6 tips for managing your family budget | Borrowed, manage your family budget in Excel – Microsoft support

Manage your family budget in Excel

It is first of all a question of analyzing your entries and exits of money during the same month. At the end of the month, you will be able to identify your main money outings. This analysis can take the form of a budget management table.

Family budget: 6 tips for good management

Following your personal expenses each month allows good visibility of your budget. For this, hold a family budget is useful. Several techniques are possible in order to best manage your money and exits money and increase your rest to live.

- Following a family budget gives good habits to family members and protecting yourself against the financial vagaries of life.

- It is necessary to arbitrate between your income and its fixed and variable expenses thanks to a budget monitoring table and bank monitoring applications.

- To better manage its budget, multiple solutions exist such as the pooling of expenses or budgetary envelopes.

Updated on February 03, 2023

by Benoit Delecroix – Managing Director Iregroup

Download this guide

- Why make a family budget ?

- What elements include in the family budget ?

- Our advice to manage your family budget

- How to follow your family budget ?

Why make a family budget ?

Establishing a family budget is crucial to control your finances and meet your expenses. You avoid spending too much and you are able to achieve your savings goals.

The management of its budget does not mean that you must deprive yourself, but rather spend in a thoughtful manner while reserving precautionary savings to deal with any unforeseen events.

What is the average budget of a family ?

On average, monthly expenses amount to € 1,387 for a single person against € 2,300 for a couple and € 3,109 for a family of four people. These figures are calculated excluding taxes, taxes and reimbursement of loans. To pay for these additional costs, you must add around € 415 for a single person and € 1,019 for a family.

What elements include in the family budget ?

To accurately calculate its family budget, you have to arbitrate between resources and fixed and variable expenses.

Home revenues

The monthly income of the members of a home include wages, income or fees, bonuses, state allowances, rental income, alimony, etc.

Fixed loads

Fixed charges include housing costs, taxes, care and education of children, various insurance, Internet and telephony costs. Credits and debts to be reimbursed also enter your family budget. Fixed charges therefore designate the recurring expenses, the amount of which is known in advance.

Variable loads

Regarding variable loads, this is all expenses for which you cannot provide for certainty their exact amount at the end of the month, such as energy bills, car costs and food races. Extras and leisure also enter this category for your family budget, such as restaurants, shopping or cinema outings.

Our advice to manage your family budget

Once your family budget has been established, you have better visibility of your Silver entries and exits. This allows you to identify solutions to be implemented when necessary or possible optimizations.

1.Determine your financial resources

To determine your financial resources, Add your fixed income to those of your spouse. You get the amount of money on which you can count for your recurring expenses.

It happens that in addition to fixed income you receive variable income as premiums. It is also necessary to take them into account but to a certain extent since they are variable. In these cases, it is advised to use these sums to build you a precautionary savings.

2.List your fixed and variable costs per month

Establishing a family budget requires the creation of an exhaustive list of all your expenses:

- Fixed expenses : loan refund, rent, insurance, invoices, taxes, etc.

- Variable expenses : food races, leisure, clothing, car maintenance, etc.

3.Calculate the rest to live in the home

THE available balance corresponds to the difference between your income and monthly expenses. It indicates the rest to live each month at your disposal for other expenses.

4.Optimize your expenses

To increase your rest to live, you can decrease certain expenditure stations in your family budget ::

- Food : Plan your meals in advance to reduce the number of outings to the supermarket and avoid unnecessary expenses, try new recipes, buy in batches or in bulk, be on the lookout for specials and special offers and avoid as much as possible meal outside.

- Service charges and suppliers : The accommodation is greedy in energy and therefore in money. Decrease the heating during the night, reduce the time spent in the shower and turn off the lights leaving a room. Also remember to compare the offers of the various suppliers to find the cheapest contracts.

- Shopping : Avoid compulsive purchases. Resisting the temptation of shopping allows you to have a little more money to save each month. Also favor sales periods to make your purchases;

- Car and transport : Opt for an economic transport mode such as public transport or bicycle. If you have to travel by car offer your carpooling trips. This allows you to save on gasoline and vehicle maintenance thanks to the participation of carpooler;

- health and wellbeing : Favor sport in the open-air if you do not regularly use your subscription to the room.

- Entertainment : Look first of all free activities in your region (parks, lakes or festivals). Cancel subscriptions to streaming services that you do not use.

- Insurance : Locate the best insurance thanks to online comparison sites.

