Google Pay: how to pay with your Android smartphone?, Google Pay (wallet): compatible banks, security. Everything about the payment service

Google Wallet (ex-Google Pay) in France: everything you need to know about the payment service

When you want to make a store purchase, you must open the Google Pay then Maintain your watch above the contactless payment terminal until a sound or vibration is heard or feel.

Google Pay: how to pay with your Android smartphone ?

You wonder how Google Pay works and what it is exactly ? What are the banks compatible with this mobile payment system and if it can be used with PayPal ? Discover everything you need to know about this dematerialized payment solution to make your purchases quickly and in all serenity.

You are looking for a mobile offer to enjoy Google Pay ? Discover the available offers and let yourself be guided in order to take advantage of the partner offer most suited to your needs (free selectra service).

- The essential

- Pay with Google Pay consists in using your smartphone rather than a bank card to make a purchase.

- THE Google Pay payment also works with a connected watch or a computer .

- A Google Pay compatible bank is a partner banking establishment of the mobile payment system.

- Pay via theGoogle Pay app Allows to carry out transactions without any payment ceiling.

Google Pay, what’s ?

![]()

At the end of 2019, the Internet giant in turn launched an electronic portfolio system called Google Pay. But what exactly means, pay with Google Pay ?

This is simply a service contactless payment Made using a smartphone. The big advantage of an app like Google Pay is that its use is not limited to online purchases. You can completely do your shopping, visit a shop or buy other mobile applications in this way.

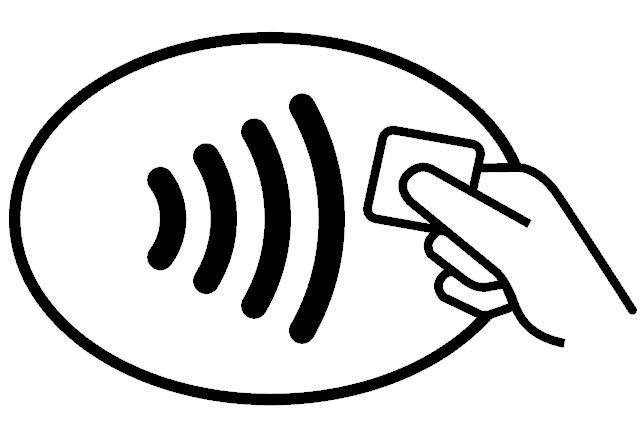

Google Pay payment mobilizes NFC technology (Near Field Communication) which allows two devices to exchange data very quickly. It is enough that the merchant in question has a contactless payment terminal and that the mobile phone has the appropriate chip for this to be possible.

However, in practice, How does Google Pay work ? You must fulfill the following three criteria to be able to Make purchases with an Android smartphone ::

- Be in possession of a Cell phone equipped NFC technology.

- Having downloaded the Google Play app on its mobile device.

- Hold a bank account with a Google Pay compatible bank.

This last condition is explained by the fact that a credit card must be registered in the Google Pay app to authorize the supply of funds from your account on that of the professional concerned.

Rest assured: the sum debited with each transaction via the application does not give rise to an additional cost invoiced by your bank. It therefore does not cost more pay with Google Pay rather than a conventional credit card.

You want to buy a smartphone with Google Pay compatible package ?

Free Selectra Service

Activate Google Pay on your smartphone

As we mentioned above, the contactless payment system works with Google Pay App, The mobile application developed by Google. This is why it is necessary to install it on your mobile phone beforehand.

THE Google Pay payment present many assets:

- Make Google Products Purchases, In Photos or Google Play, among others.

- Pay quickly and contactless via a compatible smartphone.

- Transfer or receive money (this service is currently only available in the United States).

Make sure that the operating system installed on your mobile corresponds to the version ofAndroid Lollipop (5.0) or later. Then proceed as follows to Activate Google Pay On your smartphone:

- Download the Google Pay app to the Google Play Store then open it.

- Configuration instructions are displayed on the screen, follow them. Then, Add a bank card.

- You have the possibility of Define Google Pay as default payment method In phone settings.

