the model advocated by Helios clearly detaches from the financial system in which he is irreparably attached, especially without real confirmations of his partner, proofs to support.

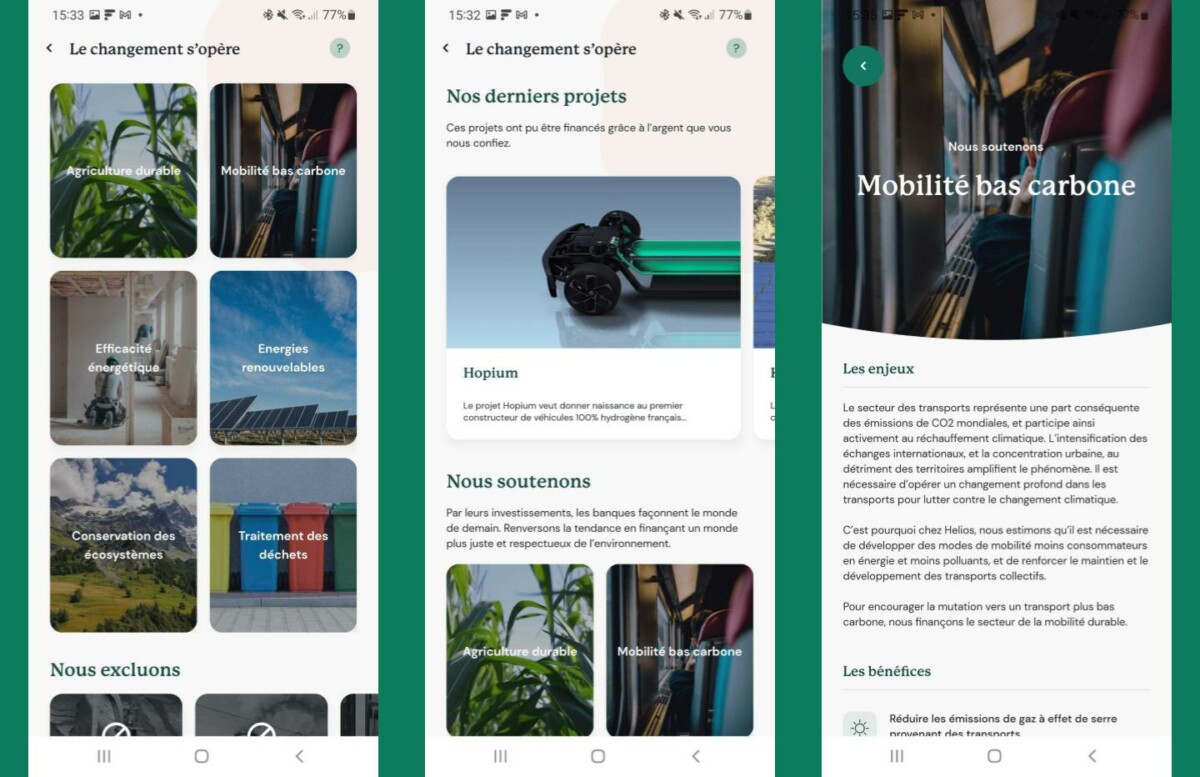

Let us insist on one point: even if Helios claims to reinvest part of his income in projects with ecological vocations (which we have no trouble believing), it is however much more opaque on the side of Solarisbank who does not gives no information as to the management of part of its deposits, the majority of which are managed by the European Central Bank. This can go to so -called polluting industries as well as to partners from all walks of life (including those with an ecological vocation).

It is also difficult with the principle of monitoring the carbon footprint strongly highlighted in the communication by the bank as well as on the main page of the application. As it stands, this data is difficult to verify and do not quantify the results of Helios in terms of environmental protection. It is more or less the same with the famous wooden card (the idea having been inspired by Tomorow) with which we see only a marketing artifice. Especially since the latter is very fragile, the finesse of the map and the type of wood used favoring the hinge in the event of humidity.