5.Delimit your needs by budget envelope

It is a question here of separating each expense and budgeting them by allocating a sum of money in advance which will correspond to each of the expenses identified for your family budget. It is possible to push the concept to the end using paper envelopes in which the amount of money is placed for the month for precise use. The amount to be expected requires checking well, on Bank statements previous months, the different expenditure by establishing an average.

6.Automate your expenses

It is often difficult to Keep a stable budget When we spend a crush. This is why it is recommended toautomate your expenses. Concretely, it is advisable to establish debits Regarding fixed expenses (rent, invoices or subscriptions for transport and leisure).

For example, you can identify an excessive weight of different credits, restricting your remains to live monthly. One solution may be to group these loans in one single rate, by means of a credit repurchase.

The reimbursement is spread over a longer period, and you will then haveOnly one credit monthly payment to be reimbursed along the loan, in a lower amount than the sum of your previous deadlines. Which allows you to find a remaining remains to live in the month and to lower at the same time its debt ratio.

How to follow your family budget ?

Rigorous monitoring of your family budget is crucial to determine a good financial strategy and remain informed of the movements of bank accounts every month.

Use banking apps

THE banks themselves and other applications that are ACCOUNTERS (when you have several in several banks) can help you Establish the family budget. Bankin ‘, Manage my accounts or Linxo can be configured to allow you to establish the basics of your follow -up.

Combine Budget table and monitoring application For an optimal result. Applications allow personalized configuration and simple monitoring, while the table allows you to be really actor in the management of your budget and allows you to identify possible improvement axes.

Create a tracking board

It is first of all a question of analyzing your entries and exits of money during the same month. At the end of the month, you will be able to identify your main money outings. This analysis can take the form of a budget management table.

In the recipe part, register all the resources of the month (net salaries, various allowances, retirement, alimony, daily allowances, etc.)). In the expense column, note the rent, the monthly mortgage, the various contracts for the telephone, the water, the electricity, the mutual, but also the food budget, clothing, various interviews and leisure.

You then established the base of a family budget to follow each month.

Family budget: what to remember

- Defining the family budget is an essential step in the right finance management. This is all the more important when it comes to a family with children.

- Use a monitoring board and bank applications to follow your income and fixed and variable expenses.

- Reduce each expenditure position as much as possible thanks to the solutions proposed in this article to increase your rest to live, finance projects and/or save more.

Benefit from our expertise in credit regrouping,

it is without commitment !

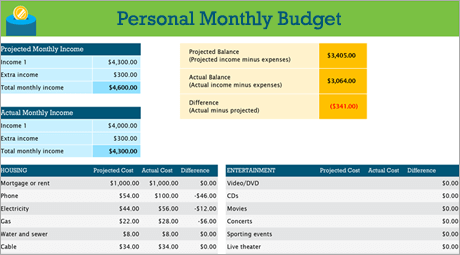

Manage your family budget in Excel

The creation of a budgetary plan for your household may seem overwhelming and difficult, but Excel can help you organize and follow with a variety of free and premium budget models.

Discover the land

The purpose of the budget of a cleaning is to summarize what you earn in relation to what you spend to help you plan your long and short -term goals. The use of a budgeting calculation sheet can help you make your financial health a priority by reducing expenses and increasing savings !

DIY projects with the personal budget model

You prefer to do things from yourself ? This Excel model can help you follow up on your monthly budget by income and expenditure. Enter your costs and income, and any difference is calculated automatically, which allows you to avoid deficits or to provide any surpluses. Compare the costs planned with real costs to refine your budget skills over time.

Advice : Follow monthly expenses

Public services, credit cards and insurance are charged monthly. The easiest way to monitor your expenses is therefore to determine the amount of your monthly expenses.

Don’t forget “supplements”

Beyond your electricity bill, do you have a subscription to a film or a game ? What about the subscription to a gym ? Be sure to keep a trace too.

Advice : Pay attention to variable expenses

If the amount of gas and telephone bills does not generally vary from one month to the next, other expenses, such as meals at the restaurant or purchases of clothing, may vary considerably.

Classify expenses

Now that you have a global idea of monthly expenses, it is time to classify them by categories in order to be able to examine your fixed, variable and discretionary expenses.

Fixed expenses

Fixed expenses remain the same from one month to the next. This is for example a mortgage or rent, health insurance, automotive payment or real estate tax. You can capture all of these elements in a “fixed expenditure” category.