To find out if you can pay with your mobile in a particular brand, check the presence of Google Pay symbols at the entrance. This will mean that the merchant you plan to make a purchase has compatible equipment to make contactless payments.

Save a bank card on the Google Pay app

In a second step, you can choose fromAdd a payment method at the Google Pay app. It may be, in other words, an additional bank card or an additional account. Here is the procedure on your Android smartphone:

- First open Google Pay App And select your profile in the upper right corner of the screen.

- Brow the top screen, then touch the button ” Add a credit or debit card »».

- Manually inform the information of the card in question (or photograph them).

- You may receive an email or SMS containing a Validation code To add this new payment method.

- If this is the case, enter this single use code and confirm your action.

You can notice the removal of a very small amount from your account. THE Paypal payment service Also practice this kind of checks. This debit aims to confirm the viability of both your bank account and the card associated with it.

Unable to configure Google Pay You meet an error message while trying to activate Google Pay ? Go to the settings menu, then in the tab ” Phone settings »». Touch the “system”, “advanced parameters” buttons and finally ” System update »». Follow the instructions displayed on the screen after the announcement of the update condition.

How to pay with Google Pay ?

Concretely, Make a payment with Google Pay via its smartphone is much faster than with a traditional credit card.

- Unlock your mobile phone and approach it from the payment terminal.

- The symbol of a checkout must then appear on the screen: ✅.

The Google Pay app does not need to be opened to authorize the transaction . This payment method can also be used to carry out “in-app” purchases, On websites and more and more physical shops in France and around the world.

What are the Google Pay compatible devices ?

The system of Google Pay mobile payment can be used with two types of devices:

- Those that work under Android.

- Those that work under Chrome bone.

To know with certainty if a smartphone allows you to make Google Pay payments, the group provides users Two search files Depending on the operating system installed on the device. The manipulation then consists in pressing the “Ctrl + F” keys simultaneously and typing the name of his mobile phone.

Some models of smartphones or tablets, too recent, are incompatible with this technology.

Use a connected watch to pay with Google Pay

THE Google Pay payment system is not limited to transactions made via a mobile phone. You can completely use your Samsung Watch To make a race or buy an online application.

Of course, the latter must have the NFC technology and operate under the Wear 2 operating system or a later version.

- If this is not already the case, Download the Google Pay App From the Google Play Store.

- Open it and proceed to configuring the screen locking.

- Then follow the instructions displayed on the watch dial for Add a credit card.

- You then notice that the bank card in question appears in the Google Pay app.

This manipulation is not synchronized with your smartphone . The bank card added in this way will therefore not be on the latter.

When you want to make a store purchase, you must open the Google Pay then Maintain your watch above the contactless payment terminal until a sound or vibration is heard or feel.

Know that some banks impose a Verification code to enter each transaction.

You are looking to buy a new smartphone with mobile package ?

Free Selectra Service

Can we install Google Pay on a computer ?

Pay with Google Pay is possible to make purchases on the Internet. The first thing to do for Configure the application on a computer is to go to the site https: // pay.Google.Com/Payments/U/0/Home to connect to its Google account .

The second step is the addition of a payment method, exactly as you must proceed on smartphone. In the future, you will be able to book an Uber taxi or an Airbnb accommodation, to name a few. If you want to pay with Google Pay, simply watch over Select this payment option Before validating your basket online to confirm your order.

Google Pay Banque Compatible: the official list

You have now activated the Google Pay payment procedure, but have you Compatible bank account with this technology ? Is it that Google Pay and the savings bank, Or Google Pay and Crédit Agricole are partners ?

If, at present, the Google Pay payment system is not yet compatible with a number of banks as high as its Apple Pay counterpart, the list of participating financial institutions continues to lie down.

This table presents the exhaustive list of banks compatible with Google Pay, classified in alphabetical order.

| Facility Name |

|---|

| APETIZ (Visa cards) |

| Boursorama (bank cards, visa cards) |

| bunq |

| Edenred (Ticket Restaurant cards) |

| Fortuneo Bank |

| Lydia |

| My French Bank |

| Manager one |

| Max |

| N26 |

| Orange Bank |

| Pixpay |

| Revolut |

| Swile |

| Up Lunch check |

| Vybe |

| Zelf |

Exhaustive list of Google Pay compatible banks, classified in alphabetical order.