Helios prices

Helios offers a readable offer based on two current accounts (including one attached account) and another thought for a young active audience (18-23 years old). Inevitably it is the individual account that influences the rest. Here are the main characteristics:

| Helios Young Account | Helios current account | Common account Helios | |

|---|---|---|---|

| Price | 3 € /month (with one year commitment) | 6 € /month | 3 € /month (per person) |

| Initial deposit | None | None | None |

| Type of flow | Systematic authorization | Systematic authorization | Systematic authorization |

| Income conditions | None | None | None |

| Payment abroad | Free of charge (Euros area) 1% (excluding euro zone) | Free of charge (Euros area) 1% (excluding euro zone) | Free of charge (Euros area) 1% (excluding euro zone) |

| Withdrawals abroad | 2 free withdrawals per month* | 5 free withdrawals per month* | 5 free withdrawals per month* |

| Payment ceiling | € 3,000 per month up to € 2,000 per day | € 3,000 per month up to € 2,000 per day | € 3,000 per month up to € 2,000 per day |

| Removal ceiling | € 3,000 per month up to € 2,000 per day | € 3,000 per month up to € 2,000 per day | € 3,000 per month up to € 2,000 per day |

We find ourselves almost in what a classic neobank can offer. This is above all the case for payments and withdrawals abroad that are offered free of charge, but only in the euro zone, where other currencies will give rise to a taxation of 1 % on each operation. The classic current account also gives entitlement to 5 free withdrawals, additional withdrawals in the euro zone being billed as well as operations outside the euro zone (the latter being particularly expensive). Regarding ceilings, if a threshold is automatically assigned, it is unfortunately not possible to go beyond. Also note that all the Iban delivered not Helios are Germans, which is far from being practical for a lot of uses.

How to feed your account ?

Even if Helios theoretically does not ask for any compulsory contribution, we could not have access to the account without depositing a minium of 30 euros to have the full means, the 6 euros of the contribution being removed from this sum. There is no other way to feed your account than to go through your regular bank and make a transfer by hand, whether recurrent or planned. Operations all the more frustrating if your bank does not make instant transfer for free.

All this is coupled with the unavailability of mobile payments such as Google Pay, Apple Pay and others which strengthens this arduousness, especially in the context of a secondary account. We can’t even count on sending money not sms.

Open an account at Helios

It is from the Helios mobile application that you will open an account, and only this. The operation does not take more than 5 minutes and does not require supporting documents apart from a two-sided photo of the identity card and a selfie that can be validated by the application itself. Once the smartphone has been validated by a code sent by SMS, you have directly access to the application.

Discourse management

No overdraft authorization is issued. You are therefore committed to feeding your account to guarantee a positive balance. If inadvertently, the account was in negative, it would not be possible to make the slightest payment or withdrawal.

Welcome premiums

Few neobancas regularly offering welcome bonuses or the opening of an account, and Helios is no exception to this rule.

Sponsorship

The Helios acquisition strategy does not exactly correspond to what can be done with many online banks. The neobank offers users to benefit from a month of subscription (therefore of contributions) free of charge each time sponsorship, without limitations.

Everything can be done since application simply by sending the dedicated link to his loved ones. However, the sponsors must have carried out their complete registrations before validating the sponsorship.

Helios insurance and services

All Helios cards are stamped by Visa, but the organization is only think as a publisher. No special insurance is therefore issued whether for protections against fraud, loss or breakage of equipment or even for travel in the event of an accident.

Cashback

Yes, Helios has a cashback system, it follows the commitment of the neobank in terms of environment since it only concerns brands whose ideas it shares in this area. It is therefore possible to obtain discounts at the end of a certain purchase amount from some food stores or services such as the fork or EATIC, money offered in exchange for an subscription to an electricity contract green at Plüm or Ekwateur or the free delivery at Wedressfair, a platform for the purchase of ethical clothing.

Even if we can greet the idea, it is still too limited and addressing a certain customers who will find his account, the other not seeing real interest in the length.