Advice : Variable expenses

You cannot do without variable expenses, but they can fluctuate from one month to the next. These expenses include grocery store, car maintenance, electricity and water consumption.

Discretionary expenses

Discretionary expenses may vary a lot from one month to the next. The examples include outings at the restaurant, subscriptions to continuous broadcasting services, membership of a club, cable and clothes.

Define your goals

Once you have a good idea of the amount of money entries in relation to that of expenses, you can start to establish priorities for your short and long -term goals.

Budgetize the renovation of a house

Is your washing machine broken down ? Are your cabinets in poor condition ? The main bathtub needs an upgrade ? The renovation of your house may have many possibilities. Do not forget to include these expenses when you examine your financial objectives.

Advice : Keep your wedding options open

A constant examination of your finances helps you to determine if you have saved enough to buy an essential article or simply “pleasant to have”. Do you need this rose vault for your bridal procession or do you just ? Anyway, don’t forget to compare this to your goals.

Plan for entertainment at university

If you stick to fixed expenses, you can reach your short and long -term goals more quickly. On the other hand, you can also include a certain amount in your monthly budget for pleasure and entertainment (variable expenditure that you will certainly want to follow during your studies).

Rule 50/30/20: how to save more by spending less

Too complicated budget management tools deprive you ? Try this simple budget rule called 50/30/20 to organize and develop your budget.

Reading time: 8 min

When it comes to managing your own budget, you are sometimes caught off guard. Who has never downloaded a budget management application by having the firm intention to control their expenses, and finally abandon it after the third day, forgetting to add the take -out of the week ? You feel concerned ?

Manage your budget and finances go hand in hand, but it should not be complicated, nor take too much time. In fact, the best tips are often the simplest, surprisingly.

The 50/30/20 rule is a smart and easy monthly budget management method that indicates you the exact amount you have for your savings and expenses each month. By having a clear overall vision of your budget of the month, you will gain confidence and avoid spending too much while saving, without having to register each transaction.

So, you are ready to develop a realistic budget and to stand ? It’s here that it happens !

What is the 50/30/20 rule ?

The 50/30/20 rule consists of a simple method to help you manage your budget efficiently, simply and durably. You divide your net monthly income into three categories of expenditure: 50 % for what you need, 30 % for what you want and 20 % for your savings, or for reimbursement of your debts.

By regularly balancing your expenses using these three categories, you will be more aware of your consumption habits and will avoid excessive expenses. There are only three categories so as not to tangle the brushes and to avoid getting into the details of each of your expenses. The 50/30/20 rule will allow you to easily achieve your financial objectives, whether it is about saving for less fast days or to repay existing debts.

What is the origin of the 50/30/20 rule ?

The 50/30/20 rule comes from the book entitled ” All Your Worth: The Ultimate Lifetime Money Plan “Written in 2005 by Elizabeth Warren, Harvard graduate, expert in bankruptcies and American senator, and her daughter Amelia Warren Tyagi.

The 20 years of research from Warren and Tyagi echo our own reflection: There is no need to respect a complicated budget to control your finances. You just need to distribute your money in a balanced way according to your needs, your desires and your savings goals, in Suima

just the 50/30/20 rule.

The bank account to manage your budget more simply

Discover the Premium bank account which gives you control of your money with intuitive features and innovative services. Manage your account in real time, and more simply with N26 Smart.

How does the 50/30/20 rule work ?

The 50/30/20 rule simplifies your budget by dividing your net income into three categories of expenditure: your needs, your desires and your savings or your debts.

If you know exactly how much allocate each category, respect your budget will be easier and you will keep control over your expenses. Using the 50/30/20 rule, here is what your budget could look like:

Spend 50 % of your income for your needs

To put it simply, your needs correspond to the expenses linked to the essential things of life, which you could hardly do without. 50 % of your net income must cover most of your necessary costs.

Are included in needs:

- the rent,

- electricity and gas bills,

- transportation costs,

- Insurance (health, car, animals),

- minimum loan monthly payments,

- basic power supply.

For example, if your net income amounts to € 2,000, the sum of € 1,000 must be allocated to your needs. This budget may vary from one person to another. However, if your total needs exceed 50 % of your net income, Warren suggests making some changes in order to clean up your budget, such as changing energy supplier or perhaps looking for a less expensive apartment.

30 % of your budget for your desires

If 50 % of your net income cover your basic needs, 30 % of your net income can be devoted to your desires. The desires are defined as non-session expenses chosen freely and which you could do without.