As long as your bank is in this list, you are able to adopt Google Pay contactless mobile payment. Not all banking establishments are favorable to this transaction system, however.

Google Pay payment limit whatever the Google Pay compatible bank To whom you are a customer, this contactless mobile payment technology is not not subject to a payment ceiling especially. A freedom that no longer applies if your bank card is capped at a certain daily amount.

How does Google Pay Paypal work ?

Created in 1998, Paypal is an American online secure payment company. It offers the possibility to all users of Make purchases worldwide. It also allows individuals to make money transfers.

Insofar as Google Pay and Paypal are compatible, you can completely chooseAdd a Paypal account to the Google Pay app. On your Android device, perform the handling indicated below:

- Open Google Pay App and touch the button ” Payment »Located at the bottom of the page.

- (Select the appropriate Google account via the “Menu” button if you have several.))

- Always at the bottom of the screen, touch the button ” + Payment method »». Select Paypal.

- Enter your Paypal identifiers and let yourself be guided by the instructions that appear on the screen.

Finally, it should be noted that the PayPal online payment and money transfers option is not available on a smart watch.

You are looking for an internet offer adapted to your needs ?

Free Selectra Service

Is Google Pay payment secure ?

Faced with the growing number of digital threats and fraudulent attempts encountered online, it is not abnormal to wonder if pay with Google Pay does not present safety flaws.

Unfortunately, no system is infallible and some hackers always manage to bypass the security measures developed by computer scientists to access sensitive information and try to extort money from individuals.

However, in the case of a mobile payment technology Deployed worldwide, security has been reinforced around Google Pay App to reassure users in their use.

Google thus highlights several guarantees to motivate the use of Google Pay payment, with or without paypal.

Reinforced security

As mentioned above, the Google Pay app was designed with multiple levels of safety To guarantee your anonymity and the protection of your bank account.

According to the Internet giant, pay with Google Pay would amount to benefiting from the most advanced protection infrastructure in the world. The firm is also guarantor of the fact that your data does not Never subject to commercial transactions.

There are also a few precautions to adopt to increase the protection of your banking information:

- Never transfer money to people you don’t know.

- Do not wait to report an unauthorized flow into your account.

- Do not wait to report any attempt at fraudulent phishing or canvassing.

As a rule, in doubt, Refrain from carrying out a banking transaction To overcome the attempts to scam.

Protected data with Google Pay

If you are a customer of a Google Pay compatible bank, be sure. Information relating to your bank card is not disseminated at any time.

- A virtual card is communicated to the merchant at each transaction.

- Integrated protection before Google Pay payment can be activated on your smartphone.

This last option is to pass a password Just before confirmation of payment. In this way, a malicious individual who would have stolen your smartphone, for example, could not make a purchase so easily via Google Pay.

Smartphone locking

Again, in the event of loss or theft of your mobile phone, Googge Pay has a functionality of remote locking. This means that by activating the service “locate my device to lock it”, you can also:

- Disconnect from your active google account.

- Erase all the data personal relating to your account.

In the event that the smartphone remains not found, it may at least not be used by a third party to make purchases without your knowledge.

In addition, all banking information Whether you store in the Google Pay app are in turn saved on Google servers. When making a transaction, these data are automatically quantified to guarantee outstanding protection.

The procedure to deactivate Google Pay

If the Google Pay mobile payment do not suit you, or for any other reason, you are free to Disable Google Pay And to go back to a more classic regulation mode.

In some countries, the Google Pay app is simply preinstalled on mobile phones. In this case, it will be impossible to uninstall it; You can, at best, break it temporarily or permanently:

- Go to the “Settings” menu then ” Applications and notifications »From your smartphone.

- Then touch the “Google Pay” icon. If it is not displayed on the screen, touch “Display all applications”.

- Then select ” Uninstall ” Or ” Disable »».

Google Pay Opinions: What do users think ?