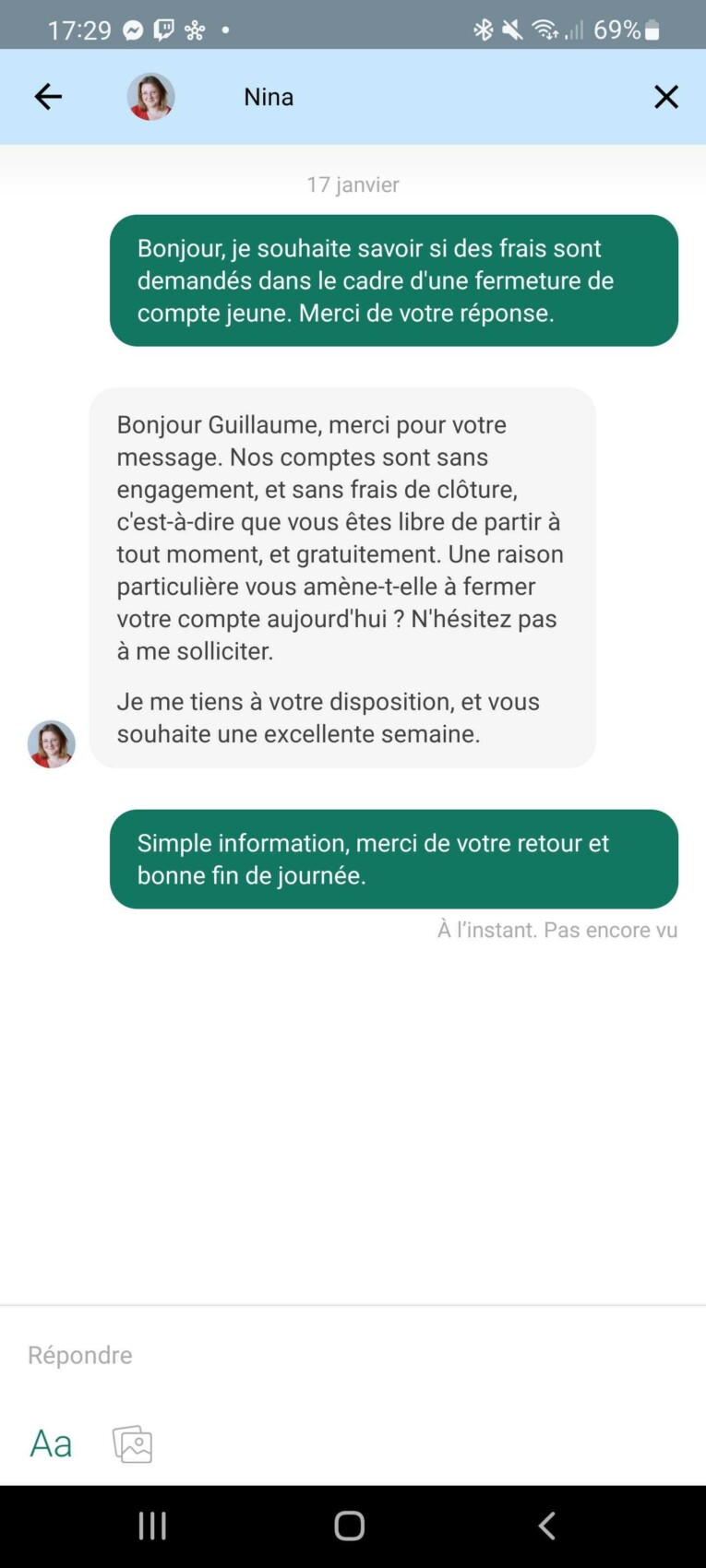

Customer service

Helios customer service is accessible from the application via an instant or by call system. We were able to try the first solution that turned out to be effective with a relatively fast response time. No bot system, available advisers respond well in French and, in the majority of cases, with written and unauthorized responses.

And cryptocurrency ?

Neither support of cryptocurrencies nor possibility of investment somehow with Helios. We understand that this type of services are not compatible with the principles of the neobank. Helios is therefore not a bank suitable for this type of use.