- Restaurant outings,

- shopping,

- holidays,

- Membership of sports clubs,

- Entertainment subscriptions (Netflix, Amazon Prime),

- Races (other than Esentials).

Always following the example above, If your net income amount to € 2,000, you can spend € 600 to your desires. But if you discover that you spend too much for your desires, it may be interesting to think about the expenses you could limit.

Following the 50/30/20 rule does not mean that they cannot enjoy life, It is only a question of being more responsible vis-à-vis your budget by finding levers to avoid superfluous expenses. If the concept of needs and desires remains vague, just ask yourself: “Can I live without that ? »». If the answer is yes, it is a desire and not a need.

Book 20 % of your income for your savings

With 50 % of your net income devoted to your needs and 30 % to your desires, The remaining 20 % can allow you to achieve your savings targets, or reimburse any debts. Although minimum reimbursements are considered to be needs, all any additional reimbursements reduce your existing debt and your future interests, they are therefore classified as savings.

If you systematically save 20 % of your salary each month, you can build up an intelligent savings plan, such as a rescue fund, a long -term personal provisional budget, or a contribution for the purchase of real estate property. If you earn € 2,000 net each month, you could devote € 400 to your savings targets. You could approach € 5,000 in just one year !

How to apply the 50/30/20 rule: a step by step guide

So how does the 50/30/20 rule work concretely ? To put it simply, calculate the percentages 50 30 20 from your income and categorize your expenses. Here’s how to do:

1. Calculate your net income.

The first step in using the 50/30/20 rule is to calculate your income after taxes. If you are independent, your net income corresponds to what you earn in a month, less your professional expenses and the amount provided for your taxes.

If you are an employee with a fixed salary, it will be easier: on your pay slip is the amount paid to you each month on your bank account. If certain payments such as health insurance or pension fund are deducted from your salary, reintegrate them.

2. Categorize your expenses last month

To find out where to go your money every month, You will have to analyze how you spent your salary last month. Bring a copy of your bank statement for the last 30 days, or simply use the management functionality in your N26 application, which classifies all your transactions in different categories: salary, food and races, or leisure and outings, etc.

Distribute your expenses now in three categories: needs, desires and savings. Remember that a need is an essential expense that you cannot avoid, like rent. A desire is a “bonus” you could do without, like a restaurant outing. Savings represent the monthly payments of additional loans, pension contributions, or the money you reserve for the less splendid periods.

3. Evaluate and adjust your expenses to respect the 50/30/20 rule.

Now that you can see the sums allocated to your needs, your desires and your savings every month, You can start optimizing your budget according to the 50/30/20 rule. The best way to proceed is to estimate how much you spend monthly for your desires.

According to the 50/30/20 rule, A desire is not extravagant, it is a simple pleasure that allows you to enjoy life. Reducing your needs can represent a complex task and a real challenge, so it is better to think about the desires you want to limit to stay in 30 % of your net income. The more you reduce your expenses related to your desires, the more the probability of achieving the target of 20 % devoted to your savings.

Calculator Rule 50/30/20

OUR online budget calculator 50/30/20 could allow you to go faster and more easily. Nerdwallet and Moneyfit both offer online calculators who will tell you the sums to be allocated to your needs, your desires and your savings each month, based on your net income.

Calculation sheet Rule 50/30/20

While an online calculator is capable of providing an overview of your ideal budget according to the 50/30/20 rule, If you want to develop a more detailed budget, a special spreading sheet Rule 50/30/20 represents a good option. Software such as Microsoft Excel, Google Sheets and Apple Numbers all offer calculation sheet models to facilitate budget management. You can find many online calculation sheets available for free, AD

suitable for the 50/30/20 rule and which are c

informable with any program, to allow you to achieve your financial goals.

N26 sub-accounts

With N26, save at your own pace for your projects thanks to the sub-accounts.

Your money at N26

Budget management is ideal for feeling more reassured and controlling its expenses. With N26, managing your money becomes child’s play. Indeed, thanks to intelligent budget management functionalities such as rounding, space subcopes or even management functionality, you will have more easier to apply the rule of 50/30/20. Access your money anywhere with your online bank account and receive instant push notifications to have an updated vision of your finances. And in addition, your free sub-account spaces help you to keep an eye on your savings goals, while the management functionality will automatically categorize your expenses to help you maintain the course.