After having seen in detail all the advantages inherent in the use of a mobile payment system, what are the Google Pay review individual ? Is this technology really effective and versatile ?

As with all services, it seems that there is for and counter Regarding the Google Pay application. It can be seen, some users are completely delighted with Google Pay features and daily payments that are facilitated.

Simple and essential . On the other hand, remember to integrate a search for loyalty !

Google Play Store review signed Sébastien – February 2022

I like all Google products, development is really serious and effective, and they are always there to help with the parameters.

Google Play Store review signed Isabelle – October 2021

The application works very well, but it’s a shame, for each Bank card renewal I encounter unpleasant technical problems.

Google Play Store review signed Émile – January 2022

Each opening the application asks me if I want to make it my default payment method. Please give the opportunity to save your answer.

Google Play Store review signed Jérémy – November 2021

Others on the other hand regret the absence of a functionality specific to reduction vouchers and loyalty cards. This characteristic is indeed not available in France for the moment.

Of course, it should be not taken into account the negative opinions of the type ” Google Pay Crédit Agricole does not work “or” Google Pay Savings Bank incompatible ”, since these two banks do not appear in the list of partner institutions.

You are looking for an internet offer to enjoy Google Pay ? Discover the available offers and let yourself be guided in order to take advantage of the partner offer most suited to your needs (free selectra service).

Updated on 10/15/2022

Floriane writes on all subjects linked to the Internet and Mobile.

Google Wallet (ex-Google Pay) in France: everything you need to know about the payment service

Google Wallet has been available in France since 2018. Partner banks, security. Here is everything you need to know about the NFC payment from its smartphone from the Mountain View firm.

Eight years after its launch in the United States, Google Pay-formerly Android Pay-finally arrived in France in 2018 in 2018. He has since become .

All French users can take advantage of Google Pay and therefore make purchases without having to take out their credit card, simply by affixing their smartphone on the payment terminal. Google also praises the extreme simplicity of this means of payment since it is enough to unlock the phone for transactions of less than 30 euros (as on CB), without launching the application or having to return password.

Who can use it ? How ? We take stock of Google Pay.

Google Pay / Wallet compatible smartphones

On the side of smartphones, the restrictions are rather low since they must meet only two criteria to operate with Google Pay:

- turn Android 5.0 lollipop or a more recent version

- be compatible with NFC For contactless payment

You will understand, all high -end smartphones are therefore compatible, while a large selection of entry and mid -range devices can also be used to pay a simple gesture. The list would therefore be too long to do here, but do not hesitate to consult our product sheets to check whether a specific model is compatible with NFC or not.

Finally, note that Wear OS devices also display compatibility with Google Pay.

Be careful however: if you install a firmware beta on your phone, that you rooter or modify its software part, the function may be deactivated for security issues.

Google Pay / Wallet compatible banks

For its launch, we could have expected from Google strong partnerships with the large French banking groups as Apple had done when it had launched, or even Samsung, which both displayed the BPCE (Banque Populaire Caisse d’Apursne) brands) on their announcement press release.

Unfortunately, Google’s list is a little less prestigious with much younger, and more dynamic banking establishments. We thus find neobancs, but also online banks or even an organization of lunch with lunch.

Here is the list of compatible banks and services with Google Pay:

During the launch in 2019, Google promised new partners quickly. Nevertheless, it must be admitted that five years later, Google Pay remains very far behind Apple Pay in terms of compatible banks. We would have appreciated seeing more big names such as the savings bank, Crédit Agricole, Banque Populaire, Crédit Mutuel or SG (Société Générale) … but this is not the case.

It is also possible to store several cards within the application. In which case, you must define a main card used by default, and choose on a case -by -case basis for transactions with other CB.

Remember, however, that you must have an account with one of these organizations. Google is not a bank And is not intended to become it (or no longer intends to become it at least, his claims having been aborted).

Note also that the service not only takes the form of a dedicated application, designed by Google, but also an API that banks can apply to their own applications. Several years later, it cannot be said, however, that it is a real success for its adoption.