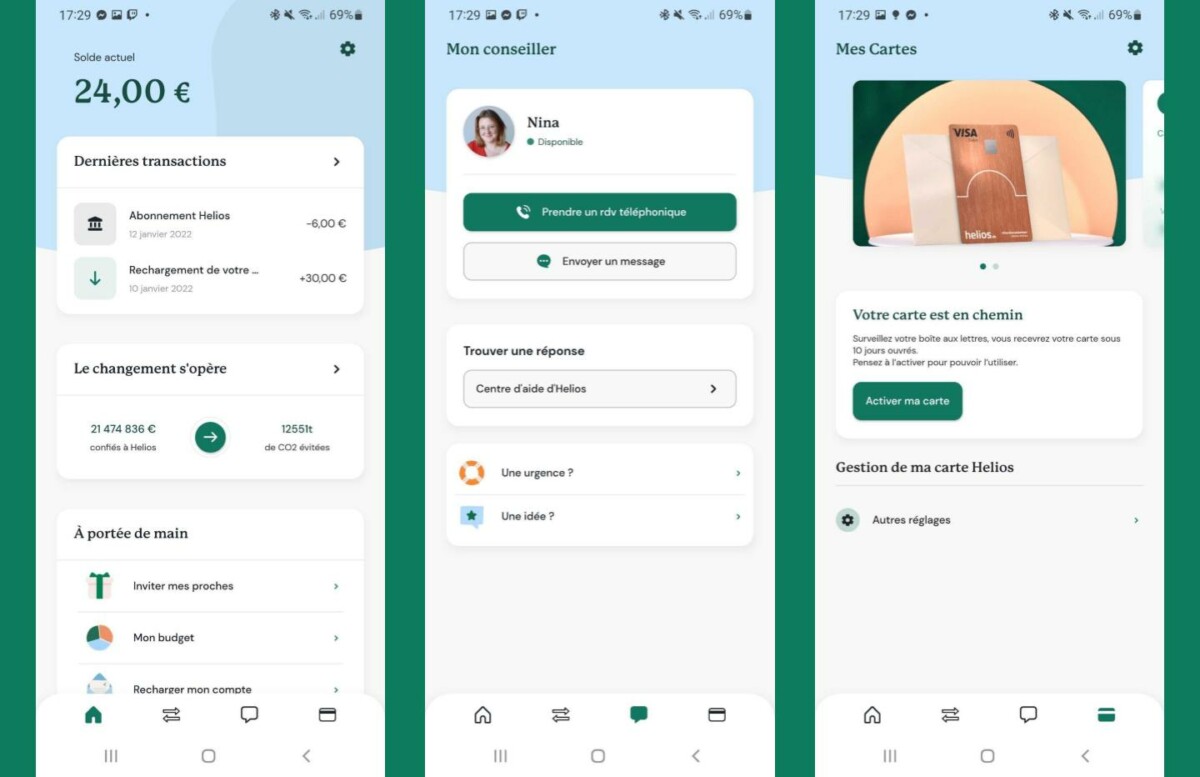

Our opinion on the Helios mobile application

Helios’ application experience is after all good quality. First of all, it is pleasant to see that the bank has chosen to develop its own platform and interface, rather than resuming a generic ecosystem. The presentation is neat and above all extremely refined, with the highlighting of the result of its ecological commitments from the first page.

The bottom menu has 4 tabs including one dedicated to the support, another for transfers and a last to have access to information from its bank (s). We also appreciate the fact that it is possible to manage a virtual card in addition to your physical card, which is also compulsory to activate on the application upon its reception.

The first tab, the main one, allows you to manage your budget with a glance with the latest transactions. But the most visible menu concerns the highlights of the banking activities with a series of items defining its commitments in terms of environmental protection.

In terms of security, we have the right to classic package, namely authentication by biometric imprint or secret code.

The Helios application is therefore effective in its approach even if the lack of features is felt, as much as the services of the bank.