Several levels

Of course, when it comes to banking transactions, security plays an important role and Google therefore wanted to reassure its future users. All banking contact details are stored in an encrypted and secure manner in Data Center Special, as is already the case for those who would have informed their contact details on the Google Play Store or subscribed to a YouTube (Music) Subscription for example. It is also obvious that Google does not use this data and does not resell it.

Google emphasizes the practicality of its service, since it is enough to put your phone unlocked on a compatible payment terminal to make a purchase, without confirmation or request for authentication. A system which is reminiscent of that of current bank cards and which, like the latter, is limited to 50 euros.

This content is blocked because you have not accepted cookies and other tracers. This content is provided by Twitter.

To be able to visualize it, you must accept the use being operated by Twitter with your data which can be used for the following purposes: Allow you to view and share content with social media, promote development and improvement of products D’humanoid and its partners, display you personalized advertisements in relation to your profile and activity, define you a personalized advertising profile, measure the performance of the advertisements and content of this site and measure the audience of this site ( more)

Beyond this sum, the user will be asked for more secure authentication, such as a fingerprint or a password.

On the smartphone is stored a virtual card number called “token”, accompanied by a unique cryptogram. This token can only be used for a limited number of times before requiring network reconnection and new user identification. So, even if you are stolen from your unlocked smartphone, no one can empty your bank account.

Finally, Google recalls that with the application locate my device, it is possible to locate, lock and even erase the memory of your phone remotely. What reassure in the event of loss.

What stores compatible with Google Pay / Wallet ?

No surprises, Google Pay works with all the terminals compatible with contactless payment. To recognize them, you must check the presence of the logo below-or simply ask the seller. Suffice to say that most businesses are now equipped since it is the same technology as on modern bank cards.

In addition to that, you will find G Pay buttons on applications and sites to pay online more easily. Among the first partners to integrate this solution, we find Deliveroo, Flixbus, Asos or Ryan Air to name a few. Once again, this list should grow in the future.

Loyalty cards, boarding cards, tickets ..

More than a simple means of payment, Google Pay actually wants to replace your wallet. It is thus possible to record loyalty cards in the dedicated app. In any case those of certain brands.

This will allow the passage to have access at a glance to certain information concerning the loyalty program. Google takes the example of Europcar, car rental company, and its application allowing you to see in real time how many cars have been rented and thus know if you can soon benefit from a promotion.

It is also possible to record other documents there, such as a ticket (cinema, concert, etc.), or the boarding card of your next trip … except that this feature still depends on Google’s partners, which are not very numerous.

Promotions on hand

Welcome to the world of consumption 2.0 ! With Google Pay, not only can you save time, but potentially also money by saving.

Google Pay incorporates a promotional system, with the possibility of being informed, if the user wishes and activates this function, of being notified of an unmissable case by passing in a store.

Download Google Wallet

The Google Wallet app is available directly on the Google Play Store, and possibly already integrated into your phone.

Google Wallet (ex Google Pay)

To follow us, we invite you to download our Android and iOS application. You can read our articles, files, and watch our latest YouTube videos.

All about Google Pay

The suite in video

Editor

Your personalized newsletter

It’s recorded ! Watch your mailbox, you will hear about us !

Receive the best of the news

The data transmitted through this form is intended for Humanoid, a company publisher of the Frandroid site as treatment controller. They will in no case be sold to third parties. These data is processed subject to obtaining your consent to send you by e-mail news and information relating to editorial content published on Frandroid. You can oppose these emails at any time by clicking on the unscrewing links present in each of them. For more information, you can consult all of our policy of processing your personal data. You have a right of access, rectification, erasure, limitation, portability and opposition for legitimate reasons for personal data concerning you. To exercise one of these rights, please make your request via our dedicated rights exercise form form.

Web notifications

Push notifications allow you to receive any Fandroid news in real time in your browser or on your Android phone.

Discover a revolutionary method to easily pay with any smartphone ! – In -depth examination of the product – Queen Mobile

[…] Parallel of the few announcements made for the Google Wallet on the occasion of the last I/O conference, Google is about to introduce in its […]

Vital card, CNI, permit … are you for or against the dematerialization of identity documents ? – Blog

[…] More and more used on our phones, thanks in particular to systems like Apple Pay and Google Pay, official documents also start to be […]

Pixel Experience Test (Android 13): Source Code – Fair Entertainment

[…] Practical apps for integration when you access certain integrations on pixel google wallet on the lock screen (practical for plane tickets) or […]

Pixel Experience Test (Android 13): Source code – VA News

[…] Practical apps for integration when you access certain integrations on pixel google wallet on the lock screen (practical for plane tickets) or […]

The Neobank that focuses on investment – natural tips

[…] Full use of it. By Default, if your account is linked to a gmail Address, the transfer of money by google pay is selectable, but it is of race possible to make a one-off transfer from another account via the […]

The neobanque that is based on investment – Kabdel

[…] By default, if your account is linked to a Gmail address, the transfer of money by Google Pay is selectable, but it is of course possible to make a punctual transfer from another […]

Banks for teenagers: is it a good idea and what are the best ? – Blog

[…] Mobile payments even before receiving the card (Apple Pay, Google Pay, Samsung Pay, Fitbit Pay and Garmin […]

Monabanq review: an online bank like no other – blog

[…] Via mobile, only Paylib and Apple Pay have recently been available. So you have to make a cross on Google Pay for the moment, which is quite problematic in […]

Société Générale opinion: does tradition rhyme with modernity ? | Sendigital

[…] Inevitably, contactless payment is quite possible via the NFC functions of its smartphone. Unfortunately, it is necessary only on Paylib and Apple Pay (visa only) where other many online banks have already integrated Google Pay. […]

The 5 novelties of Google I/O Borrowed from Apple – Insurance

[…] Grough Borrowed, this is Google-Wallet. After Android Pay, Here Googlepay, Google Renamed the NFC Service in Google Wallet. Inspiration is not only […]

Google Wallet is reborn (Again) and Apple Wallet is real

[…] Years after its internal merger google pay (which at the time was Android Pay), Google Wallet is back, Even to the point of replacing google […]

Google Wallet is Reborn (Again) as the Real Apple Wallet

[…] Was Incorporated Four Years Later Google Pay (back then it was Android Bay), Google Wallet has come back to the point where it replacements google […]

Google Wallet is reborn (Again) and Becomes A Real Apple Wallet – Bastcarsbrands

[…] Years After its Merger Within Google Pay (Which was then Android Pay), Google Wallet is back, Even to the point of Replacing Google Pay in […]

Google Wallet Rinasce (di nuovo) e diventa a vero e proprio portafoglio apple – customheadcoves

[…] Anni Dopo Fusione in Google Pay (Allora Era Android Pay), Google Wallet è Tornato, Al Punto da Sostitiire Google Pay Nella Maggior […]

Garmin test Venu 2: An ideal watch for sportsmen of sobriety – My Blog

[…] To associate a bank card in the application on smartphone to use your watch as a means of payment thanks to the NFC. Be careful however, not all banks are compatible in France, far from it. We will be able to […]

Société Générale vs ing: what is the best bank ? – Frandroid – Auto robot demo

[…] Apple Pay (visa only) where other many online banks have already integrated Google Pay.For its part, ING has made great efforts to finally develop an application worthy of the name […]

Xiaomi Redmi Note 11 test: Do not rest on your laurels – Innovate Partners

[…] Appearance to the delight of lovers of dematerialized transport and contactless payments for the delight. This is a novelty that was absent on the Redmi Note […]

Orange Bank: how the application of this online bank makes all the difference – Innovation Partners

[…] Example, Orange Bank supports Apple Pay and Google Pay mobile payment. All purchases made using mobile payment are then debited immediately and […]

How to add the vaccination pass to your Android smartphone to recover it in 1 click – Innovate partners

[…] Our tip for iPhone, here is our tip for Android. This tip works for Google Pay, but also Huawei Wallet. We also give you the method to add the vaccination pass […]

Freedom: Boursorama Banque Relaunch its offer reserved for teens (new card, new application) | Latest News

[…] Mobile payments even before receiving the card (Apple Pay, Google Pay, Samsung Pay, Fitbit Pay and Garmin […]

You want to change bank ? You might as well go through the 3 best offers of the moment | Sendigital

[…] On the application side, it is possible to open an account directly from it in addition to having a very qualitative and secure experience. We appreciate for example the many accounts of account management in addition to very good responsiveness and the support of most mobile payment systems like Apple Pay or Google Pay. […]

Information that may interest more than one ! Often criticized for its lack of security in the past, it is now possible on Android 12 (and under Google Pixel) to force the telephone unlocking for all payments, even below 30 € unlike previous versions where payments could be done just by turning on the phone screen. This is rather good news !

Opinion N26: What are the services of the neobanque worth in 2021 ? | Sendigital

[…] Banks to highlight the care of new means of payment, Apple Pay and Google Pay in mind. It also offers offers adapted to professionals as well as a service […]

You will come out the same old article each time a new “neobank” adheres to Gpay ? Take it out when the so-called classic banks will adhere to it. And ask yourself the question to know why conventional banks do not want a GPay, because no article talks about it.

Huawei = no authorized Google app

Monabanq review: an online bank like no other | Sendigital

[…] Via mobile, only Paylib has recently been available. It is therefore necessary to make a cross on Apple Pay and Google Pay for the moment, which is quite problematic in […]

Hello Bank vs Fortuneo: What is the best online bank ? | Sendigital

[…] Virtual usable via the NFC function of the smartphone. Payment methods like Apple Pay, Google Pay or Paylib are also […]

Google Maps: Paying the metro or bus becomes possible on the application – Bonneinfo

[…] All about Google Pay […]

Google Pay and Samsung Pay: Paying in Bitcoin will soon be possible – Bonneinfo

[…] All about Google Pay […]

Hello One: say goodbye to bank charges thanks to the free card of Hello Bank! – Goodinfo

[…] The Hello One bank card is compatible with Google Pay and Apple Pay, which allows you to pay directly with your phone without having to go out […]

Orange Bank: Nuevas Tarjetas Mastercard y una ofta para familias con control parental – Guía manual

[…] SOBER PAGO TODO from Google […]

I have the perfect solution for septic and those who have fears! Awesome, I just passed the cape on a rechargeable bank card from La Banque Postale + Lydia and finally with the contactless of Google Pay . I have not yet tested the contactless of Lydia+Google Pay but I think that with some € in my prize pool or piggy bank it should widely work while remaining safe with my rechargeable bank card . : D Lydia can as a blue e-card create ephemeral cards has a single use or with several uses such as subscriptions and others . ^^ I will test and if everything is well functional I will stay: D

Google Pay is death available in France – 9TO5GOOGLE

[…] Unlike other recent launches in Countries Like Chile and the United Arab Emirates, Which Were Discovered by Their inclusion on the formal list of country where google pay has launched, News of the Service’s debut in France Comes via French Outlet Frandroid. […]

You are a majority not to use your smartphone to pay – live info

[…] All about Google Pay […]

This is why I have only associated it with a rechargeable prepayed card.

To flee. No help impossible to contact them except in English or Spanish and not for a technical problem . It is serious for a payment system as much as in the event of a dispute I doubt that the bank of the card recorded on GPAY intervenes. I just installed it and I already have a blockage to delete a recorded bank card . If only our banks made it possible to pay with the NFC of the smartphone without going through Google. I hope at least being able to set up this app as long as I would have expected the money that I put in a prepayed card subscribed to replace the card of my bank that it is impossible for me to delete.

I’m not going to talk about Google but Orange Bank is a wound !! Sacred

Yes exact screen but such a locked it goes at less than 30 €. Sniff

me it works (the screen must be on however)

Yes exactly you have to leave the choice in the user settings according to what they want

Indeed, sending comments is recommended. It is the official canal where everything is centralized. This certainly allows them to more easily process requests. In any case, this system to request a code from the 1st euro is good idea. You have to cross your fingers so that they offer this functionality . at least for those interested.

Entrust these payments to Google MDR that people are kon

Yes I contacted Gpay by email. They told me to write to the devs via the “sending comments” function accessible from the application. That’s what I did. If bcp of people do, maybe they will move their buttocks. I do not have a social network suddenly I cannot contact them through this.

Yes you are right, I got tangled with my brushes. Google Pay uses virtual cards (no physical card information storage). In case of loss or flight, you must use Google Find My Device to block the device and therefore its use. Indeed, if your phone is not connected to the Internet when you try to block it remotely, it will remain unlocked until it will reconnect to the Internet. At that time, he will receive the blocking control from Google Find My Device. On the other hand, and it is to be checked as information, it seems to me that in the event of loss of the physical bank card and after having opposed it, Google Pay risks no longer functioning with this card. Indeed, the virtual card inserted in Google Pay will no longer be able to issue payments. I completely agree with you about the blocking by code even below 30 €. Do you know that you can send comments to the teams that develop Google Pay ? You can also challenge them on their official Twitter account. In any case, do not hesitate to send them comments and messages, maybe they will change their mind and offer this feature in a next version. For my part, I would also raise information and this request from Google. Regarding the deactivation and reactivation of the NFC before each payment or after making a payment it is a good idea while waiting to have better. Personally, I find it binding to have to activate and deactivate it but I can understand that the one can be afraid for others. On my phone, I let the NFC activate constantly (it automatically deactivates when the screen is off). Until now, I have never had any problems (fortunately). But it is obvious that we are not immune to anything.

There could still be basic security, unlocking the phone should be the minimum to initiate a transaction. Personally I would never have put my card on my phone if it was not the case.

[Edit] In fact, this is unfortunately the case. We steal from you or you lose your phone, indeed anyone can make payments of € 30 or less by just turning on the screen. However, after some research, it seems that the number of payments with the locked screen (so screen just lit) is limited. After a number of payments, you are forced to unlock your smartphone (source: https: // support.Google.Com/Pay/Answer/7644132?HL = FR). Losing or being robbed of your phone is ultimately identical to a conventional bank card. You must declare the loss of your card/phone via the assistance number registered on the back of it. As payment via Google Pay is based on your bank card, opposition will block fraudulent payments on your bank card as well as those from Google Pay. In addition, you can also block your phone via the application and/or the website, Google Find My Device.

No, that’s not exactly that for the loss of such. – The Visa card on Tel, is a virtual card, so if loss of such it should be noted to Gpay, your initial physical card if not lost is always good. – I know the blocking function of such that works if of the network. – It’s really bad not to be able to force the such to be unlocked to make all the payments. This is the reason why I have not activated the NFC on my real physical card. In case of loss or theft I avoid losing 3 x 30 €. – Suddenly my intermediate solution to manually activate the NFC before each payment and to deactivate it immediately after a purchase seems not bad in terms of security, it avoids in the event of loss of such that the lucky little purchases make purchases.

I think they want a real contactless payment service, not this stew lol.

I agree that it would be much more reassuring if we could define a locking from the 1st euro spent. But this limit of € 30 is valid for France in order to correspond to the practices of contactless bank cards. The number of payments without unlocking the phone is limited (as with a contactless CB) and you will still have to unlock your smartphone from time to time. More information here -> https: // support.Google.Com/Pay/Answer/7644132?Hl = fr

It’s very stupid, after a certain amount, generally 30 €, you have to type the code. It avoids using the card, and above all it avoids ending up with a rejection of contactless and having to start again. It comes back to the same as Google Pay.

Why do they do how abroad is a limit note without code ?

Ah the famous limit of € 30 on contactless CB. The Franco-French thing totally useless, just for Emm *** er the world. I’m glad that G Pay arrives to correct it all.

Ok thank you, suddenly it’s not top security. There is a way to configure to oblige unlock to pay for small amounts ?

Yes I know there is no limit.

It is completely normal indeed. Below 30 €, the screen must only be lit. Beyond 30 € the phone must also be unlocked to allow payment. This is also why the configuration of Google Pay requires defining a code/diagram/imprint/unlocking face.

So if you lose your such, by just turning on the screen, the one that will find the such or stolen aura can make payments at -30 € . Really crazy from a safety point of view. They should allow you to configure so that such is unlocked for all payments !